Thrivent Financial for Lutherans lifted its position in Repligen Co. (NASDAQ:RGEN - Free Report) by 6.1% during the third quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 638,602 shares of the biotechnology company's stock after buying an additional 36,773 shares during the period. Thrivent Financial for Lutherans owned approximately 1.14% of Repligen worth $95,037,000 at the end of the most recent reporting period.

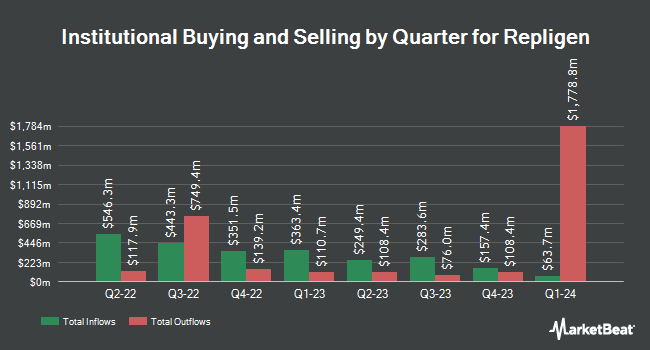

A number of other hedge funds and other institutional investors also recently modified their holdings of RGEN. Bank of New York Mellon Corp raised its position in shares of Repligen by 21.0% during the second quarter. Bank of New York Mellon Corp now owns 1,370,375 shares of the biotechnology company's stock worth $172,749,000 after purchasing an additional 237,884 shares during the period. Conestoga Capital Advisors LLC raised its position in Repligen by 26.7% during the second quarter. Conestoga Capital Advisors LLC now owns 946,877 shares of the biotechnology company's stock valued at $119,363,000 after buying an additional 199,322 shares during the period. Dimensional Fund Advisors LP raised its position in Repligen by 39.4% during the second quarter. Dimensional Fund Advisors LP now owns 429,524 shares of the biotechnology company's stock valued at $54,149,000 after buying an additional 121,305 shares during the period. New York State Common Retirement Fund raised its position in Repligen by 14.4% during the third quarter. New York State Common Retirement Fund now owns 567,044 shares of the biotechnology company's stock valued at $84,387,000 after buying an additional 71,274 shares during the period. Finally, Renaissance Technologies LLC acquired a new position in Repligen during the second quarter valued at $5,320,000. Institutional investors own 97.64% of the company's stock.

Insider Buying and Selling at Repligen

In related news, Director Anthony Hunt sold 22,191 shares of the firm's stock in a transaction on Tuesday, September 10th. The stock was sold at an average price of $145.37, for a total transaction of $3,225,905.67. Following the sale, the director now owns 139,840 shares of the company's stock, valued at approximately $20,328,540.80. This trade represents a 13.70 % decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through this link. Corporate insiders own 1.20% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages have commented on RGEN. Stephens restated an "overweight" rating and issued a $170.00 target price on shares of Repligen in a research note on Tuesday, July 30th. Royal Bank of Canada restated an "outperform" rating and issued a $205.00 target price on shares of Repligen in a research note on Thursday, September 26th. JPMorgan Chase & Co. upped their price target on Repligen from $190.00 to $200.00 and gave the stock an "overweight" rating in a research note on Wednesday, July 31st. StockNews.com upgraded Repligen from a "sell" rating to a "hold" rating in a research note on Wednesday, November 13th. Finally, UBS Group cut their price objective on Repligen from $205.00 to $185.00 and set a "buy" rating for the company in a research report on Wednesday, July 31st. Four investment analysts have rated the stock with a hold rating and eight have given a buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and a consensus target price of $190.25.

Check Out Our Latest Stock Analysis on RGEN

Repligen Price Performance

Shares of RGEN traded down $1.32 during mid-day trading on Monday, reaching $123.41. The company had a trading volume of 1,000,261 shares, compared to its average volume of 667,466. Repligen Co. has a twelve month low of $113.50 and a twelve month high of $211.13. The company has a debt-to-equity ratio of 0.26, a current ratio of 6.65 and a quick ratio of 5.56. The company's 50-day moving average is $141.09 and its 200-day moving average is $144.24. The company has a market capitalization of $6.91 billion, a P/E ratio of -336.48, a P/E/G ratio of 3.43 and a beta of 0.96.

Repligen (NASDAQ:RGEN - Get Free Report) last released its quarterly earnings results on Tuesday, November 12th. The biotechnology company reported $0.43 EPS for the quarter, topping analysts' consensus estimates of $0.34 by $0.09. The business had revenue of $154.87 million for the quarter, compared to analyst estimates of $153.34 million. Repligen had a positive return on equity of 3.92% and a negative net margin of 3.36%. Repligen's revenue for the quarter was up 9.7% on a year-over-year basis. During the same period in the prior year, the company earned $0.23 EPS. On average, equities analysts anticipate that Repligen Co. will post 1.52 EPS for the current year.

About Repligen

(

Free Report)

Repligen Corporation develops and commercializes bioprocessing technologies and systems for use in biological drug manufacturing process in North America, Europe, the Asia Pacific, and internationally. It offers Protein A ligands that are the binding components of Protein A affinity chromatography resins; and cell culture growth factor products.

See Also

Before you consider Repligen, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Repligen wasn't on the list.

While Repligen currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.