Renaissance Technologies LLC trimmed its holdings in AXIS Capital Holdings Limited (NYSE:AXS - Free Report) by 35.5% in the fourth quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 92,000 shares of the insurance provider's stock after selling 50,600 shares during the period. Renaissance Technologies LLC owned 0.11% of AXIS Capital worth $8,153,000 at the end of the most recent quarter.

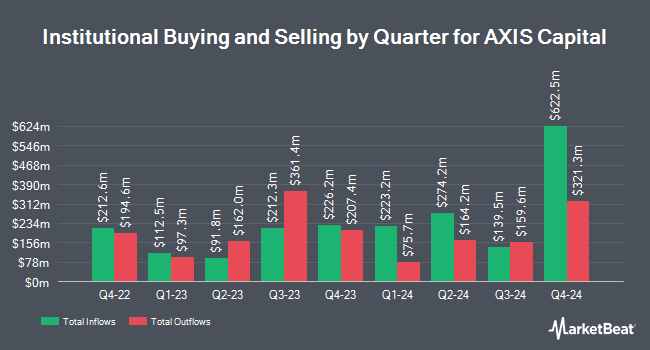

Several other hedge funds and other institutional investors also recently made changes to their positions in the business. Steward Partners Investment Advisory LLC acquired a new position in AXIS Capital in the 4th quarter valued at $53,000. Versant Capital Management Inc raised its stake in AXIS Capital by 24.0% in the 4th quarter. Versant Capital Management Inc now owns 671 shares of the insurance provider's stock worth $59,000 after purchasing an additional 130 shares in the last quarter. EverSource Wealth Advisors LLC increased its holdings in shares of AXIS Capital by 73.8% during the fourth quarter. EverSource Wealth Advisors LLC now owns 671 shares of the insurance provider's stock worth $59,000 after purchasing an additional 285 shares during the period. SBI Securities Co. Ltd. acquired a new stake in shares of AXIS Capital in the fourth quarter valued at approximately $60,000. Finally, Assetmark Inc. bought a new stake in shares of AXIS Capital in the fourth quarter valued at approximately $70,000. 93.44% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of analysts have recently weighed in on AXS shares. StockNews.com upgraded AXIS Capital from a "hold" rating to a "buy" rating in a research report on Saturday, April 12th. Wells Fargo & Company increased their price target on shares of AXIS Capital from $97.00 to $100.00 and gave the stock an "equal weight" rating in a research report on Thursday, April 10th. BMO Capital Markets assumed coverage on AXIS Capital in a research note on Monday, January 13th. They set a "market perform" rating and a $93.00 target price for the company. JMP Securities reissued a "market perform" rating on shares of AXIS Capital in a report on Monday, February 3rd. Finally, UBS Group boosted their target price on AXIS Capital from $105.00 to $115.00 and gave the stock a "buy" rating in a research note on Wednesday, April 9th. Three investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company's stock. According to MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $106.75.

Read Our Latest Stock Report on AXIS Capital

AXIS Capital Trading Up 0.5 %

Shares of NYSE:AXS traded up $0.51 on Wednesday, reaching $96.34. 93,504 shares of the company traded hands, compared to its average volume of 599,879. The stock has a market capitalization of $7.58 billion, a P/E ratio of 7.80, a price-to-earnings-growth ratio of 3.96 and a beta of 0.67. AXIS Capital Holdings Limited has a 52 week low of $60.64 and a 52 week high of $101.42. The business's 50-day simple moving average is $94.34 and its 200 day simple moving average is $89.78. The company has a current ratio of 0.60, a quick ratio of 0.60 and a debt-to-equity ratio of 0.27.

AXIS Capital (NYSE:AXS - Get Free Report) last posted its earnings results on Wednesday, January 29th. The insurance provider reported $2.97 earnings per share (EPS) for the quarter, beating the consensus estimate of $2.68 by $0.29. AXIS Capital had a return on equity of 18.89% and a net margin of 18.16%. As a group, equities analysts anticipate that AXIS Capital Holdings Limited will post 11.19 EPS for the current fiscal year.

AXIS Capital Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Thursday, April 17th. Investors of record on Monday, March 31st were issued a $0.44 dividend. This represents a $1.76 annualized dividend and a yield of 1.83%. The ex-dividend date of this dividend was Monday, March 31st. AXIS Capital's dividend payout ratio is currently 14.25%.

Insiders Place Their Bets

In other news, Director Charles A. Davis sold 2,139,037 shares of the stock in a transaction that occurred on Wednesday, March 5th. The shares were sold at an average price of $93.50, for a total value of $199,999,959.50. Following the transaction, the director now owns 2,404,133 shares in the company, valued at $224,786,435.50. This represents a 47.08 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 0.70% of the stock is currently owned by insiders.

About AXIS Capital

(

Free Report)

AXIS Capital Holdings Limited, through its subsidiaries, provides various specialty insurance and reinsurance products in Bermuda, the United States, and internationally. It operates through two segments, Insurance and Reinsurance. The Insurance segment offers professional insurance products that cover directors' and officers' liability, errors and omissions, employment practices, fiduciary, crime, professional indemnity, medical malpractice, and other financial insurance related coverages for commercial enterprises, financial institutions, not-for-profit organizations, and other professional service providers; and property insurance products for commercial buildings, residential premises, construction projects, property in transit, onshore renewable energy installations, and physical damage and business interruption following an act of terrorism.

Featured Stories

Before you consider AXIS Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AXIS Capital wasn't on the list.

While AXIS Capital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.