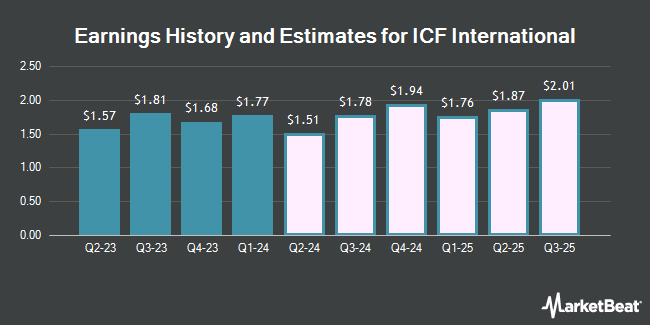

ICF International, Inc. (NASDAQ:ICFI - Free Report) - Analysts at Barrington Research lifted their FY2024 EPS estimates for ICF International in a note issued to investors on Monday, December 16th. Barrington Research analyst K. Steinke now anticipates that the business services provider will earn $7.44 per share for the year, up from their prior estimate of $7.05. Barrington Research currently has a "Outperform" rating and a $174.00 price target on the stock. The consensus estimate for ICF International's current full-year earnings is $7.35 per share. Barrington Research also issued estimates for ICF International's Q4 2024 earnings at $1.85 EPS and FY2025 earnings at $8.15 EPS.

ICF International (NASDAQ:ICFI - Get Free Report) last announced its quarterly earnings results on Friday, November 1st. The business services provider reported $2.13 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.77 by $0.36. ICF International had a net margin of 5.38% and a return on equity of 14.68%. The business had revenue of $517.00 million during the quarter, compared to the consensus estimate of $528.02 million. During the same quarter last year, the firm earned $1.81 EPS. The business's revenue was up 3.1% compared to the same quarter last year.

Several other analysts have also issued reports on the stock. D. Boral Capital restated an "outperform" rating and issued a $174.00 price objective on shares of ICF International in a report on Monday. StockNews.com downgraded shares of ICF International from a "strong-buy" rating to a "buy" rating in a research note on Wednesday, November 27th. Sidoti upgraded shares of ICF International from a "neutral" rating to a "buy" rating and set a $185.00 price objective on the stock in a report on Tuesday, November 19th. Finally, Truist Financial dropped their target price on shares of ICF International from $180.00 to $140.00 and set a "hold" rating for the company in a report on Friday, November 22nd. One investment analyst has rated the stock with a hold rating and six have issued a buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and a consensus target price of $168.60.

Get Our Latest Stock Report on ICFI

ICF International Trading Down 3.2 %

NASDAQ:ICFI traded down $4.06 on Wednesday, reaching $122.34. The company's stock had a trading volume of 209,303 shares, compared to its average volume of 116,107. The firm has a market cap of $2.30 billion, a price-to-earnings ratio of 21.50 and a beta of 0.54. The company has a quick ratio of 1.21, a current ratio of 1.21 and a debt-to-equity ratio of 0.43. ICF International has a 12-month low of $122.00 and a 12-month high of $179.67. The stock has a 50 day moving average price of $152.77 and a 200 day moving average price of $152.41.

Institutional Investors Weigh In On ICF International

A number of large investors have recently modified their holdings of the company. Pier Capital LLC acquired a new position in shares of ICF International during the third quarter worth $6,579,000. Congress Asset Management Co. boosted its position in shares of ICF International by 10.7% during the 3rd quarter. Congress Asset Management Co. now owns 353,824 shares of the business services provider's stock worth $59,014,000 after acquiring an additional 34,299 shares in the last quarter. Geode Capital Management LLC boosted its position in shares of ICF International by 4.3% during the 3rd quarter. Geode Capital Management LLC now owns 440,985 shares of the business services provider's stock worth $73,566,000 after acquiring an additional 18,109 shares in the last quarter. Tilia Fiduciary Partners Inc. purchased a new position in shares of ICF International in the 3rd quarter valued at about $2,364,000. Finally, BNP Paribas Financial Markets lifted its stake in ICF International by 94.1% during the third quarter. BNP Paribas Financial Markets now owns 17,631 shares of the business services provider's stock worth $2,941,000 after purchasing an additional 8,548 shares during the last quarter. 94.12% of the stock is owned by hedge funds and other institutional investors.

Insider Buying and Selling at ICF International

In other ICF International news, COO James C. M. Morgan sold 2,500 shares of the company's stock in a transaction dated Wednesday, October 16th. The stock was sold at an average price of $175.07, for a total transaction of $437,675.00. Following the sale, the chief operating officer now owns 37,663 shares in the company, valued at $6,593,661.41. This represents a 6.22 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director Scott B. Salmirs acquired 400 shares of the firm's stock in a transaction dated Monday, November 18th. The stock was bought at an average price of $138.38 per share, with a total value of $55,352.00. Following the purchase, the director now directly owns 5,803 shares in the company, valued at approximately $803,019.14. This trade represents a 7.40 % increase in their position. The disclosure for this purchase can be found here. Insiders sold 4,038 shares of company stock valued at $705,355 in the last 90 days. Company insiders own 1.39% of the company's stock.

ICF International Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Friday, January 10th. Shareholders of record on Friday, December 6th will be issued a dividend of $0.14 per share. The ex-dividend date of this dividend is Friday, December 6th. This represents a $0.56 dividend on an annualized basis and a yield of 0.46%. ICF International's dividend payout ratio (DPR) is presently 9.84%.

About ICF International

(

Get Free Report)

ICF International, Inc provides management, technology, and policy consulting and implementation services to government and commercial clients in the United States and internationally. The company researches critical policy, industry, stakeholder issues, trends, and behaviors; measures and evaluates results and their impact; and provides strategic planning and advisory services to its clients on how to navigate societal, business, market, business, communication, and technology challenges.

Featured Articles

Before you consider ICF International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ICF International wasn't on the list.

While ICF International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.