Renaissance Technologies LLC reduced its holdings in shares of National Presto Industries, Inc. (NYSE:NPK - Free Report) by 12.4% in the fourth quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission. The fund owned 202,000 shares of the conglomerate's stock after selling 28,599 shares during the period. Renaissance Technologies LLC owned about 2.85% of National Presto Industries worth $19,881,000 at the end of the most recent quarter.

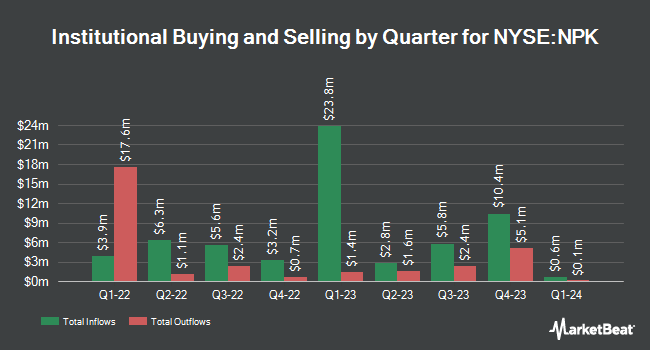

A number of other institutional investors also recently bought and sold shares of NPK. PNC Financial Services Group Inc. lifted its holdings in National Presto Industries by 50.2% during the fourth quarter. PNC Financial Services Group Inc. now owns 362 shares of the conglomerate's stock valued at $36,000 after purchasing an additional 121 shares in the last quarter. Wilmington Savings Fund Society FSB purchased a new position in shares of National Presto Industries during the 3rd quarter valued at $75,000. Newbridge Financial Services Group Inc. bought a new position in National Presto Industries in the 4th quarter worth $79,000. US Bancorp DE increased its stake in National Presto Industries by 11.6% in the 4th quarter. US Bancorp DE now owns 1,616 shares of the conglomerate's stock worth $159,000 after buying an additional 168 shares in the last quarter. Finally, Victory Capital Management Inc. purchased a new stake in National Presto Industries in the 4th quarter worth $243,000. 58.57% of the stock is owned by institutional investors.

National Presto Industries Trading Up 0.2 %

Shares of NYSE:NPK traded up $0.20 during midday trading on Tuesday, reaching $85.09. 45,232 shares of the company were exchanged, compared to its average volume of 40,776. The stock has a market cap of $607.76 million, a PE ratio of 17.91 and a beta of 0.55. The business's fifty day moving average is $91.75 and its two-hundred day moving average is $87.53. National Presto Industries, Inc. has a one year low of $69.58 and a one year high of $103.93.

National Presto Industries (NYSE:NPK - Get Free Report) last released its quarterly earnings data on Friday, March 14th. The conglomerate reported $2.91 EPS for the quarter. National Presto Industries had a net margin of 9.63% and a return on equity of 9.88%. The business had revenue of $134.69 million during the quarter.

National Presto Industries Dividend Announcement

The company also recently disclosed an annual dividend, which was paid on Monday, March 17th. Shareholders of record on Tuesday, March 4th were paid a $1.00 dividend. This represents a yield of 1%. The ex-dividend date of this dividend was Tuesday, March 4th. National Presto Industries's payout ratio is 17.21%.

Wall Street Analyst Weigh In

Separately, StockNews.com raised National Presto Industries from a "hold" rating to a "buy" rating in a report on Tuesday, March 18th.

Check Out Our Latest Research Report on NPK

About National Presto Industries

(

Free Report)

National Presto Industries, Inc provides housewares and small appliance, defense, and safety products in North America. The company's Housewares/Small Appliance segment designs, markets, and distributes housewares and small electrical appliances, including pressure cookers and canners; heat control line of skillets, griddles, woks, and multi-purpose cookers; slow cookers; deep fryers; air fryers; waffle makers; pizza ovens; slicer/shredders; electric heaters; hot air, oil, and microwave corn poppers; dehydrators; vacuum sealers; rice cookers; microwave bacon cookers; egg cookers; coffeemakers and coffeemaker accessories; electric knife sharpeners; and timers under the Presto Control Master brand.

Featured Stories

Before you consider National Presto Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and National Presto Industries wasn't on the list.

While National Presto Industries currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.