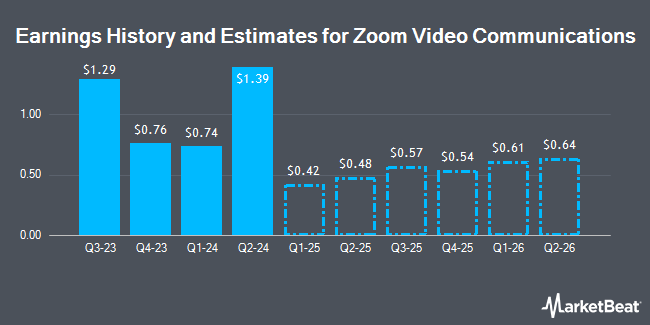

Zoom Video Communications, Inc. (NASDAQ:ZM - Free Report) - Equities researchers at Wedbush increased their Q2 2026 earnings per share (EPS) estimates for shares of Zoom Video Communications in a note issued to investors on Tuesday, November 26th. Wedbush analyst D. Ives now anticipates that the company will earn $0.63 per share for the quarter, up from their previous estimate of $0.61. Wedbush currently has a "Outperform" rating and a $85.00 target price on the stock. The consensus estimate for Zoom Video Communications' current full-year earnings is $2.77 per share.

A number of other research analysts have also commented on ZM. Wells Fargo & Company increased their price objective on Zoom Video Communications from $60.00 to $70.00 and gave the company an "underweight" rating in a research report on Tuesday. Stifel Nicolaus raised their price target on Zoom Video Communications from $70.00 to $90.00 and gave the company a "hold" rating in a report on Tuesday. Rosenblatt Securities reissued a "buy" rating and set a $78.00 price objective on shares of Zoom Video Communications in a report on Friday, November 22nd. Needham & Company LLC restated a "hold" rating on shares of Zoom Video Communications in a research report on Friday, October 11th. Finally, Bank of America lifted their price target on shares of Zoom Video Communications from $75.00 to $90.00 and gave the stock a "neutral" rating in a research report on Tuesday. Two analysts have rated the stock with a sell rating, fifteen have assigned a hold rating and seven have issued a buy rating to the company's stock. According to data from MarketBeat.com, Zoom Video Communications currently has an average rating of "Hold" and a consensus target price of $85.19.

View Our Latest Stock Report on ZM

Zoom Video Communications Stock Performance

Zoom Video Communications stock traded up $1.95 on Thursday, reaching $85.36. The company's stock had a trading volume of 5,212,338 shares, compared to its average volume of 4,329,774. The business's fifty day moving average price is $74.92 and its 200 day moving average price is $66.16. The company has a market cap of $26.27 billion, a price-to-earnings ratio of 28.45, a PEG ratio of 7.12 and a beta of -0.05. Zoom Video Communications has a twelve month low of $55.06 and a twelve month high of $92.80.

Insider Buying and Selling

In other Zoom Video Communications news, CAO Shane Crehan sold 1,550 shares of the firm's stock in a transaction on Tuesday, September 10th. The stock was sold at an average price of $66.87, for a total transaction of $103,648.50. Following the transaction, the chief accounting officer now owns 1,463 shares in the company, valued at $97,830.81. This trade represents a 51.44 % decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, insider Velchamy Sankarlingam sold 3,614 shares of Zoom Video Communications stock in a transaction on Tuesday, September 10th. The shares were sold at an average price of $66.87, for a total value of $241,668.18. Following the completion of the transaction, the insider now directly owns 94,000 shares of the company's stock, valued at $6,285,780. This represents a 3.70 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 367,108 shares of company stock valued at $26,796,191. Insiders own 10.78% of the company's stock.

Hedge Funds Weigh In On Zoom Video Communications

Several hedge funds and other institutional investors have recently made changes to their positions in the company. Jacobs Levy Equity Management Inc. bought a new stake in shares of Zoom Video Communications during the 1st quarter worth $260,000. California State Teachers Retirement System grew its holdings in shares of Zoom Video Communications by 1.7% during the 1st quarter. California State Teachers Retirement System now owns 396,209 shares of the company's stock valued at $25,900,000 after purchasing an additional 6,630 shares during the last quarter. Tidal Investments LLC lifted its stake in Zoom Video Communications by 89.7% in the 1st quarter. Tidal Investments LLC now owns 34,352 shares of the company's stock valued at $2,246,000 after purchasing an additional 16,248 shares during the last quarter. Comerica Bank boosted its position in Zoom Video Communications by 15.6% in the first quarter. Comerica Bank now owns 4,966 shares of the company's stock valued at $325,000 after buying an additional 670 shares in the last quarter. Finally, iA Global Asset Management Inc. grew its stake in shares of Zoom Video Communications by 27.3% during the first quarter. iA Global Asset Management Inc. now owns 4,060 shares of the company's stock worth $265,000 after buying an additional 870 shares during the last quarter. 66.54% of the stock is currently owned by institutional investors and hedge funds.

About Zoom Video Communications

(

Get Free Report)

Zoom Video Communications, Inc provides unified communications platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa. The company offers Zoom Meetings that offers HD video, voice, chat, and content sharing through mobile devices, desktops, laptops, telephones, and conference room systems; Zoom Phone, an enterprise cloud phone system; and Zoom Chat enables users to share messages, images, audio files, and content in desktop, laptop, tablet, and mobile devices.

Further Reading

Before you consider Zoom Video Communications, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zoom Video Communications wasn't on the list.

While Zoom Video Communications currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.