Worldquant Millennium Advisors LLC lifted its holdings in Repligen Co. (NASDAQ:RGEN - Free Report) by 11.9% in the 3rd quarter, according to its most recent filing with the SEC. The firm owned 50,276 shares of the biotechnology company's stock after purchasing an additional 5,337 shares during the period. Worldquant Millennium Advisors LLC owned about 0.09% of Repligen worth $7,482,000 at the end of the most recent quarter.

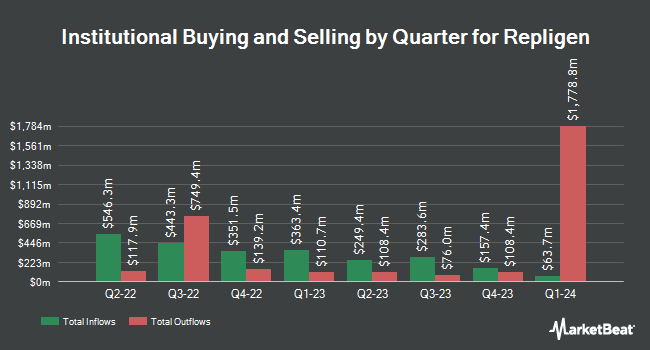

A number of other hedge funds and other institutional investors have also recently modified their holdings of the business. Andra AP fonden purchased a new stake in shares of Repligen during the second quarter valued at about $25,000. International Assets Investment Management LLC purchased a new stake in Repligen during the second quarter valued at approximately $33,000. UMB Bank n.a. lifted its position in Repligen by 138.3% during the third quarter. UMB Bank n.a. now owns 224 shares of the biotechnology company's stock valued at $33,000 after acquiring an additional 130 shares during the last quarter. Blue Trust Inc. boosted its stake in Repligen by 113.4% in the third quarter. Blue Trust Inc. now owns 239 shares of the biotechnology company's stock valued at $36,000 after acquiring an additional 127 shares in the last quarter. Finally, Quarry LP grew its holdings in Repligen by 796.7% in the third quarter. Quarry LP now owns 269 shares of the biotechnology company's stock worth $40,000 after purchasing an additional 239 shares during the last quarter. 97.64% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

A number of analysts have recently weighed in on the company. Wolfe Research started coverage on Repligen in a research report on Thursday, November 14th. They issued a "peer perform" rating for the company. StockNews.com raised Repligen from a "sell" rating to a "hold" rating in a report on Friday, November 22nd. Wells Fargo & Company began coverage on Repligen in a research note on Tuesday, August 27th. They set an "overweight" rating and a $180.00 price target on the stock. Finally, Royal Bank of Canada reaffirmed an "outperform" rating and issued a $205.00 price objective on shares of Repligen in a research report on Thursday, September 26th. Four analysts have rated the stock with a hold rating and eight have issued a buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $190.25.

Check Out Our Latest Stock Report on Repligen

Insider Activity at Repligen

In related news, Director Anthony Hunt sold 22,191 shares of Repligen stock in a transaction dated Tuesday, September 10th. The stock was sold at an average price of $145.37, for a total value of $3,225,905.67. Following the completion of the transaction, the director now owns 139,840 shares in the company, valued at $20,328,540.80. The trade was a 13.70 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 1.20% of the stock is owned by company insiders.

Repligen Stock Performance

RGEN traded up $6.94 during trading on Friday, reaching $149.20. 590,853 shares of the company's stock were exchanged, compared to its average volume of 693,035. The stock has a market capitalization of $8.36 billion, a P/E ratio of -403.24, a price-to-earnings-growth ratio of 4.48 and a beta of 0.96. Repligen Co. has a 1 year low of $113.50 and a 1 year high of $211.13. The company's fifty day simple moving average is $141.45 and its 200-day simple moving average is $141.82. The company has a debt-to-equity ratio of 0.26, a current ratio of 10.44 and a quick ratio of 8.76.

Repligen (NASDAQ:RGEN - Get Free Report) last posted its quarterly earnings results on Tuesday, November 12th. The biotechnology company reported $0.43 EPS for the quarter, beating the consensus estimate of $0.34 by $0.09. The company had revenue of $154.87 million for the quarter, compared to analyst estimates of $153.34 million. Repligen had a negative net margin of 3.36% and a positive return on equity of 3.90%. The firm's revenue was up 9.7% on a year-over-year basis. During the same period in the prior year, the company earned $0.23 earnings per share. As a group, research analysts predict that Repligen Co. will post 1.52 earnings per share for the current fiscal year.

Repligen Profile

(

Free Report)

Repligen Corporation develops and commercializes bioprocessing technologies and systems for use in biological drug manufacturing process in North America, Europe, the Asia Pacific, and internationally. It offers Protein A ligands that are the binding components of Protein A affinity chromatography resins; and cell culture growth factor products.

Featured Stories

Before you consider Repligen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Repligen wasn't on the list.

While Repligen currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.