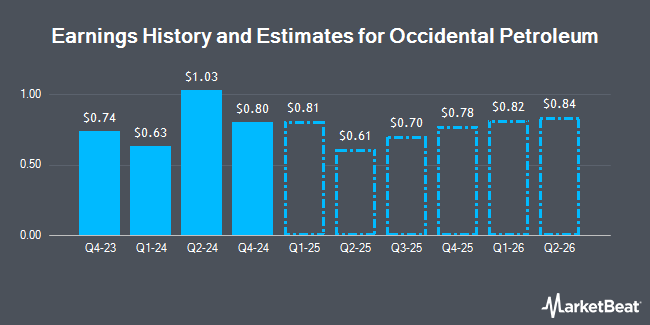

Occidental Petroleum Co. (NYSE:OXY - Free Report) - Research analysts at Capital One Financial raised their FY2024 earnings per share estimates for shares of Occidental Petroleum in a research note issued to investors on Monday, November 18th. Capital One Financial analyst B. Velie now anticipates that the oil and gas producer will post earnings per share of $3.25 for the year, up from their previous estimate of $2.84. The consensus estimate for Occidental Petroleum's current full-year earnings is $3.25 per share. Capital One Financial also issued estimates for Occidental Petroleum's Q4 2024 earnings at $0.57 EPS, Q1 2025 earnings at $0.59 EPS, Q2 2025 earnings at $0.59 EPS, Q3 2025 earnings at $0.59 EPS, Q4 2025 earnings at $0.59 EPS, FY2025 earnings at $2.36 EPS and FY2026 earnings at $2.62 EPS.

OXY has been the subject of a number of other research reports. Truist Financial dropped their price target on Occidental Petroleum from $65.00 to $56.00 and set a "hold" rating for the company in a research note on Monday, September 30th. JPMorgan Chase & Co. reiterated a "neutral" rating and set a $56.00 price target on shares of Occidental Petroleum in a report on Friday, November 8th. Mizuho dropped their price target on Occidental Petroleum from $76.00 to $72.00 and set a "neutral" rating for the company in a research note on Monday, September 16th. StockNews.com upgraded Occidental Petroleum from a "sell" rating to a "hold" rating in a research report on Tuesday. Finally, Stephens increased their target price on Occidental Petroleum from $70.00 to $71.00 and gave the company an "overweight" rating in a research report on Wednesday, November 13th. One investment analyst has rated the stock with a sell rating, thirteen have given a hold rating and seven have given a buy rating to the company. According to MarketBeat, Occidental Petroleum presently has an average rating of "Hold" and an average price target of $63.65.

View Our Latest Analysis on Occidental Petroleum

Occidental Petroleum Price Performance

Shares of NYSE OXY opened at $50.91 on Thursday. The business has a fifty day moving average price of $51.76 and a two-hundred day moving average price of $57.15. The stock has a market capitalization of $47.77 billion, a PE ratio of 13.26 and a beta of 1.58. The company has a debt-to-equity ratio of 0.96, a current ratio of 1.00 and a quick ratio of 0.76. Occidental Petroleum has a fifty-two week low of $48.42 and a fifty-two week high of $71.18.

Institutional Trading of Occidental Petroleum

Several large investors have recently made changes to their positions in the company. Fortitude Family Office LLC grew its stake in Occidental Petroleum by 160.0% in the third quarter. Fortitude Family Office LLC now owns 494 shares of the oil and gas producer's stock valued at $25,000 after acquiring an additional 304 shares during the period. Mizuho Securities Co. Ltd. bought a new stake in Occidental Petroleum during the 3rd quarter worth approximately $32,000. New Covenant Trust Company N.A. purchased a new stake in Occidental Petroleum in the 1st quarter valued at $44,000. LRI Investments LLC purchased a new stake in shares of Occidental Petroleum in the first quarter valued at about $44,000. Finally, Transamerica Financial Advisors Inc. purchased a new stake in Occidental Petroleum in the 3rd quarter valued at about $50,000. 88.70% of the stock is currently owned by institutional investors and hedge funds.

Occidental Petroleum Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 10th will be issued a dividend of $0.22 per share. The ex-dividend date of this dividend is Tuesday, December 10th. This represents a $0.88 annualized dividend and a dividend yield of 1.73%. Occidental Petroleum's dividend payout ratio is currently 22.92%.

Occidental Petroleum Company Profile

(

Get Free Report)

Occidental Petroleum Corporation, together with its subsidiaries, engages in the acquisition, exploration, and development of oil and gas properties in the United States, the Middle East, and North Africa. It operates through three segments: Oil and Gas, Chemical, and Midstream and Marketing. The company's Oil and Gas segment explores for, develops, and produces oil and condensate, natural gas liquids (NGLs), and natural gas.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Occidental Petroleum, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Occidental Petroleum wasn't on the list.

While Occidental Petroleum currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.