Algert Global LLC increased its stake in Resideo Technologies, Inc. (NYSE:REZI - Free Report) by 15.3% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 163,750 shares of the company's stock after buying an additional 21,770 shares during the period. Algert Global LLC owned 0.11% of Resideo Technologies worth $3,298,000 at the end of the most recent reporting period.

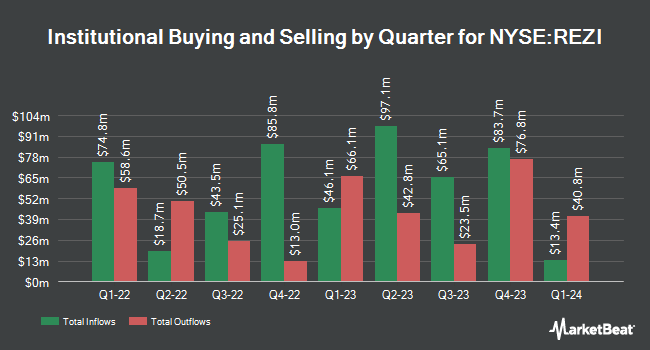

A number of other institutional investors also recently bought and sold shares of the stock. GAMMA Investing LLC lifted its holdings in shares of Resideo Technologies by 50.0% during the second quarter. GAMMA Investing LLC now owns 1,592 shares of the company's stock valued at $31,000 after purchasing an additional 531 shares during the last quarter. International Assets Investment Management LLC raised its holdings in Resideo Technologies by 1,740.5% in the 3rd quarter. International Assets Investment Management LLC now owns 2,135 shares of the company's stock worth $43,000 after acquiring an additional 2,019 shares during the last quarter. Blue Trust Inc. raised its holdings in Resideo Technologies by 55.0% in the 3rd quarter. Blue Trust Inc. now owns 2,515 shares of the company's stock worth $49,000 after acquiring an additional 892 shares during the last quarter. Quarry LP raised its holdings in Resideo Technologies by 79.7% in the 2nd quarter. Quarry LP now owns 2,892 shares of the company's stock worth $57,000 after acquiring an additional 1,283 shares during the last quarter. Finally, nVerses Capital LLC raised its holdings in Resideo Technologies by 1,166.7% in the 2nd quarter. nVerses Capital LLC now owns 3,800 shares of the company's stock worth $74,000 after acquiring an additional 3,500 shares during the last quarter. 91.71% of the stock is owned by institutional investors.

Insider Buying and Selling at Resideo Technologies

In other news, insider Robert B. Aarnes sold 98,829 shares of the business's stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $26.16, for a total transaction of $2,585,366.64. Following the completion of the sale, the insider now owns 458,928 shares of the company's stock, valued at $12,005,556.48. The trade was a 17.72 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Company insiders own 1.50% of the company's stock.

Resideo Technologies Stock Performance

REZI traded down $0.37 during mid-day trading on Tuesday, reaching $27.32. 807,841 shares of the company traded hands, compared to its average volume of 877,031. The stock has a market capitalization of $4.02 billion, a P/E ratio of 24.68 and a beta of 2.09. The company has a quick ratio of 1.10, a current ratio of 1.82 and a debt-to-equity ratio of 0.69. The company's fifty day moving average price is $21.55 and its 200-day moving average price is $20.68. Resideo Technologies, Inc. has a 52-week low of $16.16 and a 52-week high of $28.28.

Wall Street Analysts Forecast Growth

Separately, Evercore ISI assumed coverage on shares of Resideo Technologies in a report on Friday, August 9th. They issued an "outperform" rating and a $25.00 price objective for the company.

View Our Latest Stock Analysis on Resideo Technologies

Resideo Technologies Company Profile

(

Free Report)

Resideo Technologies, Inc develops, manufactures, and sells comfort, energy management, and safety and security solutions to the commercial and residential end markets in the United States, Europe, and internationally. The company operates in two segments, Products and Solutions, and ADI Global Distribution.

Read More

Before you consider Resideo Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Resideo Technologies wasn't on the list.

While Resideo Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.