Retirement Systems of Alabama lowered its holdings in shares of Microchip Technology Incorporated (NASDAQ:MCHP - Free Report) by 5.6% during the third quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 246,047 shares of the semiconductor company's stock after selling 14,694 shares during the period. Retirement Systems of Alabama's holdings in Microchip Technology were worth $19,755,000 as of its most recent SEC filing.

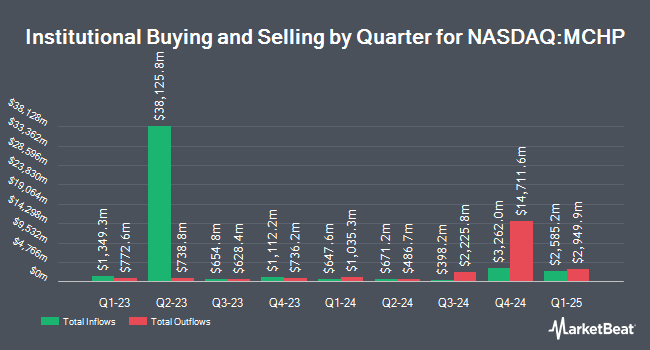

Several other hedge funds and other institutional investors have also modified their holdings of the stock. Swedbank AB lifted its stake in shares of Microchip Technology by 78.7% in the 2nd quarter. Swedbank AB now owns 21,493 shares of the semiconductor company's stock valued at $1,967,000 after purchasing an additional 9,465 shares during the period. Nisa Investment Advisors LLC boosted its stake in shares of Microchip Technology by 4.8% in the second quarter. Nisa Investment Advisors LLC now owns 220,191 shares of the semiconductor company's stock valued at $20,147,000 after buying an additional 10,081 shares during the period. Apollon Wealth Management LLC raised its position in shares of Microchip Technology by 7.7% in the 2nd quarter. Apollon Wealth Management LLC now owns 26,257 shares of the semiconductor company's stock valued at $2,403,000 after buying an additional 1,880 shares in the last quarter. First Horizon Advisors Inc. boosted its stake in shares of Microchip Technology by 5.7% in the 2nd quarter. First Horizon Advisors Inc. now owns 3,273 shares of the semiconductor company's stock valued at $300,000 after purchasing an additional 177 shares in the last quarter. Finally, First Citizens Bank & Trust Co. raised its position in Microchip Technology by 21.2% in the second quarter. First Citizens Bank & Trust Co. now owns 10,461 shares of the semiconductor company's stock valued at $957,000 after purchasing an additional 1,832 shares during the last quarter. Institutional investors own 91.51% of the company's stock.

Microchip Technology Price Performance

Shares of MCHP traded down $1.57 during trading hours on Friday, reaching $59.93. 9,040,132 shares of the company traded hands, compared to its average volume of 6,203,403. The stock has a market capitalization of $32.18 billion, a PE ratio of 41.91 and a beta of 1.50. The company has a quick ratio of 0.48, a current ratio of 0.88 and a debt-to-equity ratio of 0.71. Microchip Technology Incorporated has a fifty-two week low of $57.96 and a fifty-two week high of $100.57. The stock has a fifty day simple moving average of $70.49 and a 200 day simple moving average of $79.91.

Microchip Technology (NASDAQ:MCHP - Get Free Report) last posted its quarterly earnings results on Tuesday, November 5th. The semiconductor company reported $0.46 EPS for the quarter, beating the consensus estimate of $0.43 by $0.03. The firm had revenue of $1.16 billion for the quarter, compared to analyst estimates of $1.15 billion. Microchip Technology had a net margin of 14.22% and a return on equity of 19.47%. Microchip Technology's revenue for the quarter was down 48.4% compared to the same quarter last year. During the same quarter last year, the firm posted $1.54 earnings per share. As a group, research analysts predict that Microchip Technology Incorporated will post 1.33 EPS for the current fiscal year.

Microchip Technology Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Friday, December 6th. Shareholders of record on Friday, November 22nd were paid a dividend of $0.455 per share. The ex-dividend date was Friday, November 22nd. This represents a $1.82 annualized dividend and a yield of 3.04%. This is a boost from Microchip Technology's previous quarterly dividend of $0.45. Microchip Technology's dividend payout ratio is presently 127.27%.

Wall Street Analysts Forecast Growth

Several brokerages have recently weighed in on MCHP. KeyCorp decreased their price target on Microchip Technology from $95.00 to $90.00 and set an "overweight" rating for the company in a research note on Tuesday, December 3rd. Evercore ISI reissued an "outperform" rating and issued a $95.00 price target (down previously from $101.00) on shares of Microchip Technology in a research report on Wednesday, November 6th. Citigroup lowered their price target on Microchip Technology from $92.00 to $82.00 and set a "buy" rating for the company in a research report on Wednesday, November 6th. TD Cowen cut their price target on shares of Microchip Technology from $80.00 to $70.00 and set a "hold" rating on the stock in a report on Wednesday, November 6th. Finally, Truist Financial lowered shares of Microchip Technology from a "buy" rating to a "hold" rating and reduced their price objective for the company from $89.00 to $80.00 in a research note on Monday, September 23rd. Six investment analysts have rated the stock with a hold rating and fourteen have assigned a buy rating to the stock. Based on data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus target price of $90.95.

Read Our Latest Analysis on MCHP

Microchip Technology Profile

(

Free Report)

Microchip Technology Incorporated engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia. The company offers general purpose 8-bit, 16-bit, and 32-bit mixed-signal microcontrollers; 32-bit embedded mixed-signal microprocessors; and specialized microcontrollers for automotive, industrial, computing, communications, lighting, power supplies, motor control, human machine interface, security, wired connectivity, and wireless connectivity applications.

Featured Articles

Before you consider Microchip Technology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microchip Technology wasn't on the list.

While Microchip Technology currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.