Retirement Systems of Alabama boosted its stake in Welltower Inc. (NYSE:WELL - Free Report) by 3.7% in the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The firm owned 470,419 shares of the real estate investment trust's stock after purchasing an additional 16,946 shares during the period. Retirement Systems of Alabama owned approximately 0.08% of Welltower worth $60,228,000 at the end of the most recent quarter.

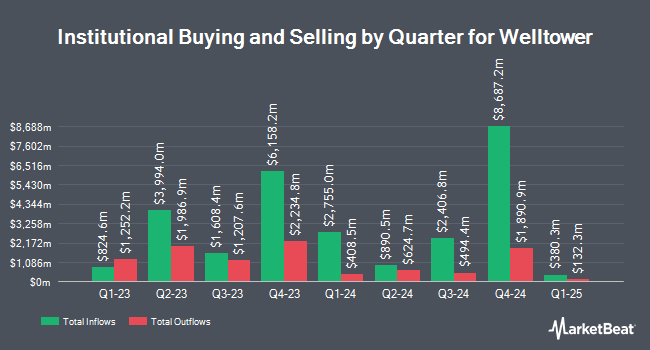

A number of other hedge funds have also added to or reduced their stakes in WELL. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its position in Welltower by 638.0% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 6,920,426 shares of the real estate investment trust's stock valued at $886,022,000 after buying an additional 5,982,711 shares during the period. FMR LLC grew its position in shares of Welltower by 38.1% during the 3rd quarter. FMR LLC now owns 14,428,564 shares of the real estate investment trust's stock valued at $1,847,289,000 after acquiring an additional 3,977,845 shares during the period. Duff & Phelps Investment Management Co. bought a new stake in shares of Welltower during the 2nd quarter valued at $254,977,000. Wellington Management Group LLP increased its stake in shares of Welltower by 10.6% in the 3rd quarter. Wellington Management Group LLP now owns 18,685,844 shares of the real estate investment trust's stock worth $2,392,349,000 after purchasing an additional 1,797,330 shares in the last quarter. Finally, Canada Pension Plan Investment Board raised its holdings in Welltower by 24.6% in the 2nd quarter. Canada Pension Plan Investment Board now owns 2,112,452 shares of the real estate investment trust's stock worth $220,223,000 after purchasing an additional 417,046 shares during the period. 94.80% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

Several research firms have issued reports on WELL. Mizuho boosted their price target on Welltower from $136.00 to $141.00 and gave the company an "outperform" rating in a report on Thursday, December 5th. StockNews.com raised shares of Welltower from a "sell" rating to a "hold" rating in a report on Wednesday, October 30th. Wells Fargo & Company reaffirmed an "equal weight" rating and set a $135.00 price target (up previously from $134.00) on shares of Welltower in a report on Tuesday, October 1st. Evercore ISI increased their price objective on shares of Welltower from $106.00 to $114.00 and gave the stock an "in-line" rating in a research note on Monday, September 16th. Finally, Scotiabank lifted their target price on shares of Welltower from $133.00 to $142.00 and gave the company a "sector outperform" rating in a research note on Monday, November 25th. Five equities research analysts have rated the stock with a hold rating, seven have given a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $120.77.

Read Our Latest Report on Welltower

Welltower Price Performance

NYSE WELL traded up $0.68 on Friday, reaching $129.12. The company had a trading volume of 1,927,221 shares, compared to its average volume of 2,686,859. The stock has a market capitalization of $80.40 billion, a PE ratio of 84.53, a price-to-earnings-growth ratio of 2.88 and a beta of 1.20. Welltower Inc. has a 12 month low of $85.40 and a 12 month high of $140.75. The company has a quick ratio of 4.10, a current ratio of 4.10 and a debt-to-equity ratio of 0.51. The firm's 50 day moving average price is $132.88 and its 200 day moving average price is $120.12.

Welltower (NYSE:WELL - Get Free Report) last issued its earnings results on Monday, October 28th. The real estate investment trust reported $0.73 earnings per share (EPS) for the quarter, missing the consensus estimate of $1.04 by ($0.31). Welltower had a return on equity of 3.20% and a net margin of 12.22%. The firm had revenue of $2.06 billion during the quarter, compared to the consensus estimate of $1.95 billion. During the same period last year, the firm posted $0.92 earnings per share. The company's revenue for the quarter was up 23.7% compared to the same quarter last year. As a group, equities analysts predict that Welltower Inc. will post 4.3 earnings per share for the current year.

Welltower Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Thursday, November 21st. Stockholders of record on Wednesday, November 13th were given a dividend of $0.67 per share. The ex-dividend date was Wednesday, November 13th. This represents a $2.68 dividend on an annualized basis and a dividend yield of 2.08%. Welltower's dividend payout ratio is currently 176.32%.

About Welltower

(

Free Report)

Welltower Inc NYSE: WELL, a real estate investment trust ("REIT") and S&P 500 company headquartered in Toledo, Ohio, is driving the transformation of health care infrastructure. Welltower invests with leading seniors housing operators, post-acute providers and health systems to fund the real estate infrastructure needed to scale innovative care delivery models and improve people's wellness and overall health care experience.

Featured Articles

Before you consider Welltower, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Welltower wasn't on the list.

While Welltower currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.