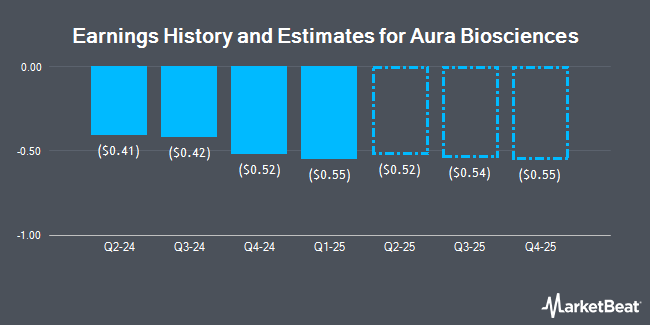

Aura Biosciences, Inc. (NASDAQ:AURA - Free Report) - Research analysts at Leerink Partnrs raised their FY2024 earnings per share (EPS) estimates for shares of Aura Biosciences in a report issued on Tuesday, November 12th. Leerink Partnrs analyst A. Berens now expects that the company will earn ($1.67) per share for the year, up from their previous forecast of ($1.68). The consensus estimate for Aura Biosciences' current full-year earnings is ($1.70) per share. Leerink Partnrs also issued estimates for Aura Biosciences' Q4 2024 earnings at ($0.44) EPS, FY2025 earnings at ($1.93) EPS and FY2026 earnings at ($2.21) EPS.

Aura Biosciences (NASDAQ:AURA - Get Free Report) last posted its quarterly earnings results on Tuesday, November 12th. The company reported ($0.42) EPS for the quarter, beating analysts' consensus estimates of ($0.44) by $0.02.

Other equities analysts have also issued research reports about the stock. JMP Securities increased their price objective on shares of Aura Biosciences from $19.00 to $23.00 and gave the company a "market outperform" rating in a research report on Friday, September 13th. BTIG Research lifted their price target on Aura Biosciences from $21.00 to $24.00 and gave the stock a "buy" rating in a research report on Friday, October 18th. Evercore ISI upgraded Aura Biosciences to a "strong-buy" rating in a research report on Monday, September 16th. Lifesci Capital upgraded Aura Biosciences to a "strong-buy" rating in a report on Monday, September 9th. Finally, Cowen restated a "buy" rating on shares of Aura Biosciences in a research report on Friday, October 18th. Five research analysts have rated the stock with a buy rating and two have issued a strong buy rating to the stock. According to data from MarketBeat, the company has an average rating of "Buy" and an average price target of $23.00.

Check Out Our Latest Stock Report on AURA

Aura Biosciences Price Performance

Shares of Aura Biosciences stock traded down $0.50 during trading on Friday, reaching $9.47. 279,739 shares of the stock traded hands, compared to its average volume of 175,707. Aura Biosciences has a 52-week low of $6.63 and a 52-week high of $12.38. The business has a fifty day simple moving average of $9.79 and a two-hundred day simple moving average of $8.51. The company has a market capitalization of $473.04 million, a price-to-earnings ratio of -5.47 and a beta of 0.33.

Insider Buying and Selling

In other news, CFO Julie B. Feder sold 25,131 shares of Aura Biosciences stock in a transaction on Friday, October 18th. The stock was sold at an average price of $12.03, for a total value of $302,325.93. Following the completion of the sale, the chief financial officer now directly owns 134,276 shares of the company's stock, valued at approximately $1,615,340.28. The trade was a 15.77 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which can be accessed through this hyperlink. Also, insider Los Pinos Elisabet De sold 9,200 shares of the stock in a transaction on Tuesday, October 29th. The shares were sold at an average price of $10.74, for a total value of $98,808.00. Following the completion of the sale, the insider now owns 320,647 shares in the company, valued at approximately $3,443,748.78. The trade was a 2.79 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 67,259 shares of company stock valued at $780,699. Corporate insiders own 5.40% of the company's stock.

Hedge Funds Weigh In On Aura Biosciences

Several hedge funds have recently bought and sold shares of AURA. Charles Schwab Investment Management Inc. lifted its holdings in shares of Aura Biosciences by 2.7% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 138,356 shares of the company's stock worth $1,233,000 after acquiring an additional 3,612 shares during the period. American International Group Inc. lifted its position in shares of Aura Biosciences by 27.4% in the 1st quarter. American International Group Inc. now owns 17,579 shares of the company's stock worth $138,000 after buying an additional 3,782 shares during the last quarter. The Manufacturers Life Insurance Company lifted its holdings in Aura Biosciences by 14.6% in the second quarter. The Manufacturers Life Insurance Company now owns 64,452 shares of the company's stock worth $487,000 after acquiring an additional 8,194 shares during the last quarter. Levin Capital Strategies L.P. grew its holdings in shares of Aura Biosciences by 11.2% during the first quarter. Levin Capital Strategies L.P. now owns 111,200 shares of the company's stock valued at $873,000 after purchasing an additional 11,200 shares during the last quarter. Finally, Renaissance Technologies LLC grew its stake in Aura Biosciences by 26.3% during the 2nd quarter. Renaissance Technologies LLC now owns 72,100 shares of the company's stock worth $545,000 after buying an additional 15,000 shares during the last quarter. 96.75% of the stock is owned by hedge funds and other institutional investors.

Aura Biosciences Company Profile

(

Get Free Report)

Aura Biosciences, Inc, a clinical-stage biotechnology company, develops precision immunotherapies to treat a range of solid tumors. The company's proprietary platform enables the targeting of a range of solid tumors using virus-like particles conjugated with drugs or loaded with nucleic acids to create virus-like drug conjugates.

Further Reading

Before you consider Aura Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aura Biosciences wasn't on the list.

While Aura Biosciences currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.