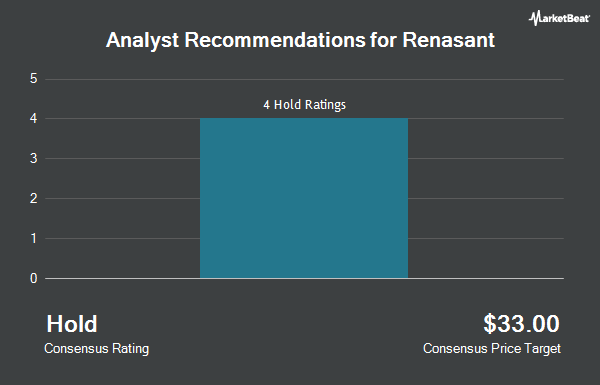

Renasant (NASDAQ:RNST - Get Free Report) was downgraded by investment analysts at Hovde Group from an "outperform" rating to a "market perform" rating in a note issued to investors on Wednesday, MarketBeat reports.

Several other analysts have also issued reports on the company. Truist Financial cut their price target on Renasant from $38.00 to $37.00 and set a "hold" rating for the company in a report on Friday, September 20th. Stephens raised shares of Renasant from an "equal weight" rating to an "overweight" rating and increased their target price for the stock from $34.00 to $41.00 in a report on Wednesday, July 31st. Keefe, Bruyette & Woods raised shares of Renasant from a "market perform" rating to an "outperform" rating and lifted their price target for the company from $36.00 to $40.00 in a report on Friday, August 2nd. Piper Sandler upgraded shares of Renasant from a "neutral" rating to an "overweight" rating and upped their price target for the stock from $34.00 to $40.00 in a research report on Monday, August 5th. Finally, Raymond James upgraded shares of Renasant from a "market perform" rating to an "outperform" rating and set a $39.00 price objective on the stock in a research report on Wednesday, July 31st. Three research analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $39.33.

View Our Latest Analysis on RNST

Renasant Stock Performance

NASDAQ RNST traded down $0.39 during trading hours on Wednesday, hitting $37.01. The company's stock had a trading volume of 512,647 shares, compared to its average volume of 401,935. Renasant has a 12 month low of $26.28 and a 12 month high of $38.77. The company's 50 day simple moving average is $33.41 and its two-hundred day simple moving average is $32.23. The company has a debt-to-equity ratio of 0.16, a current ratio of 0.96 and a quick ratio of 0.94. The company has a market cap of $2.35 billion, a P/E ratio of 13.36 and a beta of 1.01.

Renasant (NASDAQ:RNST - Get Free Report) last issued its quarterly earnings data on Tuesday, October 22nd. The financial services provider reported $0.70 earnings per share for the quarter, beating analysts' consensus estimates of $0.63 by $0.07. The company had revenue of $318.34 million for the quarter, compared to the consensus estimate of $184.73 million. Renasant had a net margin of 16.83% and a return on equity of 6.70%. During the same quarter in the prior year, the firm earned $0.75 earnings per share. As a group, sell-side analysts expect that Renasant will post 2.64 EPS for the current fiscal year.

Insider Buying and Selling

In other news, Director John Creekmore sold 3,000 shares of the stock in a transaction that occurred on Wednesday, November 6th. The stock was sold at an average price of $38.00, for a total transaction of $114,000.00. Following the completion of the transaction, the director now directly owns 24,057 shares in the company, valued at approximately $914,166. This represents a 0.00 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. 2.82% of the stock is owned by company insiders.

Institutional Trading of Renasant

Several hedge funds have recently made changes to their positions in RNST. BNP Paribas Financial Markets boosted its stake in Renasant by 74.7% during the first quarter. BNP Paribas Financial Markets now owns 41,701 shares of the financial services provider's stock worth $1,306,000 after buying an additional 17,836 shares during the period. Edgestream Partners L.P. bought a new stake in shares of Renasant in the 1st quarter worth about $4,124,000. Duncan Williams Asset Management LLC boosted its stake in shares of Renasant by 19.9% during the 3rd quarter. Duncan Williams Asset Management LLC now owns 11,115 shares of the financial services provider's stock worth $361,000 after purchasing an additional 1,847 shares during the period. Allspring Global Investments Holdings LLC grew its holdings in Renasant by 21.1% during the 3rd quarter. Allspring Global Investments Holdings LLC now owns 1,746,924 shares of the financial services provider's stock valued at $56,775,000 after purchasing an additional 303,945 shares during the last quarter. Finally, Magnolia Capital Advisors LLC purchased a new stake in Renasant in the 2nd quarter worth about $675,000. 77.31% of the stock is currently owned by hedge funds and other institutional investors.

About Renasant

(

Get Free Report)

Renasant Corporation operates as a bank holding company for Renasant Bank that provides a range of financial, wealth management, fiduciary, and insurance services to retail and commercial customers. The company operates through Community Banks, Insurance, and Wealth Management segments. The Community Banks segment offers checking and savings accounts, business and personal loans, asset-based lending, and factoring equipment leasing services, as well as safe deposit and night depository facilities.

Featured Articles

Before you consider Renasant, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Renasant wasn't on the list.

While Renasant currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.