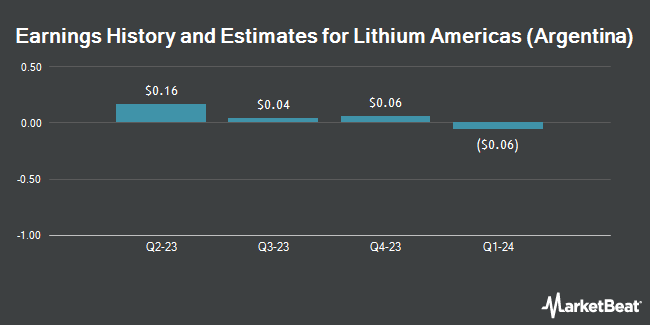

Lithium Americas (Argentina) Corp. (NYSE:LAAC - Free Report) - Equities researchers at Scotiabank decreased their FY2024 earnings estimates for Lithium Americas (Argentina) in a research report issued to clients and investors on Wednesday, November 6th. Scotiabank analyst B. Isaacson now expects that the company will post earnings per share of $0.08 for the year, down from their previous estimate of $0.26. Scotiabank currently has a "Sector Outperform" rating and a $4.25 target price on the stock. The consensus estimate for Lithium Americas (Argentina)'s current full-year earnings is ($0.02) per share. Scotiabank also issued estimates for Lithium Americas (Argentina)'s FY2025 earnings at $0.38 EPS and FY2026 earnings at $0.58 EPS.

A number of other research analysts also recently issued reports on LAAC. HSBC upgraded shares of Lithium Americas (Argentina) from a "hold" rating to a "buy" rating in a research report on Wednesday, August 14th. Hsbc Global Res raised shares of Lithium Americas (Argentina) to a "strong-buy" rating in a research note on Wednesday, August 14th. Four equities research analysts have rated the stock with a hold rating, three have issued a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $7.05.

Check Out Our Latest Stock Report on LAAC

Lithium Americas (Argentina) Stock Down 0.3 %

Shares of NYSE LAAC traded down $0.01 during mid-day trading on Friday, reaching $3.24. 1,483,643 shares of the company were exchanged, compared to its average volume of 1,523,123. The company's 50-day simple moving average is $3.09 and its 200-day simple moving average is $3.51. The stock has a market capitalization of $524.62 million, a P/E ratio of 0.41 and a beta of 1.33. Lithium Americas has a twelve month low of $2.07 and a twelve month high of $6.69.

Lithium Americas (Argentina) (NYSE:LAAC - Get Free Report) last posted its earnings results on Tuesday, August 13th. The company reported ($0.05) earnings per share for the quarter, missing the consensus estimate of ($0.03) by ($0.02).

Hedge Funds Weigh In On Lithium Americas (Argentina)

Several institutional investors and hedge funds have recently modified their holdings of the business. Apollon Wealth Management LLC boosted its stake in Lithium Americas (Argentina) by 25.8% in the third quarter. Apollon Wealth Management LLC now owns 28,607 shares of the company's stock valued at $93,000 after buying an additional 5,870 shares in the last quarter. General Motors Holdings LLC bought a new stake in shares of Lithium Americas (Argentina) during the 3rd quarter valued at $48,907,000. M&G PLC increased its stake in Lithium Americas (Argentina) by 11.2% in the 3rd quarter. M&G PLC now owns 1,530,176 shares of the company's stock worth $4,591,000 after acquiring an additional 154,067 shares during the last quarter. Old West Investment Management LLC boosted its holdings in shares of Lithium Americas (Argentina) by 193.6% in the 3rd quarter. Old West Investment Management LLC now owns 98,032 shares of the company's stock worth $320,000 after purchasing an additional 64,646 shares in the last quarter. Finally, Intact Investment Management Inc. lifted its holdings in Lithium Americas (Argentina) by 47.3% in the 3rd quarter. Intact Investment Management Inc. now owns 510,200 shares of the company's stock worth $1,671,000 after buying an additional 163,800 shares during the period. 49.17% of the stock is currently owned by institutional investors and hedge funds.

Lithium Americas (Argentina) Company Profile

(

Get Free Report)

Lithium Americas (Argentina) Corp. operates as a resource company. The company explores for lithium deposits. The company owns interests in the Cauchari-Olaroz project located in Jujuy province of Argentina. It also has a pipeline of development and exploration stage projects, including the Pastos Grandes project and the Sal de la Puna project located in Salta Province in northwestern Argentina.

Read More

Before you consider Lithium Americas (Argentina), you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lithium Americas (Argentina) wasn't on the list.

While Lithium Americas (Argentina) currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.