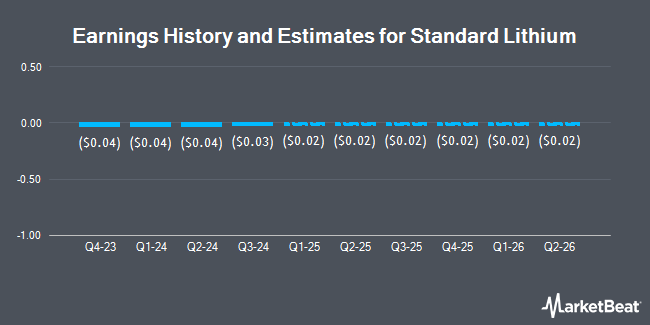

Standard Lithium Ltd. (NYSE:SLI - Free Report) - Equities research analysts at Roth Capital issued their FY2026 earnings per share (EPS) estimates for Standard Lithium in a research report issued to clients and investors on Monday, November 25th. Roth Capital analyst J. Reagor forecasts that the company will earn ($0.09) per share for the year. The consensus estimate for Standard Lithium's current full-year earnings is ($0.05) per share.

Separately, Canaccord Genuity Group increased their price objective on Standard Lithium from $3.90 to $4.40 and gave the stock a "speculative buy" rating in a report on Monday.

Check Out Our Latest Stock Report on Standard Lithium

Standard Lithium Stock Performance

SLI stock traded up $0.06 on Wednesday, reaching $1.72. The company's stock had a trading volume of 483,483 shares, compared to its average volume of 1,382,528. The business has a fifty day simple moving average of $1.91 and a two-hundred day simple moving average of $1.55. Standard Lithium has a 12-month low of $1.05 and a 12-month high of $2.64.

Standard Lithium (NYSE:SLI - Get Free Report) last announced its quarterly earnings results on Tuesday, September 24th. The company reported ($0.04) EPS for the quarter, hitting analysts' consensus estimates of ($0.04).

Hedge Funds Weigh In On Standard Lithium

Institutional investors have recently added to or reduced their stakes in the company. MBA Advisors LLC bought a new position in shares of Standard Lithium during the third quarter valued at $37,000. Legacy Capital Wealth Partners LLC bought a new position in shares of Standard Lithium during the second quarter valued at $74,000. XTX Topco Ltd bought a new position in shares of Standard Lithium during the second quarter valued at $78,000. Nwam LLC bought a new position in shares of Standard Lithium during the third quarter valued at $80,000. Finally, Simmons Bank increased its holdings in shares of Standard Lithium by 29.4% during the third quarter. Simmons Bank now owns 56,476 shares of the company's stock valued at $91,000 after acquiring an additional 12,840 shares in the last quarter. Institutional investors own 16.77% of the company's stock.

Standard Lithium Company Profile

(

Get Free Report)

Standard Lithium Ltd. explores for, develops, and processes lithium brine properties in the United States. Its flagship project is the Lanxess project with area of approximately 150,000 acres located in southern Arkansas. The company was formerly known as Patriot Petroleum Corp. and changed its name to Standard Lithium Ltd.

Read More

Before you consider Standard Lithium, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Standard Lithium wasn't on the list.

While Standard Lithium currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.