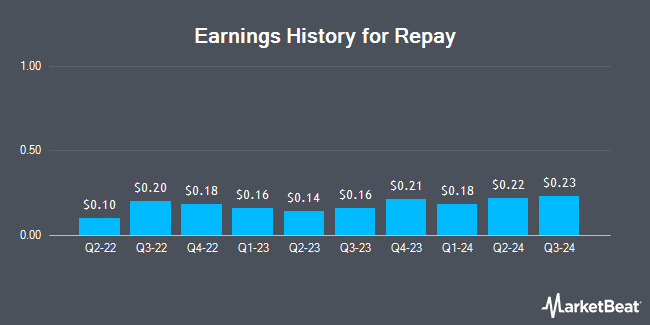

Repay (NASDAQ:RPAY - Get Free Report) released its earnings results on Monday. The company reported $0.19 earnings per share for the quarter, missing analysts' consensus estimates of $0.24 by ($0.05), Zacks reports. Repay had a positive return on equity of 8.73% and a negative net margin of 25.53%. The business had revenue of $78.27 million during the quarter, compared to analysts' expectations of $82.56 million. During the same period last year, the business earned $0.27 earnings per share.

Repay Trading Down 4.6 %

NASDAQ RPAY traded down $0.29 on Thursday, reaching $5.96. The stock had a trading volume of 1,060,041 shares, compared to its average volume of 516,506. The firm has a market capitalization of $581.89 million, a price-to-earnings ratio of -6.85 and a beta of 1.54. The company has a quick ratio of 2.70, a current ratio of 2.70 and a debt-to-equity ratio of 0.64. Repay has a 12-month low of $5.93 and a 12-month high of $11.27. The stock has a fifty day moving average price of $7.36 and a two-hundred day moving average price of $7.84.

Insider Buying and Selling at Repay

In other Repay news, CFO Timothy John Murphy sold 57,000 shares of the business's stock in a transaction that occurred on Wednesday, December 11th. The stock was sold at an average price of $8.25, for a total value of $470,250.00. Following the sale, the chief financial officer now owns 450,879 shares of the company's stock, valued at $3,719,751.75. The trade was a 11.22 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. 11.00% of the stock is owned by corporate insiders.

Analyst Ratings Changes

RPAY has been the topic of a number of research reports. Canaccord Genuity Group decreased their target price on shares of Repay from $13.00 to $12.00 and set a "buy" rating on the stock in a research note on Tuesday. Stephens reaffirmed an "overweight" rating and set a $11.00 price target on shares of Repay in a research report on Tuesday. UBS Group reduced their price target on shares of Repay from $9.50 to $7.50 and set a "neutral" rating on the stock in a research report on Tuesday. Keefe, Bruyette & Woods reduced their price target on shares of Repay from $9.00 to $8.00 and set a "market perform" rating on the stock in a research report on Monday, January 6th. Finally, BMO Capital Markets reduced their price target on shares of Repay from $10.00 to $8.00 and set a "market perform" rating on the stock in a research report on Tuesday. Three research analysts have rated the stock with a hold rating and five have given a buy rating to the company. Based on data from MarketBeat, Repay has a consensus rating of "Moderate Buy" and an average price target of $10.56.

Read Our Latest Report on Repay

About Repay

(

Get Free Report)

Repay Holdings Corporation, payments technology company, provides integrated payment processing solutions to industry-oriented markets in the United States. It operates through two segments: Consumer Payments and Business Payments. The company's payment processing solutions enable consumers and businesses to make payments using electronic payment methods.

Featured Stories

Before you consider Repay, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Repay wasn't on the list.

While Repay currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.