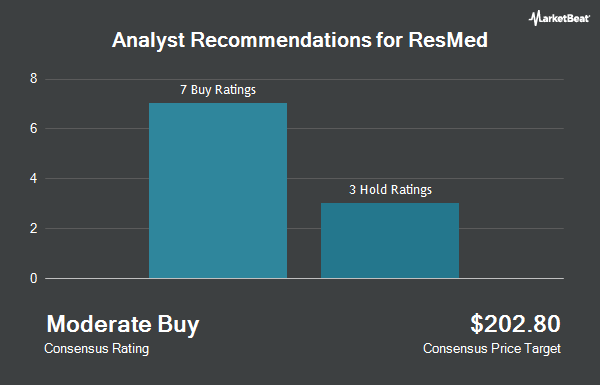

Shares of ResMed Inc. (NYSE:RMD - Get Free Report) have earned an average rating of "Hold" from the thirteen brokerages that are currently covering the stock, Marketbeat Ratings reports. One investment analyst has rated the stock with a sell rating, six have given a hold rating, five have assigned a buy rating and one has given a strong buy rating to the company. The average 1-year price objective among analysts that have issued a report on the stock in the last year is $227.91.

A number of brokerages have commented on RMD. Royal Bank of Canada upped their price objective on shares of ResMed from $224.00 to $232.00 and gave the stock a "sector perform" rating in a research report on Friday, October 25th. Bank of America increased their price objective on shares of ResMed from $240.00 to $270.00 and gave the company a "buy" rating in a research note on Thursday, September 26th. Wolfe Research reaffirmed an "underperform" rating and set a $180.00 price target on shares of ResMed in a research note on Wednesday, September 18th. KeyCorp raised their price target on shares of ResMed from $251.00 to $266.00 and gave the stock an "overweight" rating in a research note on Friday, October 25th. Finally, Baird R W upgraded shares of ResMed to a "strong-buy" rating in a report on Tuesday, September 24th.

Check Out Our Latest Stock Analysis on ResMed

Insiders Place Their Bets

In other news, Director Witte Jan De sold 796 shares of the business's stock in a transaction on Tuesday, November 12th. The shares were sold at an average price of $248.81, for a total transaction of $198,052.76. Following the completion of the transaction, the director now owns 6,723 shares of the company's stock, valued at approximately $1,672,749.63. The trade was a 10.59 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which can be accessed through the SEC website. Also, insider Kaushik Ghoshal sold 4,260 shares of the business's stock in a transaction on Friday, October 11th. The shares were sold at an average price of $238.48, for a total transaction of $1,015,924.80. Following the transaction, the insider now directly owns 21,788 shares of the company's stock, valued at approximately $5,196,002.24. This trade represents a 16.35 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 47,725 shares of company stock valued at $11,253,448 over the last 90 days. 0.71% of the stock is owned by company insiders.

Hedge Funds Weigh In On ResMed

Hedge funds and other institutional investors have recently modified their holdings of the company. Versor Investments LP boosted its holdings in shares of ResMed by 327.3% during the second quarter. Versor Investments LP now owns 4,700 shares of the medical equipment provider's stock valued at $900,000 after acquiring an additional 3,600 shares during the period. Assenagon Asset Management S.A. boosted its holdings in shares of ResMed by 245.2% during the second quarter. Assenagon Asset Management S.A. now owns 33,507 shares of the medical equipment provider's stock valued at $6,414,000 after acquiring an additional 23,801 shares during the period. Retireful LLC acquired a new position in shares of ResMed during the third quarter valued at $742,000. Asset Management One Co. Ltd. boosted its holdings in shares of ResMed by 5.1% during the third quarter. Asset Management One Co. Ltd. now owns 58,860 shares of the medical equipment provider's stock valued at $14,369,000 after acquiring an additional 2,878 shares during the period. Finally, Empowered Funds LLC raised its stake in shares of ResMed by 284.3% during the third quarter. Empowered Funds LLC now owns 8,208 shares of the medical equipment provider's stock valued at $2,004,000 after purchasing an additional 6,072 shares in the last quarter. Institutional investors and hedge funds own 54.98% of the company's stock.

ResMed Stock Performance

RMD stock traded down $3.99 on Friday, hitting $238.52. The company's stock had a trading volume of 580,589 shares, compared to its average volume of 661,581. The firm has a 50 day moving average of $242.75 and a two-hundred day moving average of $227.59. ResMed has a 1 year low of $164.12 and a 1 year high of $260.49. The stock has a market cap of $35.01 billion, a price-to-earnings ratio of 31.59, a price-to-earnings-growth ratio of 1.73 and a beta of 0.68. The company has a current ratio of 2.92, a quick ratio of 1.91 and a debt-to-equity ratio of 0.13.

ResMed (NYSE:RMD - Get Free Report) last released its quarterly earnings results on Thursday, October 24th. The medical equipment provider reported $2.20 EPS for the quarter, beating the consensus estimate of $2.03 by $0.17. The firm had revenue of $1.22 billion during the quarter, compared to the consensus estimate of $1.19 billion. ResMed had a net margin of 23.15% and a return on equity of 25.53%. ResMed's revenue for the quarter was up 11.1% on a year-over-year basis. During the same quarter in the prior year, the firm earned $1.64 EPS. Equities analysts predict that ResMed will post 9.34 EPS for the current fiscal year.

ResMed Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, December 12th. Shareholders of record on Thursday, November 7th were issued a $0.53 dividend. This represents a $2.12 dividend on an annualized basis and a yield of 0.89%. The ex-dividend date was Thursday, November 7th. ResMed's dividend payout ratio is presently 28.08%.

About ResMed

(

Get Free ReportResMed Inc develops, manufactures, distributes, and markets medical devices and cloud-based software applications for the healthcare markets. The company operates in two segments, Sleep and Respiratory Care, and Software as a Service. It offers various products and solutions for a range of respiratory disorders, including ApneaLink Air, a portable diagnostic device that measures oximetry, respiratory effort, pulse, nasal flow, and snoring; and NightOwl, a portable, cloud-connected, and disposable diagnostic device that measures AHI based on derived peripheral arterial tone, actigraphy, and oximetry over several nights.

Further Reading

Before you consider ResMed, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ResMed wasn't on the list.

While ResMed currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.