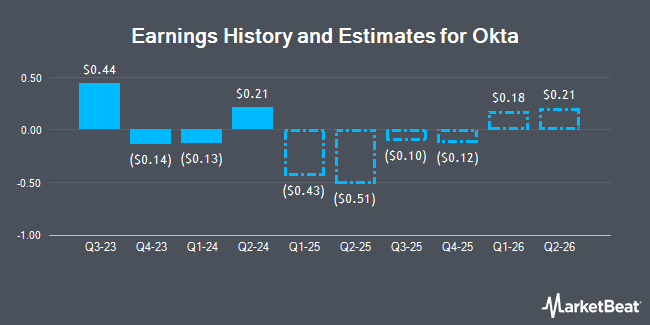

Okta, Inc. (NASDAQ:OKTA - Free Report) - William Blair upped their Q4 2025 earnings per share estimates for shares of Okta in a research report issued to clients and investors on Wednesday, December 4th. William Blair analyst J. Ho now forecasts that the company will post earnings per share of $0.14 for the quarter, up from their previous estimate of $0.08. The consensus estimate for Okta's current full-year earnings is $0.20 per share.

Several other research analysts also recently issued reports on the stock. Piper Sandler raised their price objective on shares of Okta from $85.00 to $90.00 and gave the stock a "neutral" rating in a research report on Wednesday. Stifel Nicolaus raised their price target on Okta from $108.00 to $115.00 and gave the stock a "buy" rating in a report on Wednesday. Scotiabank upped their price objective on Okta from $92.00 to $96.00 and gave the company a "sector perform" rating in a research note on Wednesday. Westpark Capital reaffirmed a "buy" rating and set a $140.00 price objective on shares of Okta in a research report on Wednesday. Finally, BTIG Research boosted their target price on Okta from $98.00 to $110.00 and gave the company a "buy" rating in a report on Wednesday. One equities research analyst has rated the stock with a sell rating, sixteen have assigned a hold rating and fourteen have issued a buy rating to the company's stock. According to data from MarketBeat, the stock presently has an average rating of "Hold" and an average price target of $103.77.

View Our Latest Research Report on OKTA

Okta Stock Performance

Shares of Okta stock traded up $1.28 on Friday, hitting $84.79. The stock had a trading volume of 5,295,390 shares, compared to its average volume of 3,695,332. The company has a quick ratio of 1.83, a current ratio of 1.83 and a debt-to-equity ratio of 0.18. Okta has a 52-week low of $70.56 and a 52-week high of $114.50. The company's 50 day moving average price is $75.77 and its 200 day moving average price is $84.16.

Insider Buying and Selling at Okta

In other news, insider Larissa Schwartz sold 2,791 shares of Okta stock in a transaction dated Monday, November 4th. The stock was sold at an average price of $71.50, for a total value of $199,556.50. Following the transaction, the insider now directly owns 22,125 shares of the company's stock, valued at $1,581,937.50. The trade was a 11.20 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available at this link. Also, CEO Todd Mckinnon sold 200,512 shares of the stock in a transaction that occurred on Friday, September 20th. The stock was sold at an average price of $75.21, for a total transaction of $15,080,507.52. Following the sale, the chief executive officer now directly owns 8,495 shares of the company's stock, valued at approximately $638,908.95. This trade represents a 95.94 % decrease in their position. The disclosure for this sale can be found here. Insiders sold 607,215 shares of company stock worth $46,304,810 in the last 90 days. 7.00% of the stock is owned by company insiders.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently modified their holdings of OKTA. Itau Unibanco Holding S.A. acquired a new position in shares of Okta in the third quarter worth about $25,000. Future Financial Wealth Managment LLC purchased a new stake in Okta during the 3rd quarter worth approximately $26,000. Blue Trust Inc. raised its position in shares of Okta by 105.5% in the 3rd quarter. Blue Trust Inc. now owns 372 shares of the company's stock valued at $28,000 after purchasing an additional 191 shares in the last quarter. Legacy Investment Solutions LLC purchased a new position in shares of Okta during the 3rd quarter valued at approximately $32,000. Finally, EverSource Wealth Advisors LLC grew its position in shares of Okta by 71.4% during the first quarter. EverSource Wealth Advisors LLC now owns 341 shares of the company's stock worth $36,000 after buying an additional 142 shares in the last quarter. Institutional investors and hedge funds own 86.64% of the company's stock.

Okta Company Profile

(

Get Free Report)

Okta, Inc operates as an identity partner in the United States and internationally. The company offers Okta's suite of products and services used to manage and secure identities, such as Single Sign-On that enables users to access applications in the cloud or on-premises from various devices; Adaptive Multi-Factor Authentication provides a layer of security for cloud, mobile, web applications, and data; API Access Management enables organizations to secure APIs; Access Gateway enables organizations to extend Workforce Identity Cloud; and Okta Device Access enables end users to securely log in to devices with Okta credentials.

Read More

Before you consider Okta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Okta wasn't on the list.

While Okta currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.