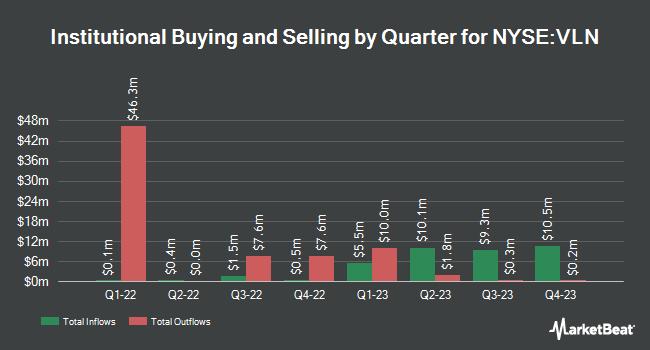

Renaissance Technologies LLC increased its holdings in shares of Valens Semiconductor Ltd. (NYSE:VLN - Free Report) by 41.4% in the 4th quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 1,001,930 shares of the company's stock after purchasing an additional 293,230 shares during the quarter. Renaissance Technologies LLC owned approximately 0.94% of Valens Semiconductor worth $2,605,000 as of its most recent SEC filing.

A number of other institutional investors and hedge funds also recently made changes to their positions in the stock. Value Base Ltd. bought a new position in shares of Valens Semiconductor in the fourth quarter worth $53,672,000. Oppenheimer & Co. Inc. lifted its holdings in Valens Semiconductor by 24.1% during the 4th quarter. Oppenheimer & Co. Inc. now owns 273,797 shares of the company's stock worth $712,000 after buying an additional 53,155 shares during the period. IGP Investments G.P.L.P LP acquired a new position in shares of Valens Semiconductor in the 4th quarter worth approximately $8,996,000. Finally, Brown Brothers Harriman & Co. acquired a new stake in Valens Semiconductor during the 4th quarter worth about $109,000. Institutional investors own 33.90% of the company's stock.

Valens Semiconductor Trading Down 3.5 %

Shares of NYSE VLN traded down $0.09 during midday trading on Monday, hitting $2.51. 169,796 shares of the company's stock were exchanged, compared to its average volume of 376,202. The business's fifty day moving average price is $2.16 and its two-hundred day moving average price is $2.25. The company has a market cap of $266.92 million, a price-to-earnings ratio of -10.04 and a beta of 0.33. Valens Semiconductor Ltd. has a 12-month low of $1.67 and a 12-month high of $3.50.

Wall Street Analysts Forecast Growth

Separately, Needham & Company LLC started coverage on shares of Valens Semiconductor in a research note on Friday, April 11th. They set a "buy" rating and a $4.00 price target for the company.

Get Our Latest Research Report on VLN

Valens Semiconductor Profile

(

Free Report)

Valens Semiconductor Ltd. engages in the provision of semiconductor products for the audio-video and automotive industries. The company offers HDBaseT technology, which enables the simultaneous delivery of ultra-high-definition digital video and audio, Ethernet, USB, control signals, and power through a single long-reach cable.

Featured Articles

Before you consider Valens Semiconductor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Valens Semiconductor wasn't on the list.

While Valens Semiconductor currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.