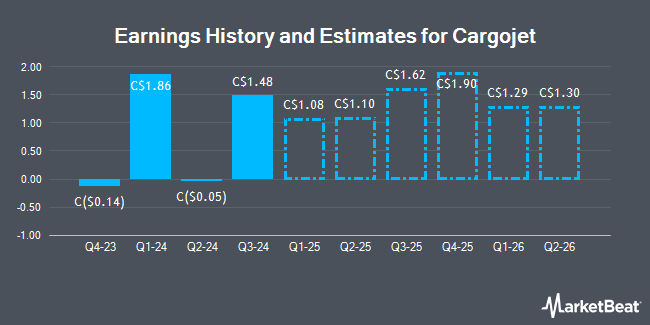

Cargojet Inc. (TSE:CJT - Free Report) - Analysts at Cormark raised their Q4 2024 earnings per share (EPS) estimates for shares of Cargojet in a research note issued to investors on Wednesday, November 6th. Cormark analyst D. Ocampo now anticipates that the company will post earnings of $1.82 per share for the quarter, up from their prior forecast of $1.80. The consensus estimate for Cargojet's current full-year earnings is $5.89 per share. Cormark also issued estimates for Cargojet's Q1 2025 earnings at $1.29 EPS, Q2 2025 earnings at $1.36 EPS, Q3 2025 earnings at $1.59 EPS and FY2025 earnings at $6.24 EPS.

Cargojet (TSE:CJT - Get Free Report) last released its quarterly earnings results on Tuesday, August 13th. The company reported C($0.05) EPS for the quarter, missing the consensus estimate of C$1.10 by C($1.15). The firm had revenue of C$230.80 million for the quarter, compared to the consensus estimate of C$239.77 million. Cargojet had a negative return on equity of 2.13% and a negative net margin of 1.88%.

CJT has been the subject of several other research reports. National Bankshares increased their price target on Cargojet from C$154.00 to C$158.00 and gave the stock an "outperform" rating in a research note on Thursday, October 17th. Acumen Capital raised their target price on shares of Cargojet from C$175.00 to C$178.00 in a research note on Thursday, August 15th. Scotiabank lowered shares of Cargojet from a "strong-buy" rating to a "hold" rating in a research note on Wednesday, July 10th. ATB Capital decreased their price objective on shares of Cargojet from C$165.00 to C$155.00 in a report on Wednesday. Finally, Canaccord Genuity Group boosted their target price on Cargojet from C$160.00 to C$165.00 in a report on Wednesday. Two equities research analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average price target of C$159.00.

Check Out Our Latest Report on Cargojet

Cargojet Stock Performance

CJT traded up C$4.89 during trading hours on Thursday, hitting C$137.05. The company's stock had a trading volume of 80,900 shares, compared to its average volume of 55,391. The company has a 50-day simple moving average of C$133.73 and a 200 day simple moving average of C$127.21. The company has a current ratio of 0.59, a quick ratio of 0.79 and a debt-to-equity ratio of 99.84. The firm has a market capitalization of C$2.21 billion, a PE ratio of -144.26 and a beta of 0.91. Cargojet has a fifty-two week low of C$82.22 and a fifty-two week high of C$144.97.

Cargojet Increases Dividend

The business also recently declared a quarterly dividend, which was paid on Friday, October 4th. Stockholders of record on Friday, October 4th were given a $0.35 dividend. This represents a $1.40 dividend on an annualized basis and a dividend yield of 1.02%. This is a positive change from Cargojet's previous quarterly dividend of $0.32. The ex-dividend date of this dividend was Friday, September 20th. Cargojet's dividend payout ratio is -147.37%.

About Cargojet

(

Get Free Report)

Cargojet Inc provides time sensitive overnight air cargo services and carriers in Canada. It operates domestic air cargo network services between 16 Canadian cities; and provides dedicated aircraft to customers on an aircraft, crew, maintenance, and insurance basis operating between points in Canada, North and South America, and Europe.

Recommended Stories

Before you consider Cargojet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cargojet wasn't on the list.

While Cargojet currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.