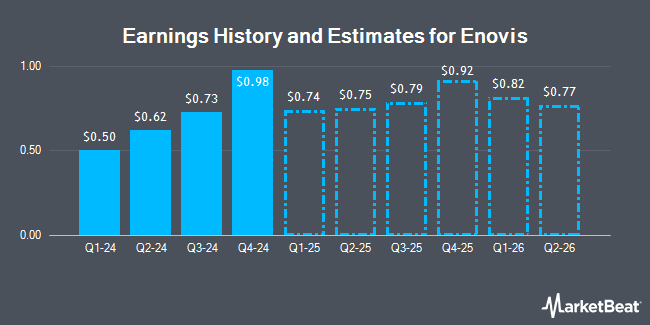

Enovis Co. (NYSE:ENOV - Free Report) - Equities researchers at Roth Capital raised their FY2025 earnings per share (EPS) estimates for Enovis in a report released on Wednesday, November 6th. Roth Capital analyst J. Wittes now forecasts that the company will post earnings of $3.31 per share for the year, up from their prior forecast of $3.03. The consensus estimate for Enovis' current full-year earnings is $2.79 per share. Roth Capital also issued estimates for Enovis' FY2026 earnings at $3.99 EPS.

Several other equities research analysts have also recently weighed in on the company. Needham & Company LLC restated a "buy" rating and set a $65.00 target price on shares of Enovis in a research note on Thursday. Evercore ISI lowered their price target on shares of Enovis from $62.00 to $58.00 and set an "outperform" rating for the company in a report on Tuesday, October 1st. JPMorgan Chase & Co. lowered their price target on shares of Enovis from $53.00 to $50.00 and set a "neutral" rating for the company in a report on Thursday, August 8th. Finally, JMP Securities initiated coverage on shares of Enovis in a report on Thursday, October 3rd. They set an "outperform" rating and a $62.00 price target for the company. One analyst has rated the stock with a hold rating and eight have issued a buy rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of $67.00.

Check Out Our Latest Report on ENOV

Enovis Stock Up 2.0 %

Shares of ENOV stock traded up $0.93 during trading on Monday, hitting $47.35. The company had a trading volume of 525,711 shares, compared to its average volume of 584,049. The stock's 50-day moving average price is $42.23 and its 200 day moving average price is $45.43. The company has a current ratio of 2.27, a quick ratio of 1.08 and a debt-to-equity ratio of 0.40. Enovis has a one year low of $38.27 and a one year high of $65.03.

Enovis (NYSE:ENOV - Get Free Report) last issued its quarterly earnings results on Wednesday, November 6th. The company reported $0.73 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.62 by $0.11. The business had revenue of $505.22 million during the quarter, compared to analysts' expectations of $504.44 million. Enovis had a positive return on equity of 4.39% and a negative net margin of 5.95%. The firm's revenue for the quarter was up 21.0% compared to the same quarter last year. During the same period in the previous year, the company posted $0.56 earnings per share.

Hedge Funds Weigh In On Enovis

Institutional investors and hedge funds have recently made changes to their positions in the stock. Landscape Capital Management L.L.C. bought a new position in Enovis in the 3rd quarter valued at about $331,000. Quest Partners LLC bought a new position in Enovis in the 3rd quarter valued at about $741,000. Mutual of America Capital Management LLC lifted its position in Enovis by 5.6% in the 3rd quarter. Mutual of America Capital Management LLC now owns 30,183 shares of the company's stock valued at $1,299,000 after acquiring an additional 1,604 shares in the last quarter. Natixis Advisors LLC purchased a new stake in Enovis in the 3rd quarter valued at about $546,000. Finally, Royce & Associates LP increased its stake in Enovis by 16.8% in the 3rd quarter. Royce & Associates LP now owns 2,403,685 shares of the company's stock valued at $103,479,000 after buying an additional 346,317 shares during the last quarter. Institutional investors own 98.45% of the company's stock.

About Enovis

(

Get Free Report)

Enovis Corporation operates as a medical technology company focus on developing clinically differentiated solutions worldwide. It also manufactures and distributes medical devices which are used for reconstructive surgery, rehabilitation, pain management, and physical therapy. The company operates through Prevention and Recovery, and Reconstructive segments.

See Also

Before you consider Enovis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enovis wasn't on the list.

While Enovis currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.