Groupama Asset Managment increased its holdings in Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN - Free Report) by 7.0% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 71,277 shares of the biopharmaceutical company's stock after acquiring an additional 4,648 shares during the period. Regeneron Pharmaceuticals comprises 1.5% of Groupama Asset Managment's investment portfolio, making the stock its 21st biggest holding. Groupama Asset Managment owned 0.06% of Regeneron Pharmaceuticals worth $74,929,000 as of its most recent SEC filing.

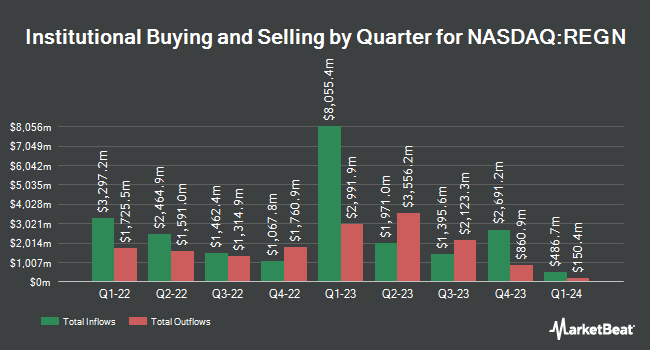

A number of other hedge funds and other institutional investors have also recently added to or reduced their stakes in the stock. Sachetta LLC grew its position in Regeneron Pharmaceuticals by 71.4% in the 2nd quarter. Sachetta LLC now owns 24 shares of the biopharmaceutical company's stock worth $26,000 after purchasing an additional 10 shares in the last quarter. Rakuten Securities Inc. boosted its stake in shares of Regeneron Pharmaceuticals by 380.0% in the 3rd quarter. Rakuten Securities Inc. now owns 24 shares of the biopharmaceutical company's stock worth $25,000 after buying an additional 19 shares during the last quarter. Stephens Consulting LLC bought a new position in shares of Regeneron Pharmaceuticals in the second quarter valued at approximately $26,000. FSA Wealth Management LLC purchased a new stake in shares of Regeneron Pharmaceuticals during the third quarter valued at approximately $26,000. Finally, Family Firm Inc. bought a new stake in Regeneron Pharmaceuticals during the second quarter worth $33,000. 83.31% of the stock is owned by institutional investors.

Analysts Set New Price Targets

Several brokerages recently weighed in on REGN. Oppenheimer decreased their price objective on Regeneron Pharmaceuticals from $1,150.00 to $1,000.00 and set an "outperform" rating for the company in a report on Wednesday, November 6th. JPMorgan Chase & Co. decreased their price target on shares of Regeneron Pharmaceuticals from $1,200.00 to $1,150.00 and set an "overweight" rating on the stock in a report on Thursday, October 24th. Wells Fargo & Company dropped their price objective on Regeneron Pharmaceuticals from $1,200.00 to $1,050.00 and set an "overweight" rating for the company in a research note on Tuesday, October 22nd. Cantor Fitzgerald restated a "neutral" rating and issued a $1,015.00 target price on shares of Regeneron Pharmaceuticals in a research note on Wednesday, October 23rd. Finally, BMO Capital Markets cut their price objective on Regeneron Pharmaceuticals from $1,300.00 to $1,190.00 and set an "outperform" rating for the company in a report on Friday, November 1st. One research analyst has rated the stock with a sell rating, four have assigned a hold rating, seventeen have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $1,107.29.

Get Our Latest Stock Analysis on REGN

Regeneron Pharmaceuticals Price Performance

Shares of REGN traded up $10.10 during mid-day trading on Monday, hitting $778.00. 813,685 shares of the company were exchanged, compared to its average volume of 798,371. The company has a debt-to-equity ratio of 0.09, a quick ratio of 4.46 and a current ratio of 5.28. Regeneron Pharmaceuticals, Inc. has a 1-year low of $735.95 and a 1-year high of $1,211.20. The stock has a market cap of $85.49 billion, a price-to-earnings ratio of 19.25, a price-to-earnings-growth ratio of 3.00 and a beta of 0.08. The company has a 50 day moving average of $876.85 and a 200-day moving average of $1,011.88.

About Regeneron Pharmaceuticals

(

Free Report)

Regeneron Pharmaceuticals, Inc discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company's products include EYLEA injection to treat wet age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; diabetic retinopathy; neovascular glaucoma; and retinopathy of prematurity.

Featured Stories

Before you consider Regeneron Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regeneron Pharmaceuticals wasn't on the list.

While Regeneron Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.