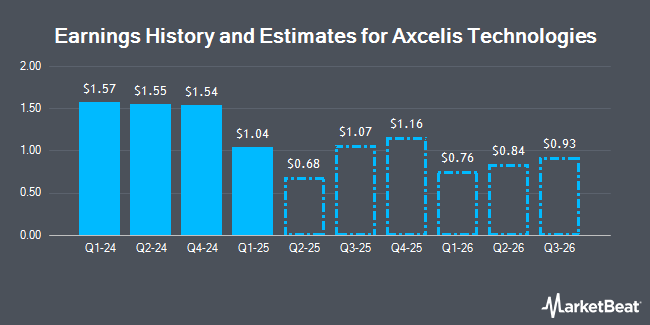

Axcelis Technologies, Inc. (NASDAQ:ACLS - Free Report) - Investment analysts at William Blair reduced their Q1 2025 earnings per share (EPS) estimates for shares of Axcelis Technologies in a report released on Wednesday, November 13th. William Blair analyst J. Dorsheimer now forecasts that the semiconductor company will post earnings of $1.06 per share for the quarter, down from their prior forecast of $1.41. The consensus estimate for Axcelis Technologies' current full-year earnings is $5.86 per share. William Blair also issued estimates for Axcelis Technologies' Q2 2025 earnings at $1.15 EPS, Q3 2025 earnings at $1.40 EPS, Q4 2025 earnings at $1.57 EPS and FY2025 earnings at $5.19 EPS.

A number of other research analysts also recently commented on the stock. Benchmark downgraded shares of Axcelis Technologies from a "buy" rating to a "hold" rating in a research report on Friday, November 8th. B. Riley dropped their target price on Axcelis Technologies from $190.00 to $165.00 and set a "buy" rating on the stock in a research report on Friday, August 2nd. Finally, Needham & Company LLC restated a "hold" rating on shares of Axcelis Technologies in a research note on Friday, November 8th. Three analysts have rated the stock with a hold rating and four have assigned a buy rating to the stock. Based on data from MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average price target of $167.33.

Read Our Latest Research Report on ACLS

Axcelis Technologies Stock Down 1.5 %

Shares of Axcelis Technologies stock traded down $1.08 during trading on Monday, hitting $72.14. 1,166,694 shares of the stock traded hands, compared to its average volume of 636,934. Axcelis Technologies has a 52-week low of $71.64 and a 52-week high of $158.61. The stock's fifty day simple moving average is $94.75 and its 200 day simple moving average is $112.56. The firm has a market cap of $2.34 billion, a P/E ratio of 10.83, a price-to-earnings-growth ratio of 2.28 and a beta of 1.60. The company has a current ratio of 4.45, a quick ratio of 3.29 and a debt-to-equity ratio of 0.04.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently added to or reduced their stakes in ACLS. ProShare Advisors LLC grew its holdings in shares of Axcelis Technologies by 19.1% during the first quarter. ProShare Advisors LLC now owns 11,597 shares of the semiconductor company's stock valued at $1,293,000 after buying an additional 1,861 shares during the last quarter. State Board of Administration of Florida Retirement System increased its stake in shares of Axcelis Technologies by 15.4% in the 1st quarter. State Board of Administration of Florida Retirement System now owns 10,740 shares of the semiconductor company's stock valued at $1,198,000 after purchasing an additional 1,430 shares in the last quarter. Mitsubishi UFJ Asset Management Co. Ltd. boosted its position in Axcelis Technologies by 239.4% during the first quarter. Mitsubishi UFJ Asset Management Co. Ltd. now owns 46,434 shares of the semiconductor company's stock worth $5,178,000 after purchasing an additional 32,753 shares in the last quarter. Vanguard Group Inc. increased its position in shares of Axcelis Technologies by 6.5% in the first quarter. Vanguard Group Inc. now owns 4,304,516 shares of the semiconductor company's stock valued at $480,040,000 after buying an additional 263,604 shares in the last quarter. Finally, Covestor Ltd raised its stake in shares of Axcelis Technologies by 35.6% during the 1st quarter. Covestor Ltd now owns 1,551 shares of the semiconductor company's stock worth $173,000 after buying an additional 407 shares during the period. 89.98% of the stock is currently owned by hedge funds and other institutional investors.

About Axcelis Technologies

(

Get Free Report)

Axcelis Technologies, Inc designs, manufactures, and services ion implantation and other processing equipment used in the fabrication of semiconductor chips in the United States, Europe, and Asia Pacific. The company offers high energy, high current, and medium current implanters for various application requirements.

Recommended Stories

Before you consider Axcelis Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Axcelis Technologies wasn't on the list.

While Axcelis Technologies currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.