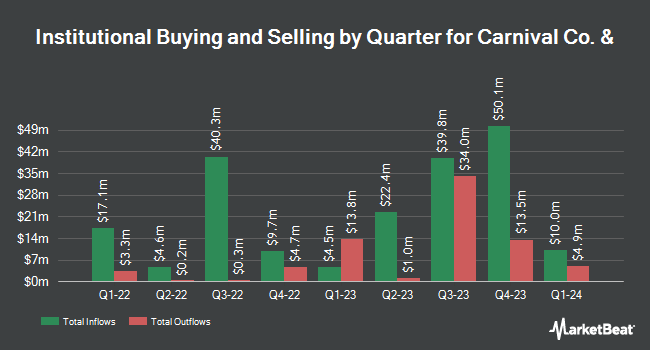

Renaissance Technologies LLC raised its holdings in shares of Carnival Co. & plc (NYSE:CUK - Free Report) by 2.2% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 2,673,700 shares of the company's stock after buying an additional 58,600 shares during the quarter. Renaissance Technologies LLC owned about 1.42% of Carnival Co. & worth $60,185,000 as of its most recent SEC filing.

Other hedge funds also recently modified their holdings of the company. Norges Bank acquired a new position in Carnival Co. & during the 4th quarter valued at $132,714,000. ABC Arbitrage SA acquired a new stake in Carnival Co. & during the fourth quarter worth about $15,184,000. KLP Kapitalforvaltning AS bought a new position in Carnival Co. & during the fourth quarter valued at about $9,435,000. Arrowstreet Capital Limited Partnership raised its holdings in Carnival Co. & by 4.7% in the 4th quarter. Arrowstreet Capital Limited Partnership now owns 3,061,521 shares of the company's stock valued at $68,915,000 after acquiring an additional 136,764 shares in the last quarter. Finally, Commonwealth of Pennsylvania Public School Empls Retrmt SYS bought a new stake in shares of Carnival Co. & in the 4th quarter worth approximately $2,836,000. 23.80% of the stock is owned by institutional investors.

Carnival Co. & Stock Performance

Carnival Co. & stock traded up $0.13 on Tuesday, hitting $16.21. The company's stock had a trading volume of 1,061,120 shares, compared to its average volume of 1,831,197. The firm has a market cap of $3.04 billion, a P/E ratio of 11.66 and a beta of 2.47. The company has a fifty day moving average price of $19.49 and a 200-day moving average price of $20.90. Carnival Co. & plc has a one year low of $12.50 and a one year high of $26.14. The company has a quick ratio of 0.25, a current ratio of 0.29 and a debt-to-equity ratio of 2.80.

Carnival Co. & (NYSE:CUK - Get Free Report) last released its quarterly earnings results on Friday, March 21st. The company reported $0.13 earnings per share for the quarter, beating analysts' consensus estimates of $0.02 by $0.11. The firm had revenue of $5.81 billion during the quarter, compared to analysts' expectations of $6.19 billion. Carnival Co. & had a return on equity of 24.13% and a net margin of 7.66%. On average, equities analysts anticipate that Carnival Co. & plc will post 1.7 earnings per share for the current year.

Carnival Co. & Profile

(

Free Report)

Carnival Plc operates as a global cruise and vacation company. The firm offers holiday and vacation products to a customer base that is broadly varied in terms of cultures, languages and leisure-time preferences. It operates through the North America and Australia (NAA), Europe and Asia (EA), Cruise Support, and Tour and Other segments.

Featured Stories

Before you consider Carnival Co. &, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Carnival Co. & wasn't on the list.

While Carnival Co. & currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.