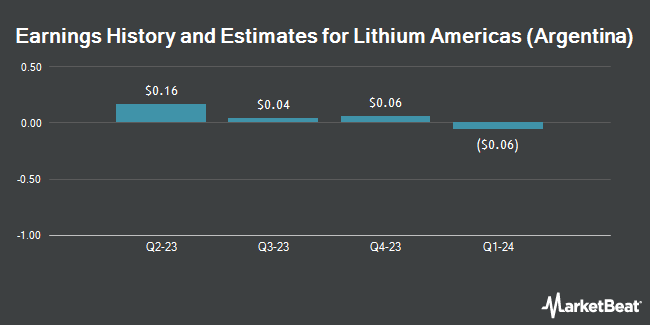

Lithium Americas (Argentina) Corp. (NYSE:LAAC - Free Report) - Equities research analysts at Cormark lowered their FY2024 earnings per share (EPS) estimates for Lithium Americas (Argentina) in a research note issued to investors on Thursday, November 7th. Cormark analyst M. Whale now anticipates that the company will post earnings of ($0.09) per share for the year, down from their prior forecast of $0.05. The consensus estimate for Lithium Americas (Argentina)'s current full-year earnings is ($0.06) per share. Cormark also issued estimates for Lithium Americas (Argentina)'s FY2025 earnings at $0.22 EPS.

Lithium Americas (Argentina) (NYSE:LAAC - Get Free Report) last announced its earnings results on Tuesday, August 13th. The company reported ($0.05) EPS for the quarter, missing the consensus estimate of ($0.03) by ($0.02).

Several other equities analysts have also recently weighed in on the stock. HSBC upgraded shares of Lithium Americas (Argentina) from a "hold" rating to a "buy" rating in a research report on Wednesday, August 14th. Hsbc Global Res upgraded Lithium Americas (Argentina) to a "strong-buy" rating in a report on Wednesday, August 14th. Finally, Scotiabank lowered their price objective on shares of Lithium Americas (Argentina) from $8.00 to $4.25 and set a "sector outperform" rating on the stock in a research report on Thursday, August 15th. Four research analysts have rated the stock with a hold rating, three have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat.com, Lithium Americas (Argentina) presently has an average rating of "Moderate Buy" and a consensus price target of $7.05.

View Our Latest Report on LAAC

Lithium Americas (Argentina) Trading Up 5.6 %

Shares of LAAC traded up $0.18 during midday trading on Monday, hitting $3.42. The stock had a trading volume of 1,105,195 shares, compared to its average volume of 1,521,179. Lithium Americas has a fifty-two week low of $2.07 and a fifty-two week high of $6.69. The business has a 50-day simple moving average of $3.11 and a two-hundred day simple moving average of $3.48. The firm has a market cap of $553.77 million, a P/E ratio of 0.44 and a beta of 1.33.

Institutional Investors Weigh In On Lithium Americas (Argentina)

Large investors have recently added to or reduced their stakes in the stock. General Motors Holdings LLC bought a new stake in shares of Lithium Americas (Argentina) in the first quarter valued at approximately $80,862,000. William Blair Investment Management LLC bought a new stake in Lithium Americas (Argentina) in the 2nd quarter valued at $10,465,000. M&G Plc acquired a new stake in Lithium Americas (Argentina) in the 1st quarter worth $5,944,000. Van ECK Associates Corp raised its position in shares of Lithium Americas (Argentina) by 16.3% during the third quarter. Van ECK Associates Corp now owns 3,041,365 shares of the company's stock valued at $10,615,000 after buying an additional 426,419 shares during the last quarter. Finally, Decade Renewable Partners LP lifted its stake in shares of Lithium Americas (Argentina) by 102.7% in the second quarter. Decade Renewable Partners LP now owns 547,625 shares of the company's stock valued at $1,752,000 after buying an additional 277,500 shares during the period. Institutional investors own 49.17% of the company's stock.

About Lithium Americas (Argentina)

(

Get Free Report)

Lithium Americas (Argentina) Corp. operates as a resource company. The company explores for lithium deposits. The company owns interests in the Cauchari-Olaroz project located in Jujuy province of Argentina. It also has a pipeline of development and exploration stage projects, including the Pastos Grandes project and the Sal de la Puna project located in Salta Province in northwestern Argentina.

Featured Articles

Before you consider Lithium Americas (Argentina), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lithium Americas (Argentina) wasn't on the list.

While Lithium Americas (Argentina) currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.