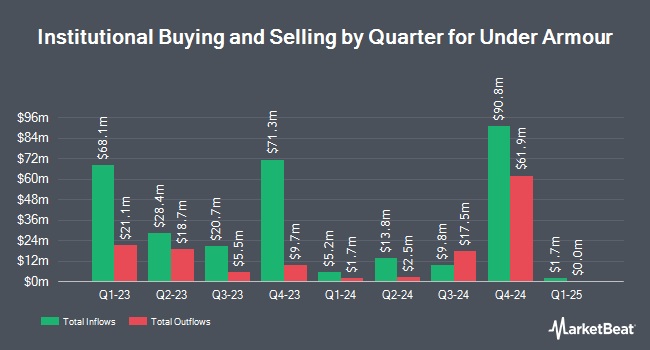

Renaissance Technologies LLC raised its position in Under Armour, Inc. (NYSE:UA - Free Report) by 265.8% in the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor owned 1,293,200 shares of the company's stock after acquiring an additional 939,700 shares during the period. Renaissance Technologies LLC owned about 0.30% of Under Armour worth $9,647,000 as of its most recent SEC filing.

A number of other large investors have also modified their holdings of UA. Harbour Investments Inc. boosted its stake in Under Armour by 592.9% in the fourth quarter. Harbour Investments Inc. now owns 3,506 shares of the company's stock worth $26,000 after purchasing an additional 3,000 shares in the last quarter. Sugar Maple Asset Management LLC acquired a new stake in shares of Under Armour in the 4th quarter valued at approximately $45,000. Kercheville Advisors LLC acquired a new position in shares of Under Armour in the 4th quarter valued at $75,000. Sigma Planning Corp acquired a new position in Under Armour in the fourth quarter valued at about $82,000. Finally, Fielder Capital Group LLC lifted its holdings in shares of Under Armour by 17.9% during the 4th quarter. Fielder Capital Group LLC now owns 12,489 shares of the company's stock valued at $93,000 after purchasing an additional 1,898 shares in the last quarter. 36.35% of the stock is currently owned by institutional investors and hedge funds.

Under Armour Stock Up 2.2 %

Shares of UA stock traded up $0.12 during trading hours on Tuesday, hitting $5.52. 3,448,432 shares of the company were exchanged, compared to its average volume of 3,544,278. The business has a 50 day moving average of $5.98 and a two-hundred day moving average of $7.29. The company has a market capitalization of $2.37 billion, a PE ratio of -19.03 and a beta of 1.45. The company has a current ratio of 2.01, a quick ratio of 1.19 and a debt-to-equity ratio of 0.30. Under Armour, Inc. has a 52 week low of $4.62 and a 52 week high of $10.62.

Under Armour (NYSE:UA - Get Free Report) last posted its quarterly earnings data on Thursday, February 13th. The company reported $0.08 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.03 by $0.05. Under Armour had a negative net margin of 2.39% and a positive return on equity of 11.03%. During the same period in the prior year, the firm earned $0.25 EPS.

Under Armour Company Profile

(

Free Report)

Under Armour, Inc, together with its subsidiaries, develops, markets, and distributes performance apparel, footwear, and accessories for men, women, and youth. The company provides its apparel in compression, fitted, and loose fit types. It also offers footwear products for running, training, basketball, cleated sports, recovery, and outdoor applications.

Recommended Stories

Before you consider Under Armour, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Under Armour wasn't on the list.

While Under Armour currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.