Rench Wealth Management Inc. increased its position in Fastenal (NASDAQ:FAST - Free Report) by 13.9% in the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission. The firm owned 78,070 shares of the company's stock after purchasing an additional 9,546 shares during the quarter. Fastenal accounts for 1.9% of Rench Wealth Management Inc.'s portfolio, making the stock its 23rd largest position. Rench Wealth Management Inc.'s holdings in Fastenal were worth $5,576,000 at the end of the most recent quarter.

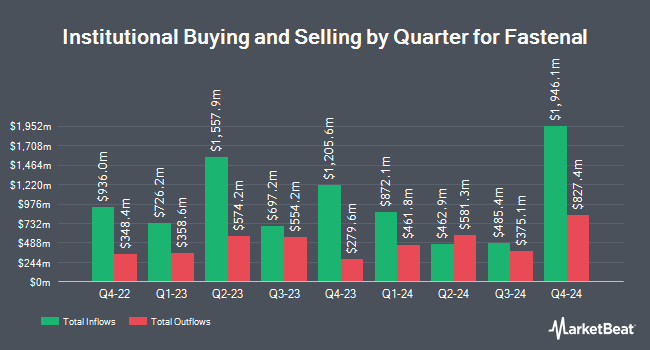

Other institutional investors and hedge funds have also made changes to their positions in the company. Marshall Wace LLP boosted its stake in Fastenal by 4,008.2% during the 2nd quarter. Marshall Wace LLP now owns 756,241 shares of the company's stock valued at $47,522,000 after acquiring an additional 737,833 shares during the last quarter. Dimensional Fund Advisors LP boosted its stake in Fastenal by 19.9% during the 2nd quarter. Dimensional Fund Advisors LP now owns 3,837,530 shares of the company's stock valued at $241,161,000 after acquiring an additional 636,546 shares during the last quarter. Charles Schwab Investment Management Inc. boosted its stake in Fastenal by 3.2% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 19,878,045 shares of the company's stock valued at $1,419,690,000 after acquiring an additional 608,596 shares during the last quarter. Renaissance Technologies LLC bought a new position in Fastenal during the 2nd quarter valued at $37,659,000. Finally, Thrivent Financial for Lutherans boosted its stake in Fastenal by 13.2% during the 2nd quarter. Thrivent Financial for Lutherans now owns 4,420,659 shares of the company's stock valued at $277,794,000 after acquiring an additional 517,172 shares during the last quarter. 81.38% of the stock is currently owned by hedge funds and other institutional investors.

Fastenal Price Performance

Fastenal stock traded down $0.40 during trading hours on Thursday, hitting $81.76. 2,158,509 shares of the company traded hands, compared to its average volume of 3,256,775. The firm has a market cap of $46.84 billion, a P/E ratio of 40.68, a P/E/G ratio of 4.85 and a beta of 1.00. The company has a quick ratio of 2.29, a current ratio of 4.40 and a debt-to-equity ratio of 0.03. The firm's 50-day simple moving average is $78.44 and its two-hundred day simple moving average is $70.72. Fastenal has a 1-year low of $61.05 and a 1-year high of $84.88.

Fastenal (NASDAQ:FAST - Get Free Report) last released its earnings results on Friday, October 11th. The company reported $0.52 EPS for the quarter, beating the consensus estimate of $0.51 by $0.01. The firm had revenue of $1.91 billion for the quarter, compared to analysts' expectations of $1.90 billion. Fastenal had a net margin of 15.44% and a return on equity of 33.30%. Fastenal's quarterly revenue was up 3.5% on a year-over-year basis. During the same quarter last year, the company earned $0.52 EPS. As a group, analysts forecast that Fastenal will post 2.03 earnings per share for the current fiscal year.

Fastenal Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Friday, November 22nd. Stockholders of record on Friday, October 25th were given a dividend of $0.39 per share. The ex-dividend date was Friday, October 25th. This represents a $1.56 annualized dividend and a dividend yield of 1.91%. Fastenal's dividend payout ratio (DPR) is 77.61%.

Analyst Upgrades and Downgrades

A number of analysts have weighed in on the stock. JPMorgan Chase & Co. increased their target price on shares of Fastenal from $57.00 to $63.00 and gave the stock a "neutral" rating in a report on Thursday, October 10th. Bank of America assumed coverage on shares of Fastenal in a report on Monday, October 7th. They set a "buy" rating and a $85.00 target price on the stock. Morgan Stanley increased their target price on shares of Fastenal from $72.00 to $76.00 and gave the stock an "equal weight" rating in a report on Monday, October 14th. Stephens increased their target price on shares of Fastenal from $56.00 to $75.00 and gave the stock an "equal weight" rating in a report on Monday, October 14th. Finally, Robert W. Baird increased their target price on shares of Fastenal from $67.00 to $80.00 and gave the stock a "neutral" rating in a report on Monday, October 14th. Eight investment analysts have rated the stock with a hold rating and two have assigned a buy rating to the stock. Based on data from MarketBeat, Fastenal currently has a consensus rating of "Hold" and a consensus price target of $74.80.

Check Out Our Latest Analysis on Fastenal

Insider Activity

In other Fastenal news, VP John Lewis Soderberg sold 488 shares of the firm's stock in a transaction dated Monday, October 14th. The shares were sold at an average price of $76.32, for a total value of $37,244.16. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Also, EVP Anthony Paul Broersma sold 680 shares of the firm's stock in a transaction dated Wednesday, October 16th. The stock was sold at an average price of $77.86, for a total transaction of $52,944.80. The disclosure for this sale can be found here. In the last quarter, insiders sold 208,289 shares of company stock worth $16,123,438. Corporate insiders own 0.41% of the company's stock.

About Fastenal

(

Free Report)

Fastenal Company, together with its subsidiaries, engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, North America, and internationally. It offers fasteners, and related industrial and construction supplies under the Fastenal name. The company's fastener products include threaded fasteners, bolts, nuts, screws, studs, and related washers that are used in manufactured products and construction projects, as well as in the maintenance and repair of machines.

See Also

Before you consider Fastenal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fastenal wasn't on the list.

While Fastenal currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.