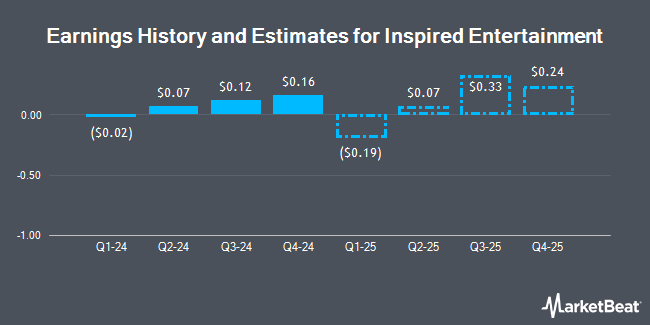

Inspired Entertainment, Inc. (NASDAQ:INSE - Free Report) - B. Riley lowered their FY2024 earnings per share (EPS) estimates for shares of Inspired Entertainment in a research report issued on Monday, November 11th. B. Riley analyst D. Bain now anticipates that the company will post earnings per share of $0.20 for the year, down from their previous forecast of $0.68. The consensus estimate for Inspired Entertainment's current full-year earnings is $0.50 per share. B. Riley also issued estimates for Inspired Entertainment's Q1 2025 earnings at $0.02 EPS, Q3 2025 earnings at $0.34 EPS and Q4 2025 earnings at $0.18 EPS.

A number of other analysts have also recently issued reports on the company. Macquarie decreased their target price on Inspired Entertainment from $11.00 to $10.00 and set a "neutral" rating for the company in a report on Friday, August 9th. Craig Hallum upgraded shares of Inspired Entertainment to a "strong-buy" rating in a report on Thursday, October 17th.

Check Out Our Latest Research Report on INSE

Inspired Entertainment Price Performance

INSE stock traded down $0.09 on Thursday, hitting $10.23. 72,042 shares of the company were exchanged, compared to its average volume of 106,711. The stock has a market capitalization of $271.89 million, a price-to-earnings ratio of -1,032.00 and a beta of 1.40. The business's fifty day moving average is $9.41 and its two-hundred day moving average is $9.06. Inspired Entertainment has a twelve month low of $7.36 and a twelve month high of $11.00.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of INSE. EntryPoint Capital LLC purchased a new stake in shares of Inspired Entertainment in the 1st quarter valued at approximately $26,000. Bfsg LLC grew its stake in shares of Inspired Entertainment by 61.9% in the second quarter. Bfsg LLC now owns 9,875 shares of the company's stock worth $90,000 after acquiring an additional 3,775 shares during the last quarter. GSA Capital Partners LLP acquired a new stake in Inspired Entertainment during the third quarter worth $106,000. Clarus Group Inc. acquired a new stake in shares of Inspired Entertainment in the 3rd quarter valued at $116,000. Finally, BNP Paribas Financial Markets lifted its holdings in Inspired Entertainment by 232.2% during the 3rd quarter. BNP Paribas Financial Markets now owns 28,317 shares of the company's stock valued at $262,000 after purchasing an additional 19,794 shares during the last quarter. Institutional investors own 77.38% of the company's stock.

Inspired Entertainment Company Profile

(

Get Free Report)

Inspired Entertainment, Inc, a gaming technology company, engages in the supply of content, platform, and other products and services to regulated lottery, betting, and gaming operators worldwide. It operates in four segments: Gaming, Virtual Sports, Interactive, and Leisure. The Gaming segment supplies gaming terminals and software to betting offices, casinos, gaming halls, and high street adult gaming centers; a portfolio of games through its digital terminals under the Centurion and Super Hot Fruits names; and traditional casino games, such as roulette, blackjack, and number games.

Featured Articles

Before you consider Inspired Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inspired Entertainment wasn't on the list.

While Inspired Entertainment currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.