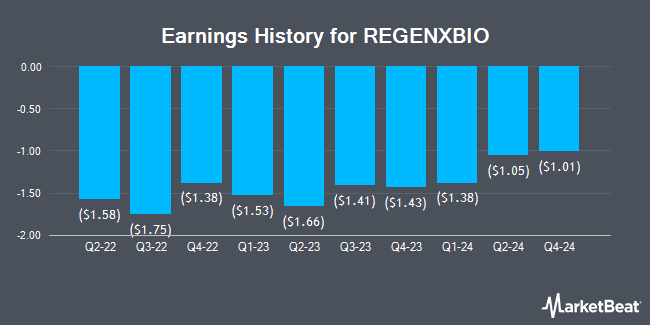

REGENXBIO (NASDAQ:RGNX - Get Free Report) is projected to announce its earnings results after the market closes on Thursday, March 13th. Analysts expect the company to announce earnings of ($1.19) per share and revenue of $23.70 million for the quarter. Investors that wish to register for the company's conference call can do so using this link.

REGENXBIO Price Performance

RGNX traded down $0.11 during midday trading on Friday, reaching $6.34. 729,861 shares of the company's stock traded hands, compared to its average volume of 947,397. The firm has a fifty day moving average of $7.44 and a two-hundred day moving average of $9.22. The stock has a market capitalization of $314.12 million, a price-to-earnings ratio of -1.26 and a beta of 1.35. REGENXBIO has a 52 week low of $5.62 and a 52 week high of $24.26.

Analysts Set New Price Targets

A number of research analysts have commented on RGNX shares. Raymond James started coverage on REGENXBIO in a research report on Friday, February 7th. They set an "outperform" rating and a $27.00 price target for the company. The Goldman Sachs Group downgraded REGENXBIO from a "buy" rating to a "neutral" rating and reduced their target price for the stock from $38.00 to $14.00 in a report on Tuesday, February 11th. StockNews.com upgraded REGENXBIO from a "sell" rating to a "hold" rating in a report on Friday. HC Wainwright reiterated a "buy" rating and set a $36.00 target price on shares of REGENXBIO in a report on Wednesday, January 15th. Finally, Royal Bank of Canada reiterated an "outperform" rating and set a $30.00 target price on shares of REGENXBIO in a report on Tuesday, January 21st. Two research analysts have rated the stock with a hold rating and six have given a buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $33.88.

Read Our Latest Research Report on RGNX

REGENXBIO Company Profile

(

Get Free Report)

REGENXBIO Inc, a clinical-stage biotechnology company, provides gene therapies that deliver functional genes to cells with genetic defects in the United States. Its gene therapy product candidates are based on NAV Technology Platform, a proprietary adeno-associated virus gene delivery platform. The company's products in pipeline includes ABBV-RGX-314 for the treatment of wet age-related macular degeneration, diabetic retinopathy, and other chronic retinal diseases; and RGX-202, which is in Phase I/II clinical trial for the treatment of Duchenne muscular dystrophy.

Read More

Before you consider REGENXBIO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and REGENXBIO wasn't on the list.

While REGENXBIO currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.