Resona Asset Management Co. Ltd. acquired a new stake in shares of Cardinal Health, Inc. (NYSE:CAH - Free Report) in the fourth quarter, according to the company in its most recent filing with the SEC. The firm acquired 98,949 shares of the company's stock, valued at approximately $11,724,000.

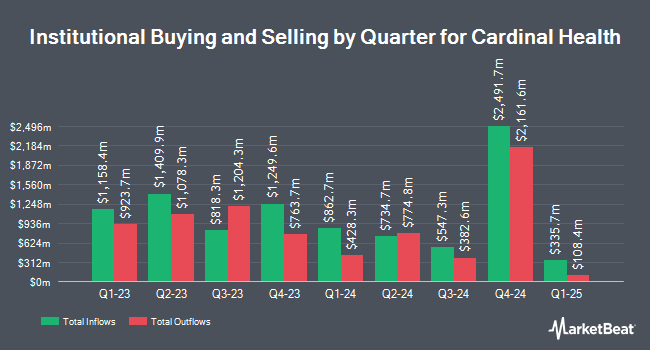

Other large investors have also recently modified their holdings of the company. Geode Capital Management LLC boosted its stake in shares of Cardinal Health by 1.9% during the fourth quarter. Geode Capital Management LLC now owns 5,859,132 shares of the company's stock valued at $691,145,000 after purchasing an additional 109,273 shares in the last quarter. Amundi boosted its position in Cardinal Health by 5.5% during the fourth quarter. Amundi now owns 2,116,291 shares of the company's stock valued at $259,309,000 after purchasing an additional 110,605 shares in the last quarter. Norges Bank purchased a new position in Cardinal Health in the fourth quarter valued at about $246,748,000. Charles Schwab Investment Management Inc. raised its holdings in Cardinal Health by 3.0% in the fourth quarter. Charles Schwab Investment Management Inc. now owns 1,519,011 shares of the company's stock worth $179,653,000 after purchasing an additional 44,386 shares in the last quarter. Finally, Robeco Institutional Asset Management B.V. lifted its position in shares of Cardinal Health by 4.3% during the fourth quarter. Robeco Institutional Asset Management B.V. now owns 972,060 shares of the company's stock valued at $114,966,000 after buying an additional 39,767 shares during the last quarter. Hedge funds and other institutional investors own 87.17% of the company's stock.

Wall Street Analyst Weigh In

A number of equities analysts have recently issued reports on the company. Wells Fargo & Company upped their price target on Cardinal Health from $135.00 to $136.00 and gave the stock an "equal weight" rating in a research report on Tuesday, February 4th. Jefferies Financial Group upgraded shares of Cardinal Health from a "hold" rating to a "buy" rating and upped their price objective for the company from $140.00 to $150.00 in a report on Wednesday, February 5th. TD Cowen upgraded shares of Cardinal Health from a "hold" rating to a "buy" rating and lifted their target price for the stock from $130.00 to $144.00 in a research note on Wednesday, January 8th. Mizuho upped their price target on shares of Cardinal Health from $142.00 to $150.00 and gave the company an "outperform" rating in a research note on Monday, March 31st. Finally, Argus set a $148.00 price objective on shares of Cardinal Health in a research note on Tuesday, February 4th. Four research analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $140.86.

Check Out Our Latest Stock Analysis on CAH

Cardinal Health Stock Up 0.9 %

Shares of Cardinal Health stock traded up $1.12 during mid-day trading on Friday, reaching $130.00. 425,100 shares of the stock traded hands, compared to its average volume of 2,169,076. The stock has a market capitalization of $31.40 billion, a PE ratio of 24.21, a PEG ratio of 1.49 and a beta of 0.61. The business has a 50-day moving average of $129.20 and a 200 day moving average of $122.23. Cardinal Health, Inc. has a fifty-two week low of $93.17 and a fifty-two week high of $139.50.

Cardinal Health (NYSE:CAH - Get Free Report) last posted its quarterly earnings data on Thursday, January 30th. The company reported $1.93 EPS for the quarter, beating the consensus estimate of $1.74 by $0.19. Cardinal Health had a negative return on equity of 59.57% and a net margin of 0.59%. On average, equities research analysts expect that Cardinal Health, Inc. will post 7.95 EPS for the current fiscal year.

Cardinal Health Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 15th. Investors of record on Tuesday, April 1st will be issued a $0.5056 dividend. The ex-dividend date is Tuesday, April 1st. This represents a $2.02 annualized dividend and a yield of 1.56%. Cardinal Health's dividend payout ratio (DPR) is currently 37.69%.

Cardinal Health Company Profile

(

Free Report)

Cardinal Health, Inc operates as a healthcare services and products company in the United States, Canada, Europe, Asia, and internationally. It provides customized solutions for hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, physician offices, and patients in the home.

Featured Articles

Before you consider Cardinal Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cardinal Health wasn't on the list.

While Cardinal Health currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.