Retirement Systems of Alabama raised its holdings in Churchill Downs Incorporated (NASDAQ:CHDN - Free Report) by 3.8% in the 3rd quarter, according to its most recent 13F filing with the SEC. The fund owned 180,569 shares of the company's stock after acquiring an additional 6,626 shares during the period. Retirement Systems of Alabama owned 0.25% of Churchill Downs worth $24,415,000 at the end of the most recent reporting period.

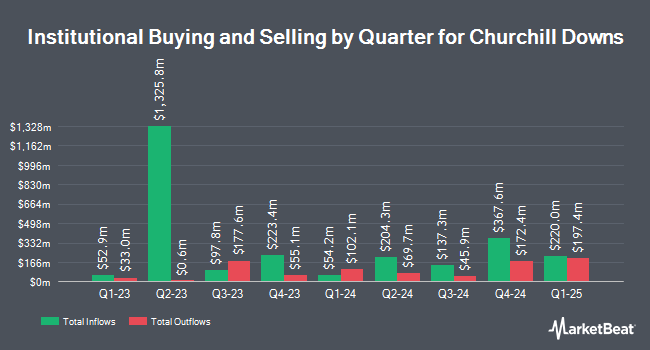

Other large investors also recently modified their holdings of the company. CWM LLC boosted its stake in shares of Churchill Downs by 36.8% during the 2nd quarter. CWM LLC now owns 439 shares of the company's stock worth $61,000 after acquiring an additional 118 shares in the last quarter. SG Americas Securities LLC acquired a new stake in Churchill Downs in the second quarter valued at approximately $1,000,000. Envestnet Portfolio Solutions Inc. boosted its position in Churchill Downs by 5.5% during the second quarter. Envestnet Portfolio Solutions Inc. now owns 10,052 shares of the company's stock valued at $1,403,000 after acquiring an additional 521 shares during the last quarter. Raymond James & Associates lifted its position in shares of Churchill Downs by 66.4% during the 2nd quarter. Raymond James & Associates now owns 80,756 shares of the company's stock worth $11,274,000 after buying an additional 32,225 shares in the last quarter. Finally, Nisa Investment Advisors LLC lifted its position in shares of Churchill Downs by 1.5% during the second quarter. Nisa Investment Advisors LLC now owns 7,065 shares of the company's stock worth $986,000 after acquiring an additional 105 shares in the last quarter. 82.59% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

CHDN has been the subject of several research reports. JMP Securities reissued a "market outperform" rating and issued a $166.00 target price on shares of Churchill Downs in a research report on Monday, October 14th. Truist Financial reissued a "buy" rating and issued a $165.00 target price (down from $166.00) on shares of Churchill Downs in a research report on Friday, October 25th. StockNews.com upgraded shares of Churchill Downs from a "sell" rating to a "hold" rating in a report on Wednesday, November 6th. Mizuho dropped their price target on shares of Churchill Downs from $157.00 to $151.00 and set an "outperform" rating on the stock in a research note on Tuesday, October 22nd. Finally, Wells Fargo & Company upped their price target on shares of Churchill Downs from $161.00 to $168.00 and gave the company an "overweight" rating in a report on Thursday, October 17th. One investment analyst has rated the stock with a hold rating and eight have issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and a consensus target price of $160.88.

Read Our Latest Analysis on Churchill Downs

Churchill Downs Price Performance

NASDAQ:CHDN traded down $1.41 during trading hours on Friday, hitting $136.05. The company's stock had a trading volume of 382,203 shares, compared to its average volume of 430,442. The company has a market capitalization of $10.00 billion, a P/E ratio of 24.78, a PEG ratio of 3.84 and a beta of 0.95. Churchill Downs Incorporated has a twelve month low of $111.10 and a twelve month high of $150.21. The stock has a fifty day simple moving average of $140.03 and a 200-day simple moving average of $138.51. The company has a debt-to-equity ratio of 4.35, a current ratio of 0.55 and a quick ratio of 0.55.

Churchill Downs (NASDAQ:CHDN - Get Free Report) last issued its quarterly earnings data on Wednesday, October 23rd. The company reported $0.97 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.96 by $0.01. The business had revenue of $628.50 million for the quarter, compared to analysts' expectations of $627.90 million. Churchill Downs had a return on equity of 45.48% and a net margin of 15.45%. The firm's quarterly revenue was up 9.8% on a year-over-year basis. During the same quarter in the prior year, the firm posted $0.87 EPS. On average, analysts anticipate that Churchill Downs Incorporated will post 5.86 EPS for the current fiscal year.

Churchill Downs Increases Dividend

The firm also recently announced an annual dividend, which will be paid on Friday, January 3rd. Stockholders of record on Friday, December 6th will be given a dividend of $0.409 per share. This represents a dividend yield of 0.29%. This is an increase from Churchill Downs's previous annual dividend of $0.38. The ex-dividend date of this dividend is Friday, December 6th. Churchill Downs's dividend payout ratio (DPR) is 7.29%.

Churchill Downs Company Profile

(

Free Report)

Churchill Downs Incorporated operates as a racing, online wagering, and gaming entertainment company in the United States. It operates through three segments: Live and Historical Racing, TwinSpires, and Gaming. The company operates pari-mutuel gaming entertainment venues; TwinSpires, an online wagering platform for horse racing, sports, and iGaming; retail sports books; casino gaming; and Terre Haute Casino Resort.

Further Reading

Before you consider Churchill Downs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Churchill Downs wasn't on the list.

While Churchill Downs currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.