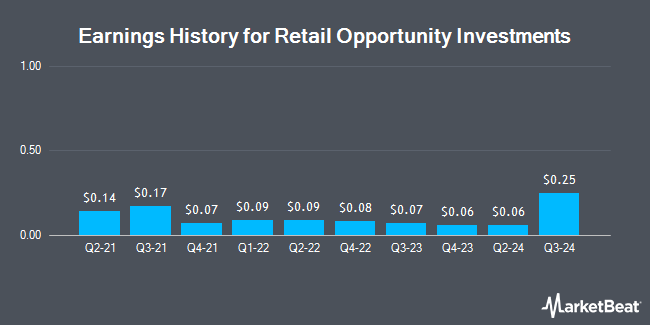

Retail Opportunity Investments (NASDAQ:ROIC - Get Free Report) is expected to announce its earnings results before the market opens on Wednesday, February 12th. Analysts expect the company to announce earnings of $0.06 per share and revenue of $83.45 million for the quarter.

Retail Opportunity Investments Stock Performance

Shares of NASDAQ ROIC traded down $0.01 during trading hours on Friday, reaching $17.48. 1,475,930 shares of the stock were exchanged, compared to its average volume of 1,467,676. The company has a debt-to-equity ratio of 1.04, a quick ratio of 1.92 and a current ratio of 1.92. The stock's fifty day simple moving average is $17.42 and its 200 day simple moving average is $16.32. Retail Opportunity Investments has a 52 week low of $11.87 and a 52 week high of $17.52. The firm has a market capitalization of $2.25 billion, a price-to-earnings ratio of 38.00 and a beta of 1.45.

Analyst Upgrades and Downgrades

Several brokerages have commented on ROIC. StockNews.com initiated coverage on shares of Retail Opportunity Investments in a research report on Thursday. They set a "hold" rating for the company. Raymond James lowered shares of Retail Opportunity Investments from an "outperform" rating to a "market perform" rating in a report on Wednesday, October 30th. Bank of America began coverage on shares of Retail Opportunity Investments in a research report on Thursday, October 24th. They set an "underperform" rating and a $14.00 price objective for the company. Robert W. Baird reissued a "neutral" rating and issued a $17.50 price target (up from $16.00) on shares of Retail Opportunity Investments in a research note on Thursday, November 7th. Finally, KeyCorp lowered shares of Retail Opportunity Investments from an "overweight" rating to a "sector weight" rating in a report on Tuesday, November 5th. One equities research analyst has rated the stock with a sell rating and seven have assigned a hold rating to the company. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and an average price target of $16.20.

Get Our Latest Research Report on Retail Opportunity Investments

Retail Opportunity Investments Company Profile

(

Get Free Report)

Retail Opportunity Investments Corp. Nasdaq: ROIC, is a fully integrated, self-managed real estate investment trust (REIT) that specializes in the acquisition, ownership and management of grocery-anchored shopping centers located in densely populated, metropolitan markets across the West Coast. As of December 31, 2023, ROIC owned 94 shopping centers encompassing approximately 10.6 million square feet.

Further Reading

Before you consider Retail Opportunity Investments, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Retail Opportunity Investments wasn't on the list.

While Retail Opportunity Investments currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.