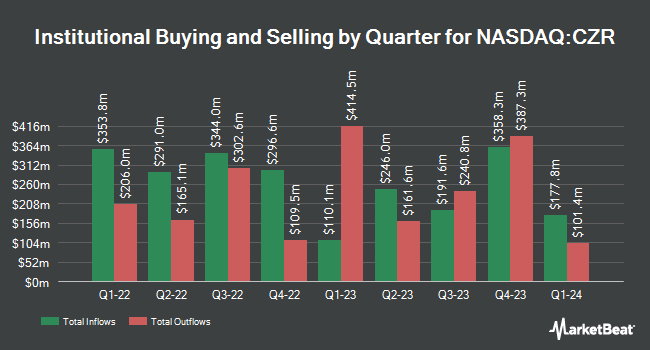

Retirement Systems of Alabama cut its position in Caesars Entertainment, Inc. (NASDAQ:CZR - Free Report) by 7.6% during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 272,632 shares of the company's stock after selling 22,328 shares during the quarter. Retirement Systems of Alabama owned approximately 0.13% of Caesars Entertainment worth $11,380,000 at the end of the most recent reporting period.

Several other institutional investors have also recently bought and sold shares of the company. Wellington Management Group LLP grew its position in Caesars Entertainment by 4.5% during the third quarter. Wellington Management Group LLP now owns 113,405 shares of the company's stock worth $4,734,000 after buying an additional 4,840 shares in the last quarter. Hsbc Holdings PLC increased its holdings in Caesars Entertainment by 42.7% in the 2nd quarter. Hsbc Holdings PLC now owns 485,077 shares of the company's stock valued at $19,148,000 after buying an additional 145,201 shares during the period. Entropy Technologies LP acquired a new position in Caesars Entertainment in the third quarter worth about $1,300,000. LMR Partners LLP acquired a new stake in shares of Caesars Entertainment during the 3rd quarter worth about $903,000. Finally, Gabelli Funds LLC increased its holdings in Caesars Entertainment by 28.0% during the 2nd quarter. Gabelli Funds LLC now owns 143,900 shares of the company's stock valued at $5,719,000 after purchasing an additional 31,500 shares in the last quarter. Institutional investors own 91.79% of the company's stock.

Caesars Entertainment Price Performance

Caesars Entertainment stock traded down $0.39 during mid-day trading on Tuesday, reaching $36.13. 3,237,353 shares of the company were exchanged, compared to its average volume of 4,107,822. The company has a fifty day simple moving average of $40.42 and a 200-day simple moving average of $38.71. The firm has a market cap of $7.68 billion, a PE ratio of -21.63 and a beta of 2.89. The company has a debt-to-equity ratio of 2.84, a current ratio of 0.84 and a quick ratio of 0.82. Caesars Entertainment, Inc. has a 12 month low of $31.74 and a 12 month high of $49.65.

Caesars Entertainment (NASDAQ:CZR - Get Free Report) last issued its earnings results on Tuesday, October 29th. The company reported ($0.04) EPS for the quarter, missing the consensus estimate of $0.21 by ($0.25). The firm had revenue of $2.87 billion during the quarter, compared to analyst estimates of $2.93 billion. Caesars Entertainment had a negative net margin of 3.20% and a negative return on equity of 4.44%. Caesars Entertainment's quarterly revenue was down 4.0% compared to the same quarter last year. During the same quarter in the previous year, the firm posted $0.34 earnings per share. As a group, equities research analysts expect that Caesars Entertainment, Inc. will post -0.56 earnings per share for the current fiscal year.

Analyst Ratings Changes

CZR has been the subject of several research reports. JPMorgan Chase & Co. lifted their target price on Caesars Entertainment from $54.00 to $58.00 and gave the company an "overweight" rating in a research note on Wednesday, October 30th. Macquarie reissued an "outperform" rating and set a $50.00 price objective on shares of Caesars Entertainment in a report on Wednesday, October 30th. Barclays cut their target price on shares of Caesars Entertainment from $57.00 to $55.00 and set an "overweight" rating on the stock in a research report on Friday. Morgan Stanley boosted their price target on shares of Caesars Entertainment from $40.00 to $42.00 and gave the stock an "equal weight" rating in a research note on Tuesday, October 22nd. Finally, Stifel Nicolaus raised their price objective on shares of Caesars Entertainment from $56.00 to $58.00 and gave the company a "buy" rating in a research note on Wednesday, October 9th. One research analyst has rated the stock with a sell rating, two have assigned a hold rating, eleven have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and a consensus price target of $53.71.

Check Out Our Latest Stock Analysis on Caesars Entertainment

Caesars Entertainment Profile

(

Free Report)

Caesars Entertainment, Inc operates as a gaming and hospitality company. The company owns, leases, or manages domestic properties in 18 states with slot machines, video lottery terminals and e-tables, and hotel rooms, as well as table games, including poker. It also operates and conducts retail and online sports wagering across 31 jurisdictions in North America and operates iGaming in five jurisdictions in North America; sports betting from our retail and online sportsbooks; and other games, such as keno.

Featured Articles

Before you consider Caesars Entertainment, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Caesars Entertainment wasn't on the list.

While Caesars Entertainment currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.