Robeco Institutional Asset Management B.V. lessened its position in shares of Regency Centers Co. (NASDAQ:REG - Free Report) by 28.5% in the 3rd quarter, according to its most recent filing with the Securities & Exchange Commission. The institutional investor owned 32,277 shares of the company's stock after selling 12,844 shares during the period. Robeco Institutional Asset Management B.V.'s holdings in Regency Centers were worth $2,331,000 as of its most recent SEC filing.

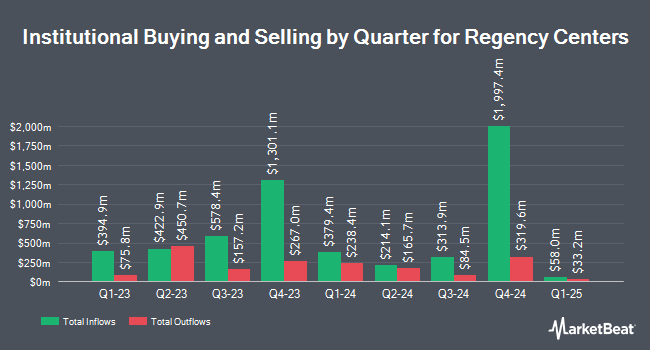

Several other institutional investors have also modified their holdings of REG. Assenagon Asset Management S.A. increased its stake in Regency Centers by 3.3% in the second quarter. Assenagon Asset Management S.A. now owns 4,744 shares of the company's stock valued at $295,000 after purchasing an additional 152 shares during the last quarter. Azzad Asset Management Inc. ADV grew its position in shares of Regency Centers by 4.3% in the 3rd quarter. Azzad Asset Management Inc. ADV now owns 4,543 shares of the company's stock valued at $328,000 after buying an additional 189 shares during the last quarter. Tectonic Advisors LLC raised its stake in Regency Centers by 3.0% during the 3rd quarter. Tectonic Advisors LLC now owns 6,941 shares of the company's stock worth $501,000 after acquiring an additional 203 shares in the last quarter. Greenleaf Trust raised its stake in Regency Centers by 5.5% during the 3rd quarter. Greenleaf Trust now owns 4,563 shares of the company's stock worth $330,000 after acquiring an additional 238 shares in the last quarter. Finally, V Square Quantitative Management LLC lifted its position in Regency Centers by 7.6% in the second quarter. V Square Quantitative Management LLC now owns 3,829 shares of the company's stock valued at $238,000 after acquiring an additional 269 shares during the last quarter. 96.07% of the stock is owned by hedge funds and other institutional investors.

Analyst Upgrades and Downgrades

A number of analysts have recently commented on the company. Robert W. Baird lifted their target price on Regency Centers from $71.00 to $78.00 and gave the stock an "outperform" rating in a research report on Thursday, October 31st. Scotiabank lifted their price target on Regency Centers from $65.00 to $75.00 and gave the stock a "sector perform" rating in a research report on Monday, August 26th. KeyCorp initiated coverage on Regency Centers in a report on Friday, October 25th. They issued an "overweight" rating and a $80.00 price objective for the company. Raymond James lifted their target price on shares of Regency Centers from $67.00 to $75.00 and gave the company an "outperform" rating in a report on Friday, August 16th. Finally, Mizuho increased their price target on shares of Regency Centers from $67.00 to $73.00 and gave the stock an "outperform" rating in a research note on Monday, August 19th. Two investment analysts have rated the stock with a hold rating, eight have assigned a buy rating and two have given a strong buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Buy" and a consensus price target of $76.92.

View Our Latest Stock Report on Regency Centers

Insider Buying and Selling

In related news, VP Michael R. Herman sold 1,000 shares of the company's stock in a transaction that occurred on Friday, August 16th. The stock was sold at an average price of $69.57, for a total value of $69,570.00. Following the sale, the vice president now owns 13,010 shares in the company, valued at $905,105.70. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. 1.00% of the stock is owned by insiders.

Regency Centers Stock Performance

REG traded up $0.37 during trading on Friday, reaching $74.24. The company's stock had a trading volume of 1,038,086 shares, compared to its average volume of 962,324. The company has a market capitalization of $13.47 billion, a price-to-earnings ratio of 34.85, a price-to-earnings-growth ratio of 4.60 and a beta of 1.21. The company's fifty day moving average price is $72.30 and its 200-day moving average price is $66.72. Regency Centers Co. has a 52-week low of $56.51 and a 52-week high of $75.26. The company has a debt-to-equity ratio of 0.65, a quick ratio of 0.93 and a current ratio of 0.95.

Regency Centers (NASDAQ:REG - Get Free Report) last announced its quarterly earnings data on Monday, October 28th. The company reported $0.54 earnings per share for the quarter, missing analysts' consensus estimates of $1.04 by ($0.50). Regency Centers had a return on equity of 5.85% and a net margin of 27.78%. The business had revenue of $360.27 million for the quarter, compared to analyst estimates of $355.17 million. During the same period in the prior year, the company earned $1.02 EPS. On average, equities analysts forecast that Regency Centers Co. will post 4.26 earnings per share for the current fiscal year.

Regency Centers Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Friday, January 3rd. Investors of record on Monday, December 16th will be paid a $0.705 dividend. This is a boost from Regency Centers's previous quarterly dividend of $0.67. The ex-dividend date of this dividend is Monday, December 16th. This represents a $2.82 annualized dividend and a dividend yield of 3.80%. Regency Centers's dividend payout ratio (DPR) is 125.82%.

Regency Centers Profile

(

Free Report)

Regency Centers is a preeminent national owner, operator, and developer of shopping centers located in suburban trade areas with compelling demographics. Our portfolio includes thriving properties merchandised with highly productive grocers, restaurants, service providers, and best-in-class retailers that connect to their neighborhoods, communities, and customers.

See Also

Before you consider Regency Centers, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regency Centers wasn't on the list.

While Regency Centers currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.