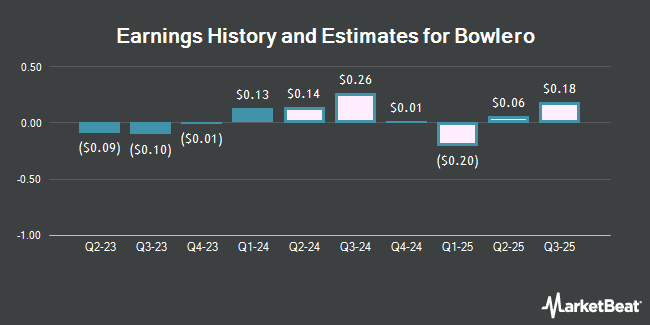

Bowlero Corp. (NYSE:BOWL - Free Report) - Analysts at Roth Capital upped their Q3 2025 earnings estimates for Bowlero in a report issued on Tuesday, November 5th. Roth Capital analyst E. Handler now forecasts that the company will post earnings per share of $0.40 for the quarter, up from their prior estimate of $0.34. The consensus estimate for Bowlero's current full-year earnings is $0.20 per share. Roth Capital also issued estimates for Bowlero's FY2026 earnings at $0.30 EPS and FY2027 earnings at $0.48 EPS.

Several other analysts have also issued reports on the stock. Canaccord Genuity Group reissued a "buy" rating and issued a $18.00 price target on shares of Bowlero in a research report on Monday, September 30th. Royal Bank of Canada raised shares of Bowlero to a "moderate buy" rating in a research report on Thursday, October 3rd. Piper Sandler assumed coverage on shares of Bowlero in a research report on Monday, October 28th. They issued a "neutral" rating and a $12.00 price target on the stock. B. Riley reissued a "buy" rating and issued a $17.00 price target on shares of Bowlero in a research report on Tuesday, September 3rd. Finally, JPMorgan Chase & Co. lowered their price target on shares of Bowlero from $16.00 to $15.00 and set an "overweight" rating on the stock in a research report on Tuesday. Two investment analysts have rated the stock with a hold rating and seven have issued a buy rating to the stock. According to data from MarketBeat.com, Bowlero presently has a consensus rating of "Moderate Buy" and a consensus price target of $15.88.

Read Our Latest Research Report on Bowlero

Bowlero Price Performance

Shares of BOWL traded up $0.10 during trading hours on Wednesday, hitting $11.72. The company's stock had a trading volume of 716,068 shares, compared to its average volume of 496,693. The business has a 50 day simple moving average of $11.47 and a two-hundred day simple moving average of $12.17. Bowlero has a 52-week low of $8.85 and a 52-week high of $15.47.

Bowlero (NYSE:BOWL - Get Free Report) last posted its quarterly earnings data on Monday, November 4th. The company reported $0.13 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.17) by $0.30. Bowlero had a negative net margin of 6.63% and a negative return on equity of 34.55%. The business had revenue of $260.20 million during the quarter, compared to the consensus estimate of $249.42 million. During the same quarter last year, the company posted ($0.10) earnings per share.

Hedge Funds Weigh In On Bowlero

Hedge funds and other institutional investors have recently bought and sold shares of the stock. Price T Rowe Associates Inc. MD boosted its stake in shares of Bowlero by 7.0% in the 1st quarter. Price T Rowe Associates Inc. MD now owns 14,953 shares of the company's stock valued at $205,000 after purchasing an additional 978 shares in the last quarter. Victory Capital Management Inc. boosted its stake in shares of Bowlero by 13.1% in the 3rd quarter. Victory Capital Management Inc. now owns 33,099 shares of the company's stock valued at $389,000 after purchasing an additional 3,835 shares in the last quarter. Summit Securities Group LLC purchased a new stake in shares of Bowlero in the 2nd quarter valued at $392,000. XTX Topco Ltd purchased a new stake in shares of Bowlero in the 2nd quarter valued at $411,000. Finally, Bessemer Group Inc. boosted its stake in shares of Bowlero by 12.3% in the 1st quarter. Bessemer Group Inc. now owns 37,200 shares of the company's stock valued at $509,000 after purchasing an additional 4,070 shares in the last quarter. Hedge funds and other institutional investors own 68.11% of the company's stock.

Bowlero Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, December 6th. Investors of record on Friday, November 22nd will be issued a dividend of $0.055 per share. This represents a $0.22 dividend on an annualized basis and a yield of 1.88%. The ex-dividend date of this dividend is Friday, November 22nd. Bowlero's dividend payout ratio (DPR) is presently -36.06%.

Bowlero Company Profile

(

Get Free Report)

Bowlero Corp. operates bowling entertainment centers under the AMF, Bowlmor Lanes, and Bowlero brand names. The company also provides hosting and overseeing professional and non-professional bowling tournaments and related broadcasting. It operates bowling centers in the United States, Mexico, and Canada.

Recommended Stories

Before you consider Bowlero, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bowlero wasn't on the list.

While Bowlero currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.