Renaissance Technologies LLC increased its holdings in shares of Conduent Incorporated (NASDAQ:CNDT - Free Report) by 10.0% in the 4th quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund owned 2,510,399 shares of the company's stock after buying an additional 227,899 shares during the quarter. Renaissance Technologies LLC owned 1.57% of Conduent worth $10,142,000 at the end of the most recent reporting period.

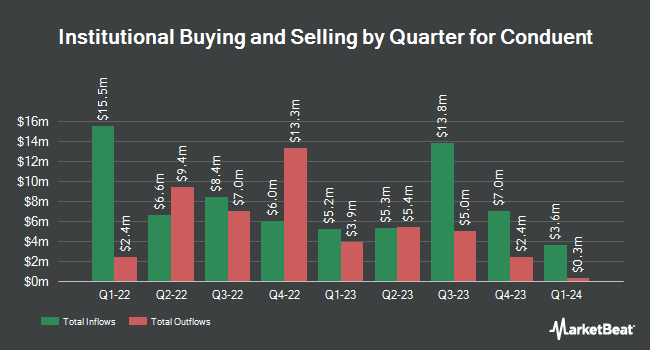

Several other large investors have also bought and sold shares of the business. Jane Street Group LLC lifted its holdings in shares of Conduent by 59.7% in the third quarter. Jane Street Group LLC now owns 833,861 shares of the company's stock worth $3,360,000 after acquiring an additional 311,579 shares during the last quarter. Public Employees Retirement System of Ohio increased its position in Conduent by 7.8% during the 3rd quarter. Public Employees Retirement System of Ohio now owns 157,607 shares of the company's stock worth $635,000 after purchasing an additional 11,464 shares in the last quarter. Barclays PLC lifted its stake in Conduent by 233.0% in the 3rd quarter. Barclays PLC now owns 271,923 shares of the company's stock valued at $1,096,000 after purchasing an additional 190,269 shares during the last quarter. Franklin Resources Inc. boosted its position in Conduent by 10.0% in the third quarter. Franklin Resources Inc. now owns 118,841 shares of the company's stock valued at $477,000 after buying an additional 10,787 shares in the last quarter. Finally, JPMorgan Chase & Co. grew its stake in shares of Conduent by 174.4% during the third quarter. JPMorgan Chase & Co. now owns 513,129 shares of the company's stock worth $2,068,000 after buying an additional 326,118 shares during the last quarter. 77.28% of the stock is owned by institutional investors and hedge funds.

Conduent Price Performance

Shares of NASDAQ:CNDT traded up $0.01 during trading on Tuesday, hitting $1.98. 1,597,358 shares of the company were exchanged, compared to its average volume of 1,149,248. The company has a quick ratio of 1.75, a current ratio of 1.68 and a debt-to-equity ratio of 0.73. Conduent Incorporated has a 1-year low of $1.93 and a 1-year high of $4.90. The company has a market capitalization of $320.42 million, a P/E ratio of 0.92 and a beta of 1.36. The business's 50 day moving average is $2.94 and its 200-day moving average is $3.63.

Conduent (NASDAQ:CNDT - Get Free Report) last issued its earnings results on Wednesday, February 12th. The company reported ($0.15) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.11) by ($0.04). Conduent had a negative return on equity of 11.39% and a net margin of 12.69%. Equities analysts forecast that Conduent Incorporated will post -0.34 earnings per share for the current year.

About Conduent

(

Free Report)

Conduent Incorporated provides digital business solutions and services for the commercial, government, and transportation spectrum in the United States, Europe, and internationally. It operates through three segments: Commercial, Government Services, and Transportation. The Commercial segment offers business process services and customized solutions to clients in various industries; and customer experience management, business operations, healthcare claims and administration, and human capital solutions.

See Also

Before you consider Conduent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Conduent wasn't on the list.

While Conduent currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.