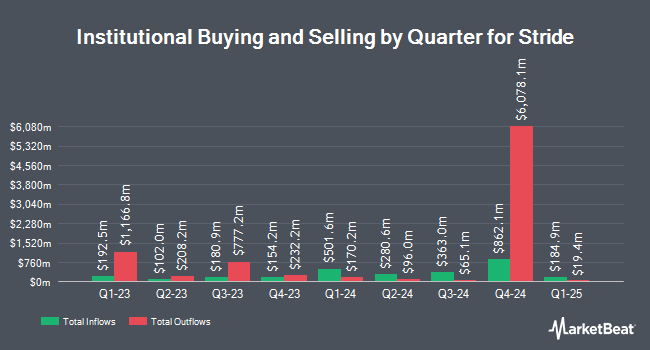

Resona Asset Management Co. Ltd. bought a new stake in Stride, Inc. (NYSE:LRN - Free Report) in the 4th quarter, according to its most recent filing with the SEC. The fund bought 4,005 shares of the company's stock, valued at approximately $416,000.

Several other large investors have also recently made changes to their positions in the company. Integrated Quantitative Investments LLC purchased a new stake in shares of Stride in the fourth quarter valued at approximately $1,354,000. ExodusPoint Capital Management LP purchased a new stake in shares of Stride during the fourth quarter worth about $5,670,000. Bryce Point Capital LLC acquired a new position in shares of Stride during the 4th quarter worth about $540,000. Geode Capital Management LLC lifted its stake in Stride by 0.6% in the 4th quarter. Geode Capital Management LLC now owns 970,395 shares of the company's stock valued at $100,877,000 after buying an additional 5,694 shares in the last quarter. Finally, B. Metzler seel. Sohn & Co. AG purchased a new stake in Stride during the 4th quarter worth approximately $2,869,000. 98.24% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

Several brokerages recently commented on LRN. BMO Capital Markets boosted their price target on Stride from $134.00 to $139.00 and gave the stock an "outperform" rating in a research report on Tuesday, April 1st. Barrington Research reiterated an "outperform" rating and issued a $140.00 target price on shares of Stride in a research report on Friday, March 14th. Finally, Canaccord Genuity Group upped their price objective on shares of Stride from $135.00 to $145.00 and gave the company a "buy" rating in a research note on Tuesday, March 11th. Three analysts have rated the stock with a hold rating and four have issued a buy rating to the company's stock. According to data from MarketBeat.com, the company presently has an average rating of "Moderate Buy" and an average target price of $120.17.

Read Our Latest Research Report on LRN

Stride Trading Up 2.3 %

Shares of NYSE LRN traded up $3.09 during midday trading on Tuesday, reaching $137.88. 522,890 shares of the stock were exchanged, compared to its average volume of 836,472. The stock has a market capitalization of $6.00 billion, a P/E ratio of 23.02, a PEG ratio of 1.04 and a beta of 0.47. The company has a debt-to-equity ratio of 0.35, a quick ratio of 5.93 and a current ratio of 6.02. The company has a 50 day simple moving average of $131.19 and a 200 day simple moving average of $111.88. Stride, Inc. has a twelve month low of $56.17 and a twelve month high of $145.00.

Stride (NYSE:LRN - Get Free Report) last posted its earnings results on Tuesday, January 28th. The company reported $2.03 EPS for the quarter, beating analysts' consensus estimates of $1.92 by $0.11. Stride had a return on equity of 22.42% and a net margin of 12.30%. As a group, equities analysts expect that Stride, Inc. will post 6.67 earnings per share for the current year.

Stride Company Profile

(

Free Report)

Stride, Inc, a technology-based education service company, engages in the provision of proprietary and third-party online curriculum, software systems, and educational services in the United States and internationally. Its technology-based products and services enable clients to attract, enroll, educate, track progress, support, and facilitate individualized learning for students.

Read More

Before you consider Stride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Stride wasn't on the list.

While Stride currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.