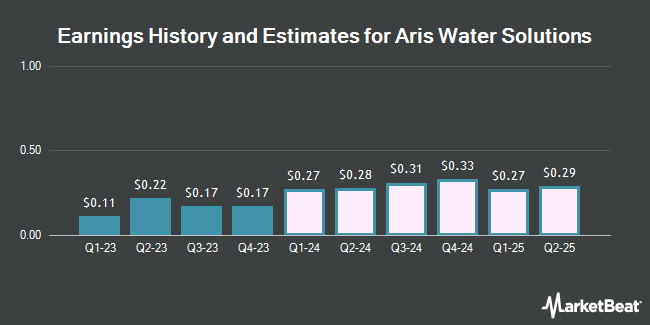

Aris Water Solutions, Inc. (NYSE:ARIS - Free Report) - Equities researchers at Seaport Res Ptn increased their FY2024 earnings estimates for Aris Water Solutions in a research note issued to investors on Wednesday, November 6th. Seaport Res Ptn analyst J. Campbell now expects that the company will earn $0.84 per share for the year, up from their previous estimate of $0.81. The consensus estimate for Aris Water Solutions' current full-year earnings is $0.88 per share. Seaport Res Ptn also issued estimates for Aris Water Solutions' Q4 2025 earnings at $0.29 EPS.

Aris Water Solutions (NYSE:ARIS - Get Free Report) last posted its quarterly earnings data on Tuesday, August 6th. The company reported $0.18 earnings per share for the quarter, hitting the consensus estimate of $0.18. The company had revenue of $101.12 million for the quarter, compared to analysts' expectations of $97.86 million. Aris Water Solutions had a net margin of 6.29% and a return on equity of 3.78%.

Other research analysts have also recently issued reports about the stock. Stifel Nicolaus upped their price objective on shares of Aris Water Solutions from $20.00 to $26.00 and gave the stock a "buy" rating in a research report on Wednesday. Evercore ISI increased their price target on shares of Aris Water Solutions from $20.00 to $25.00 and gave the company an "outperform" rating in a research report on Wednesday. JPMorgan Chase & Co. cut shares of Aris Water Solutions from an "overweight" rating to a "neutral" rating and increased their price target for the company from $19.00 to $22.00 in a research report on Wednesday. The Goldman Sachs Group increased their price target on shares of Aris Water Solutions from $18.50 to $21.00 and gave the company a "buy" rating in a research report on Wednesday. Finally, US Capital Advisors upgraded shares of Aris Water Solutions from a "moderate buy" rating to a "strong-buy" rating in a research report on Monday, October 28th. Two equities research analysts have rated the stock with a hold rating, five have given a buy rating and one has assigned a strong buy rating to the company. According to MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus target price of $18.50.

Read Our Latest Stock Report on ARIS

Aris Water Solutions Price Performance

Shares of ARIS stock traded up $1.43 during trading on Friday, hitting $23.65. The company had a trading volume of 783,430 shares, compared to its average volume of 358,607. The company has a quick ratio of 1.30, a current ratio of 1.30 and a debt-to-equity ratio of 0.62. The stock's 50-day moving average is $16.77 and its two-hundred day moving average is $15.98. The stock has a market capitalization of $1.37 billion, a price-to-earnings ratio of 27.78 and a beta of 1.62. Aris Water Solutions has a 52 week low of $7.22 and a 52 week high of $23.71.

Institutional Trading of Aris Water Solutions

A number of institutional investors and hedge funds have recently added to or reduced their stakes in the business. Rhumbline Advisers lifted its stake in Aris Water Solutions by 1.7% in the second quarter. Rhumbline Advisers now owns 44,083 shares of the company's stock worth $691,000 after acquiring an additional 758 shares during the period. Point72 Asia Singapore Pte. Ltd. purchased a new position in Aris Water Solutions during the second quarter valued at $27,000. Kings Path Partners LLC lifted its position in Aris Water Solutions by 2.6% during the third quarter. Kings Path Partners LLC now owns 67,234 shares of the company's stock valued at $1,134,000 after buying an additional 1,735 shares during the period. Price T Rowe Associates Inc. MD lifted its position in Aris Water Solutions by 9.4% during the first quarter. Price T Rowe Associates Inc. MD now owns 22,107 shares of the company's stock valued at $313,000 after buying an additional 1,902 shares during the period. Finally, Meeder Asset Management Inc. purchased a new position in Aris Water Solutions during the third quarter valued at $39,000. Hedge funds and other institutional investors own 39.71% of the company's stock.

Insider Activity

In other news, COO Brunt David Dylan Van sold 14,813 shares of the stock in a transaction that occurred on Monday, August 12th. The stock was sold at an average price of $14.84, for a total transaction of $219,824.92. Following the completion of the sale, the chief operating officer now owns 94,690 shares of the company's stock, valued at approximately $1,405,199.60. This represents a 0.00 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Insiders own 22.46% of the company's stock.

Aris Water Solutions Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Thursday, December 5th will be paid a dividend of $0.105 per share. This represents a $0.42 dividend on an annualized basis and a dividend yield of 1.78%. The ex-dividend date of this dividend is Thursday, December 5th. Aris Water Solutions's dividend payout ratio (DPR) is presently 52.50%.

Aris Water Solutions Company Profile

(

Get Free Report)

Aris Water Solutions, Inc, an environmental infrastructure and solutions company, provides water handling and recycling solutions. The company's produced water handling business gathers, transports, unless recycled, and handles produced water generated from oil and natural gas production. Its water solutions business develops and operates recycling facilities to treat, store, and recycle produced water.

Further Reading

Before you consider Aris Water Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aris Water Solutions wasn't on the list.

While Aris Water Solutions currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.