Retirement Systems of Alabama trimmed its position in shares of Affiliated Managers Group, Inc. (NYSE:AMG - Free Report) by 3.1% in the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 98,702 shares of the asset manager's stock after selling 3,112 shares during the quarter. Retirement Systems of Alabama owned about 0.33% of Affiliated Managers Group worth $17,549,000 at the end of the most recent reporting period.

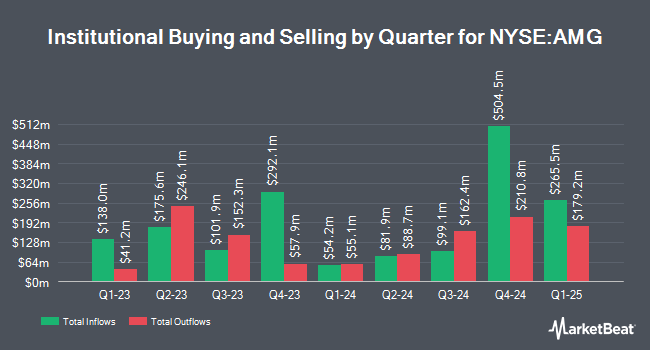

A number of other large investors have also made changes to their positions in AMG. Ariel Investments LLC lifted its position in Affiliated Managers Group by 8.7% during the second quarter. Ariel Investments LLC now owns 1,442,817 shares of the asset manager's stock valued at $225,411,000 after purchasing an additional 115,808 shares during the period. Goodman Financial Corp acquired a new stake in Affiliated Managers Group in the 3rd quarter valued at about $14,035,000. Victory Capital Management Inc. boosted its stake in Affiliated Managers Group by 150.1% during the second quarter. Victory Capital Management Inc. now owns 99,407 shares of the asset manager's stock worth $15,530,000 after buying an additional 59,659 shares during the last quarter. Barclays PLC grew its holdings in shares of Affiliated Managers Group by 261.0% in the third quarter. Barclays PLC now owns 76,488 shares of the asset manager's stock valued at $13,600,000 after purchasing an additional 55,302 shares during the period. Finally, Bank of Montreal Can lifted its holdings in Affiliated Managers Group by 328.2% in the third quarter. Bank of Montreal Can now owns 70,457 shares of the asset manager's stock valued at $12,420,000 after acquiring an additional 54,003 shares during the last quarter. 95.30% of the stock is owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

Several equities analysts have weighed in on AMG shares. TD Cowen downgraded Affiliated Managers Group from a "buy" rating to a "hold" rating and dropped their target price for the company from $226.00 to $177.00 in a research report on Tuesday, November 5th. Deutsche Bank Aktiengesellschaft upped their target price on shares of Affiliated Managers Group from $204.00 to $208.00 and gave the company a "buy" rating in a report on Monday, November 11th. Finally, Barrington Research lowered their target price on shares of Affiliated Managers Group from $210.00 to $200.00 and set an "outperform" rating on the stock in a research report on Tuesday, November 5th. Three analysts have rated the stock with a hold rating and two have given a buy rating to the company's stock. According to data from MarketBeat.com, Affiliated Managers Group currently has a consensus rating of "Hold" and a consensus target price of $196.50.

Get Our Latest Stock Analysis on Affiliated Managers Group

Affiliated Managers Group Trading Down 1.2 %

NYSE:AMG traded down $2.26 during mid-day trading on Friday, reaching $186.59. 209,837 shares of the stock were exchanged, compared to its average volume of 234,461. Affiliated Managers Group, Inc. has a 1-year low of $145.36 and a 1-year high of $199.52. The firm has a market capitalization of $5.64 billion, a PE ratio of 12.17, a PEG ratio of 0.69 and a beta of 1.15. The business has a fifty day moving average price of $187.62 and a 200 day moving average price of $174.21.

Affiliated Managers Group (NYSE:AMG - Get Free Report) last posted its quarterly earnings results on Monday, November 4th. The asset manager reported $4.82 earnings per share for the quarter, missing the consensus estimate of $4.84 by ($0.02). Affiliated Managers Group had a net margin of 27.02% and a return on equity of 16.76%. The business had revenue of $525.20 million for the quarter, compared to analyst estimates of $521.87 million. During the same period in the previous year, the firm posted $4.08 earnings per share. The firm's quarterly revenue was up 1.7% on a year-over-year basis. On average, sell-side analysts forecast that Affiliated Managers Group, Inc. will post 20.91 earnings per share for the current year.

Affiliated Managers Group Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, November 29th. Shareholders of record on Thursday, November 14th were given a $0.01 dividend. The ex-dividend date of this dividend was Thursday, November 14th. This represents a $0.04 annualized dividend and a yield of 0.02%. Affiliated Managers Group's dividend payout ratio is 0.26%.

About Affiliated Managers Group

(

Free Report)

Affiliated Managers Group, Inc, through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States. It provides advisory or sub-advisory services to mutual funds.

Featured Stories

Before you consider Affiliated Managers Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Affiliated Managers Group wasn't on the list.

While Affiliated Managers Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.