Rehmann Capital Advisory Group purchased a new stake in shares of LKQ Co. (NASDAQ:LKQ - Free Report) in the 3rd quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm purchased 15,630 shares of the auto parts company's stock, valued at approximately $634,000.

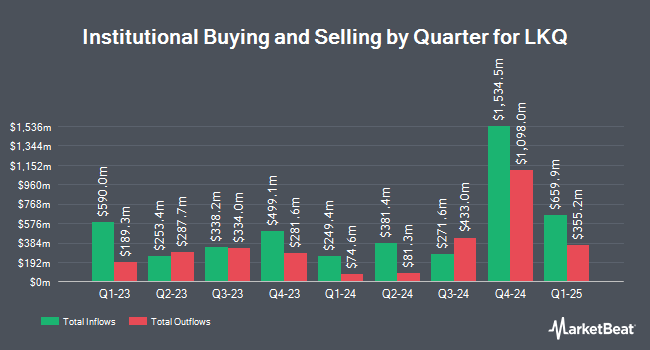

Several other large investors have also recently modified their holdings of the business. TCW Group Inc. acquired a new stake in LKQ during the 2nd quarter valued at approximately $6,601,000. Squarepoint Ops LLC raised its stake in LKQ by 3,683.6% during the second quarter. Squarepoint Ops LLC now owns 274,577 shares of the auto parts company's stock worth $11,420,000 after buying an additional 267,320 shares during the last quarter. Oppenheimer & Co. Inc. lifted its holdings in LKQ by 28.6% in the second quarter. Oppenheimer & Co. Inc. now owns 65,548 shares of the auto parts company's stock valued at $2,726,000 after buying an additional 14,573 shares during the period. Federated Hermes Inc. lifted its holdings in LKQ by 2.6% in the second quarter. Federated Hermes Inc. now owns 1,317,672 shares of the auto parts company's stock valued at $54,802,000 after buying an additional 33,459 shares during the period. Finally, Regatta Capital Group LLC boosted its position in LKQ by 3.0% during the third quarter. Regatta Capital Group LLC now owns 19,132 shares of the auto parts company's stock valued at $764,000 after acquiring an additional 556 shares during the last quarter. Institutional investors own 95.63% of the company's stock.

Analyst Ratings Changes

A number of research analysts have recently issued reports on LKQ shares. Robert W. Baird dropped their price objective on LKQ from $50.00 to $48.00 and set an "outperform" rating on the stock in a research note on Friday, October 25th. StockNews.com raised LKQ from a "hold" rating to a "buy" rating in a research note on Monday, November 18th. JPMorgan Chase & Co. raised their price objective on shares of LKQ from $54.00 to $55.00 and gave the stock an "overweight" rating in a research report on Thursday, September 12th. Roth Mkm reiterated a "buy" rating and set a $59.00 target price on shares of LKQ in a research report on Thursday, September 12th. Finally, Stifel Nicolaus cut their target price on shares of LKQ from $53.00 to $47.00 and set a "buy" rating on the stock in a research note on Friday, October 25th. Six equities research analysts have rated the stock with a buy rating, According to MarketBeat.com, the company currently has an average rating of "Buy" and a consensus price target of $53.80.

View Our Latest Research Report on LKQ

LKQ Stock Down 1.0 %

Shares of NASDAQ LKQ traded down $0.39 during midday trading on Friday, hitting $37.98. 1,495,446 shares of the stock traded hands, compared to its average volume of 1,959,914. LKQ Co. has a one year low of $35.57 and a one year high of $53.68. The business has a 50 day moving average price of $38.47 and a two-hundred day moving average price of $40.30. The company has a debt-to-equity ratio of 0.69, a quick ratio of 0.67 and a current ratio of 1.72. The company has a market cap of $9.87 billion, a PE ratio of 14.17 and a beta of 1.29.

LKQ (NASDAQ:LKQ - Get Free Report) last announced its quarterly earnings results on Thursday, October 24th. The auto parts company reported $0.88 EPS for the quarter, beating analysts' consensus estimates of $0.87 by $0.01. LKQ had a net margin of 4.90% and a return on equity of 15.15%. The business had revenue of $3.58 billion during the quarter, compared to analyst estimates of $3.65 billion. During the same quarter in the previous year, the business posted $0.86 EPS. LKQ's quarterly revenue was up .4% on a year-over-year basis. On average, equities analysts predict that LKQ Co. will post 3.43 EPS for the current year.

LKQ Dividend Announcement

The firm also recently declared a quarterly dividend, which was paid on Wednesday, November 27th. Investors of record on Thursday, November 14th were given a $0.30 dividend. The ex-dividend date was Thursday, November 14th. This represents a $1.20 annualized dividend and a yield of 3.16%. LKQ's payout ratio is 44.78%.

LKQ Profile

(

Free Report)

LKQ Corporation engages in the distribution of replacement parts, components, and systems used in the repair and maintenance of vehicles and specialty vehicle aftermarket products and accessories. It operates through four segments: Wholesale-North America, Europe, Specialty, and Self Service. The company distributes bumper covers, automotive body panels, and lights, as well as mechanical automotive parts and accessories; salvage products, including mechanical and collision parts comprising engines; transmissions; door assemblies; sheet metal products, such as trunk lids, fenders, and hoods; lights and bumper assemblies; scrap metal and other materials to metals recyclers; and brake pads, discs and sensors, clutches, steering and suspension products, filters, and oil and automotive fluids, as well as electrical products, including spark plugs and batteries.

Further Reading

Before you consider LKQ, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LKQ wasn't on the list.

While LKQ currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.