Renaissance Technologies LLC boosted its stake in shares of Adaptive Biotechnologies Co. (NASDAQ:ADPT - Free Report) by 35.6% in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 229,785 shares of the company's stock after acquiring an additional 60,385 shares during the quarter. Renaissance Technologies LLC owned 0.16% of Adaptive Biotechnologies worth $1,378,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

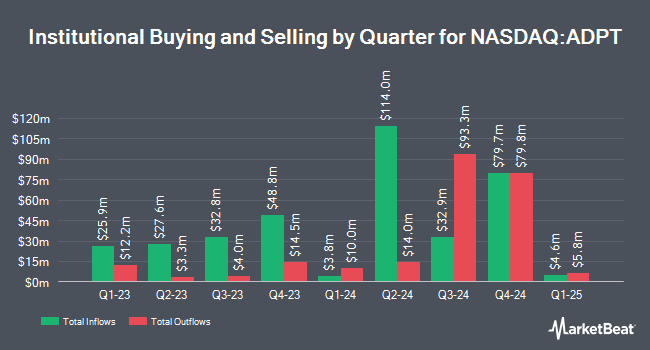

Other institutional investors and hedge funds have also bought and sold shares of the company. KBC Group NV bought a new stake in Adaptive Biotechnologies in the 4th quarter worth $50,000. GAMMA Investing LLC bought a new stake in shares of Adaptive Biotechnologies in the fourth quarter worth about $59,000. Cibc World Markets Corp purchased a new position in Adaptive Biotechnologies during the 4th quarter valued at about $65,000. Amundi lifted its holdings in Adaptive Biotechnologies by 41.2% in the 4th quarter. Amundi now owns 15,532 shares of the company's stock worth $93,000 after buying an additional 4,531 shares during the period. Finally, Proficio Capital Partners LLC bought a new stake in shares of Adaptive Biotechnologies in the 4th quarter worth approximately $93,000. 99.17% of the stock is currently owned by institutional investors.

Analyst Upgrades and Downgrades

ADPT has been the topic of several recent analyst reports. Scotiabank lifted their price target on shares of Adaptive Biotechnologies from $10.00 to $12.00 and gave the company a "sector outperform" rating in a report on Thursday, February 13th. The Goldman Sachs Group upgraded shares of Adaptive Biotechnologies from a "neutral" rating to a "buy" rating and boosted their price target for the company from $8.00 to $9.00 in a research report on Friday, March 21st. Finally, Piper Sandler restated an "overweight" rating and issued a $11.00 price objective (up from $7.00) on shares of Adaptive Biotechnologies in a report on Thursday, February 20th. Five research analysts have rated the stock with a buy rating, According to MarketBeat, the company presently has an average rating of "Buy" and a consensus price target of $9.40.

Get Our Latest Analysis on Adaptive Biotechnologies

Adaptive Biotechnologies Price Performance

Shares of NASDAQ ADPT opened at $7.77 on Tuesday. The stock has a market cap of $1.15 billion, a P/E ratio of -7.13 and a beta of 1.73. Adaptive Biotechnologies Co. has a 1 year low of $2.56 and a 1 year high of $9.01. The firm has a 50-day moving average of $7.80 and a 200 day moving average of $6.81.

Adaptive Biotechnologies (NASDAQ:ADPT - Get Free Report) last issued its quarterly earnings results on Tuesday, February 11th. The company reported ($0.23) EPS for the quarter, topping analysts' consensus estimates of ($0.27) by $0.04. Adaptive Biotechnologies had a negative return on equity of 64.65% and a negative net margin of 89.12%. During the same period in the previous year, the company posted ($0.30) EPS. Research analysts expect that Adaptive Biotechnologies Co. will post -0.92 earnings per share for the current fiscal year.

Insider Transactions at Adaptive Biotechnologies

In other Adaptive Biotechnologies news, Director Robert Hershberg sold 53,000 shares of Adaptive Biotechnologies stock in a transaction dated Wednesday, March 12th. The shares were sold at an average price of $7.59, for a total value of $402,270.00. Following the completion of the transaction, the director now directly owns 69,690 shares of the company's stock, valued at approximately $528,947.10. The trade was a 43.20 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through this link. Also, CEO Chad M. Robins sold 211,160 shares of the stock in a transaction that occurred on Tuesday, February 18th. The shares were sold at an average price of $8.50, for a total transaction of $1,794,860.00. Following the sale, the chief executive officer now owns 2,576,701 shares in the company, valued at approximately $21,901,958.50. The trade was a 7.57 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 757,601 shares of company stock valued at $6,040,624 in the last quarter. 6.20% of the stock is owned by insiders.

Adaptive Biotechnologies Company Profile

(

Free Report)

Adaptive Biotechnologies Corporation, a commercial-stage company, develops an immune medicine platform for the diagnosis and treatment of various diseases. The company offers immunosequencing platform which combines a suite of proprietary chemistry, computational biology, and machine learning to generate clinical immunomics data to decode the adaptive immune system.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Adaptive Biotechnologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Adaptive Biotechnologies wasn't on the list.

While Adaptive Biotechnologies currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.