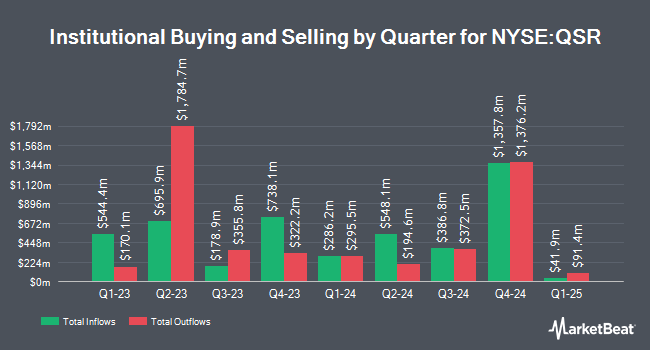

Connor Clark & Lunn Investment Management Ltd. boosted its holdings in shares of Restaurant Brands International Inc. (NYSE:QSR - Free Report) TSE: QSR by 16.2% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 2,207,251 shares of the restaurant operator's stock after purchasing an additional 307,791 shares during the period. Restaurant Brands International comprises approximately 0.8% of Connor Clark & Lunn Investment Management Ltd.'s investment portfolio, making the stock its 27th biggest holding. Connor Clark & Lunn Investment Management Ltd. owned approximately 0.68% of Restaurant Brands International worth $159,251,000 as of its most recent SEC filing.

A number of other large investors also recently bought and sold shares of QSR. Farther Finance Advisors LLC raised its stake in Restaurant Brands International by 79.4% during the 3rd quarter. Farther Finance Advisors LLC now owns 418 shares of the restaurant operator's stock valued at $30,000 after purchasing an additional 185 shares during the period. Crewe Advisors LLC bought a new position in Restaurant Brands International in the first quarter valued at about $48,000. Plato Investment Management Ltd bought a new position in Restaurant Brands International during the third quarter worth $61,000. BNP Paribas Financial Markets boosted its stake in Restaurant Brands International by 22.2% in the first quarter. BNP Paribas Financial Markets now owns 1,117 shares of the restaurant operator's stock valued at $89,000 after acquiring an additional 203 shares during the last quarter. Finally, Blue Trust Inc. increased its position in shares of Restaurant Brands International by 123.9% in the third quarter. Blue Trust Inc. now owns 1,388 shares of the restaurant operator's stock worth $98,000 after purchasing an additional 768 shares during the last quarter. 82.29% of the stock is owned by institutional investors and hedge funds.

Restaurant Brands International Stock Down 0.1 %

QSR traded down $0.04 during trading on Wednesday, reaching $69.41. 1,186,266 shares of the stock were exchanged, compared to its average volume of 1,578,694. Restaurant Brands International Inc. has a twelve month low of $65.87 and a twelve month high of $83.29. The stock has a market cap of $22.47 billion, a P/E ratio of 17.41, a price-to-earnings-growth ratio of 2.20 and a beta of 0.94. The company has a debt-to-equity ratio of 2.75, a quick ratio of 0.94 and a current ratio of 1.02. The stock's 50 day moving average price is $70.21 and its two-hundred day moving average price is $70.14.

Restaurant Brands International Announces Dividend

The business also recently announced a quarterly dividend, which will be paid on Friday, January 3rd. Stockholders of record on Friday, December 20th will be given a $0.58 dividend. The ex-dividend date is Friday, December 20th. This represents a $2.32 annualized dividend and a dividend yield of 3.34%. Restaurant Brands International's dividend payout ratio is 58.15%.

Insider Activity at Restaurant Brands International

In other news, insider Thomas Benjamin Curtis sold 6,536 shares of the company's stock in a transaction dated Tuesday, September 3rd. The stock was sold at an average price of $68.63, for a total transaction of $448,565.68. Following the completion of the sale, the insider now owns 37,179 shares in the company, valued at approximately $2,551,594.77. This represents a 14.95 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, insider Axel Mr Schwan sold 36,000 shares of the business's stock in a transaction that occurred on Friday, August 23rd. The stock was sold at an average price of $70.44, for a total value of $2,535,840.00. Following the sale, the insider now owns 97,479 shares of the company's stock, valued at approximately $6,866,420.76. This represents a 26.97 % decrease in their position. The disclosure for this sale can be found here. 1.36% of the stock is currently owned by company insiders.

Wall Street Analysts Forecast Growth

Several brokerages have recently issued reports on QSR. JPMorgan Chase & Co. boosted their price objective on Restaurant Brands International from $80.00 to $84.00 and gave the company an "overweight" rating in a report on Monday, September 16th. Argus dropped their price target on Restaurant Brands International from $85.00 to $80.00 and set a "buy" rating on the stock in a research report on Thursday, November 7th. Wells Fargo & Company dropped their price objective on Restaurant Brands International from $80.00 to $77.00 and set an "overweight" rating on the stock in a research note on Friday, August 9th. Citigroup lifted their price target on Restaurant Brands International from $75.00 to $77.00 and gave the company a "neutral" rating in a research note on Wednesday, October 16th. Finally, CIBC decreased their price target on Restaurant Brands International from $88.00 to $86.00 and set an "outperformer" rating for the company in a research report on Wednesday, November 6th. One investment analyst has rated the stock with a sell rating, eight have issued a hold rating and seventeen have assigned a buy rating to the company. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average target price of $82.37.

Check Out Our Latest Stock Report on Restaurant Brands International

Restaurant Brands International Company Profile

(

Free Report)

Restaurant Brands International Inc operates as a quick-service restaurant company in Canada, the United States, and internationally. It operates through four segments: Tim Hortons (TH), Burger King (BK), Popeyes Louisiana Kitchen (PLK), and Firehouse Subs (FHS). The company owns and franchises TH chain of donut/coffee/tea restaurants that offer blend coffee, tea, and espresso-based hot and cold specialty drinks; and fresh baked goods, including donuts, Timbits, bagels, muffins, cookies and pastries, grilled paninis, classic sandwiches, wraps, soups, and other food products.

See Also

Before you consider Restaurant Brands International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Restaurant Brands International wasn't on the list.

While Restaurant Brands International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.