Resona Asset Management Co. Ltd. bought a new position in shares of Laureate Education, Inc. (NASDAQ:LAUR - Free Report) in the 4th quarter, according to its most recent filing with the Securities and Exchange Commission. The fund bought 24,108 shares of the company's stock, valued at approximately $441,000.

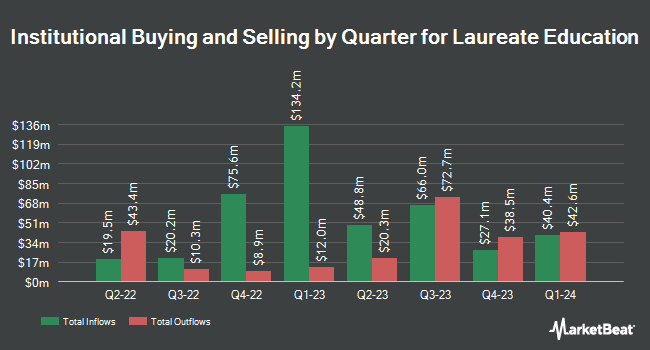

A number of other institutional investors have also made changes to their positions in LAUR. Asset Management One Co. Ltd. raised its position in shares of Laureate Education by 21.6% in the fourth quarter. Asset Management One Co. Ltd. now owns 76,317 shares of the company's stock valued at $1,390,000 after buying an additional 13,540 shares in the last quarter. Charles Schwab Investment Management Inc. raised its holdings in Laureate Education by 1.7% in the 4th quarter. Charles Schwab Investment Management Inc. now owns 2,181,073 shares of the company's stock valued at $39,892,000 after acquiring an additional 35,521 shares in the last quarter. Burney Co. acquired a new position in Laureate Education in the 4th quarter valued at $666,000. KBC Group NV lifted its position in shares of Laureate Education by 48.4% during the 4th quarter. KBC Group NV now owns 6,049 shares of the company's stock valued at $111,000 after acquiring an additional 1,974 shares during the period. Finally, Raymond James Financial Inc. acquired a new stake in shares of Laureate Education during the 4th quarter worth $408,000. 96.27% of the stock is owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Separately, BMO Capital Markets lifted their price target on Laureate Education from $21.00 to $23.00 and gave the company an "outperform" rating in a research note on Monday, February 24th.

Check Out Our Latest Report on Laureate Education

Laureate Education Price Performance

NASDAQ:LAUR traded up $0.10 on Tuesday, hitting $19.37. The company had a trading volume of 620,945 shares, compared to its average volume of 755,864. Laureate Education, Inc. has a 52 week low of $13.26 and a 52 week high of $21.73. The company has a current ratio of 0.63, a quick ratio of 0.63 and a debt-to-equity ratio of 0.15. The stock has a market capitalization of $2.92 billion, a price-to-earnings ratio of 9.98 and a beta of 0.43. The firm has a 50 day moving average of $19.65 and a two-hundred day moving average of $18.49.

Laureate Education (NASDAQ:LAUR - Get Free Report) last announced its quarterly earnings results on Thursday, February 20th. The company reported $0.62 EPS for the quarter, beating analysts' consensus estimates of $0.42 by $0.20. The company had revenue of $423.40 million during the quarter, compared to analysts' expectations of $411.50 million. Laureate Education had a return on equity of 32.35% and a net margin of 18.92%. On average, research analysts anticipate that Laureate Education, Inc. will post 1.51 earnings per share for the current year.

Insider Transactions at Laureate Education

In related news, Director Ian Kendell Snow sold 520,831 shares of the business's stock in a transaction on Thursday, March 13th. The shares were sold at an average price of $17.47, for a total value of $9,098,917.57. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Company insiders own 2.32% of the company's stock.

Laureate Education Company Profile

(

Free Report)

Laureate Education, Inc, together with its subsidiaries, offers higher education programs and services to students through a network of universities and higher education institutions. The company provides a range of undergraduate and graduate degree programs in the areas of business and management, medicine and health sciences, and engineering and information technology through campus-based, online, and hybrid programs.

Read More

Before you consider Laureate Education, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Laureate Education wasn't on the list.

While Laureate Education currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for April 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.