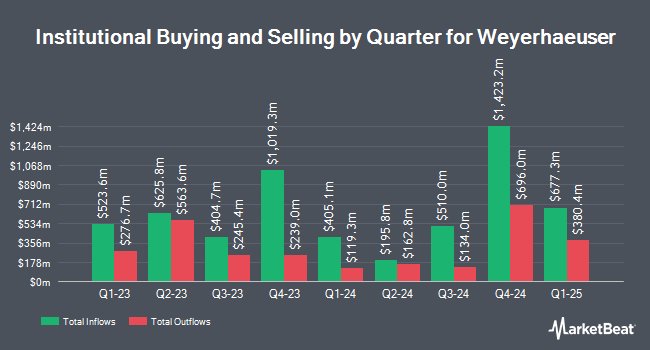

Resona Asset Management Co. Ltd. acquired a new stake in Weyerhaeuser (NYSE:WY - Free Report) in the 4th quarter, according to the company in its most recent filing with the SEC. The fund acquired 128,939 shares of the real estate investment trust's stock, valued at approximately $3,624,000.

A number of other institutional investors also recently modified their holdings of WY. Assetmark Inc. increased its holdings in shares of Weyerhaeuser by 290.9% during the fourth quarter. Assetmark Inc. now owns 1,239 shares of the real estate investment trust's stock valued at $35,000 after acquiring an additional 922 shares in the last quarter. Asset Planning Inc bought a new stake in Weyerhaeuser during the 4th quarter valued at $36,000. Lee Danner & Bass Inc. bought a new stake in Weyerhaeuser during the 4th quarter valued at $44,000. Graney & King LLC acquired a new position in Weyerhaeuser during the fourth quarter worth $44,000. Finally, AdvisorNet Financial Inc lifted its position in Weyerhaeuser by 41.2% in the 4th quarter. AdvisorNet Financial Inc now owns 1,665 shares of the real estate investment trust's stock valued at $47,000 after acquiring an additional 486 shares in the last quarter. Institutional investors and hedge funds own 82.99% of the company's stock.

Wall Street Analysts Forecast Growth

WY has been the subject of a number of analyst reports. Truist Financial lowered their price target on Weyerhaeuser from $34.00 to $33.00 and set a "hold" rating for the company in a research report on Monday, January 6th. CIBC upgraded shares of Weyerhaeuser from a "neutral" rating to an "outperformer" rating and set a $35.00 price objective for the company in a research note on Wednesday, January 15th. Cibc World Mkts upgraded Weyerhaeuser from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, January 15th. Citigroup decreased their price target on Weyerhaeuser from $38.00 to $35.00 and set a "buy" rating for the company in a research report on Wednesday, January 15th. Finally, Raymond James raised Weyerhaeuser from a "market perform" rating to an "outperform" rating and set a $32.00 price objective on the stock in a research report on Monday, December 23rd. Three investment analysts have rated the stock with a hold rating, six have given a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat, Weyerhaeuser currently has a consensus rating of "Moderate Buy" and a consensus price target of $34.50.

Read Our Latest Analysis on Weyerhaeuser

Weyerhaeuser Stock Performance

NYSE:WY traded down $0.03 during trading hours on Tuesday, reaching $26.10. The stock had a trading volume of 636,138 shares, compared to its average volume of 3,684,896. Weyerhaeuser has a 12-month low of $24.10 and a 12-month high of $34.03. The company has a debt-to-equity ratio of 0.50, a quick ratio of 1.17 and a current ratio of 1.79. The stock has a 50 day simple moving average of $29.06 and a 200 day simple moving average of $30.15. The stock has a market cap of $18.94 billion, a P/E ratio of 47.40, a price-to-earnings-growth ratio of 4.74 and a beta of 1.25.

Weyerhaeuser (NYSE:WY - Get Free Report) last announced its quarterly earnings data on Thursday, January 30th. The real estate investment trust reported $0.11 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.07 by $0.04. Weyerhaeuser had a return on equity of 3.86% and a net margin of 5.56%. On average, research analysts forecast that Weyerhaeuser will post 0.78 EPS for the current fiscal year.

Weyerhaeuser Increases Dividend

The firm also recently declared a quarterly dividend, which was paid on Friday, March 21st. Investors of record on Friday, March 7th were paid a dividend of $0.21 per share. This is a boost from Weyerhaeuser's previous quarterly dividend of $0.20. This represents a $0.84 dividend on an annualized basis and a dividend yield of 3.22%. The ex-dividend date of this dividend was Friday, March 7th. Weyerhaeuser's dividend payout ratio is presently 152.73%.

About Weyerhaeuser

(

Free Report)

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900. We own or control approximately 11 million acres of timberlands in the U.S. and manage additional timberlands under long-term licenses in Canada. We manage these timberlands on a sustainable basis in compliance with internationally recognized forestry standards.

Featured Articles

Before you consider Weyerhaeuser, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weyerhaeuser wasn't on the list.

While Weyerhaeuser currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.