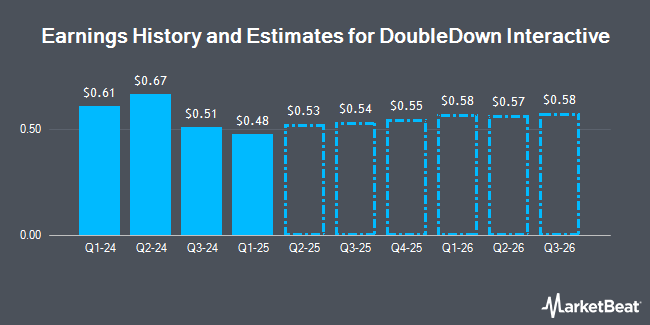

DoubleDown Interactive Co., Ltd. (NASDAQ:DDI - Free Report) - Equities research analysts at Wedbush reduced their FY2025 earnings per share estimates for shares of DoubleDown Interactive in a research report issued on Wednesday, February 12th. Wedbush analyst M. Pachter now anticipates that the company will post earnings per share of $2.30 for the year, down from their prior estimate of $2.31. Wedbush has a "Outperform" rating and a $21.00 price objective on the stock. The consensus estimate for DoubleDown Interactive's current full-year earnings is $2.38 per share. Wedbush also issued estimates for DoubleDown Interactive's Q4 2025 earnings at $0.60 EPS, FY2026 earnings at $2.33 EPS and FY2027 earnings at $2.37 EPS.

Separately, Northland Securities reduced their price objective on shares of DoubleDown Interactive from $21.00 to $18.00 and set an "outperform" rating for the company in a research report on Wednesday, February 12th.

View Our Latest Report on DDI

DoubleDown Interactive Price Performance

DDI stock traded up $0.12 during trading hours on Thursday, hitting $10.16. 46,987 shares of the stock traded hands, compared to its average volume of 31,637. The stock has a 50-day simple moving average of $10.62 and a 200 day simple moving average of $12.86. The company has a market cap of $503.46 million, a P/E ratio of 4.42 and a beta of 0.94. DoubleDown Interactive has a one year low of $8.56 and a one year high of $18.21. The company has a current ratio of 21.25, a quick ratio of 21.25 and a debt-to-equity ratio of 0.05.

Institutional Investors Weigh In On DoubleDown Interactive

Several large investors have recently modified their holdings of DDI. Heck Capital Advisors LLC purchased a new stake in shares of DoubleDown Interactive in the 4th quarter valued at approximately $76,000. JPMorgan Chase & Co. purchased a new position in DoubleDown Interactive during the 3rd quarter worth approximately $81,000. Trexquant Investment LP acquired a new stake in DoubleDown Interactive during the 4th quarter valued at $106,000. BNP Paribas Financial Markets purchased a new stake in shares of DoubleDown Interactive in the fourth quarter valued at $111,000. Finally, Raymond James Financial Inc. acquired a new stake in shares of DoubleDown Interactive in the fourth quarter worth $153,000.

DoubleDown Interactive Company Profile

(

Get Free Report)

DoubleDown Interactive Co, Ltd. engages in the development and publishing of casual games and mobile applications in South Korea. It publishes digital gaming content on mobile and web platforms. The company offers DoubleDown Casino, DoubleDown Classic, DoubleDown Fort Knox, and cash me out games, as well as sells in-game virtual chips.

Read More

Before you consider DoubleDown Interactive, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and DoubleDown Interactive wasn't on the list.

While DoubleDown Interactive currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.