StockNews.com started coverage on shares of Revance Therapeutics (NASDAQ:RVNC - Free Report) in a research note released on Monday. The firm issued a hold rating on the biopharmaceutical company's stock.

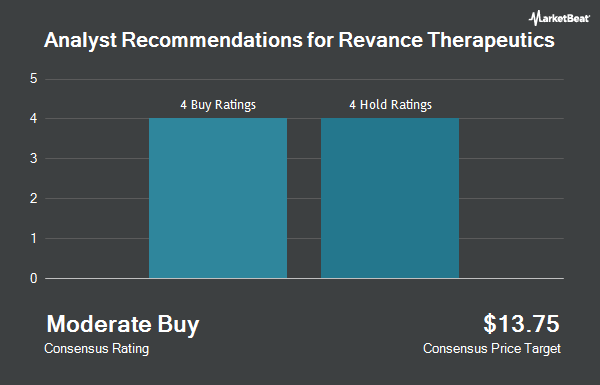

Several other research analysts also recently commented on RVNC. Piper Sandler downgraded Revance Therapeutics from a "strong-buy" rating to a "hold" rating in a report on Monday, August 12th. Needham & Company LLC restated a "hold" rating on shares of Revance Therapeutics in a report on Friday, November 8th. Stifel Nicolaus cut their price target on Revance Therapeutics from $24.00 to $20.00 and set a "buy" rating for the company in a report on Friday, August 9th. William Blair reissued a "market perform" rating on shares of Revance Therapeutics in a report on Monday, August 12th. Finally, HC Wainwright restated a "neutral" rating and issued a $6.60 price objective on shares of Revance Therapeutics in a research report on Friday, November 8th. Nine analysts have rated the stock with a hold rating and one has issued a buy rating to the stock. According to MarketBeat, the stock presently has an average rating of "Hold" and an average target price of $9.66.

Check Out Our Latest Research Report on Revance Therapeutics

Revance Therapeutics Stock Down 4.3 %

Shares of RVNC traded down $0.18 during trading hours on Monday, reaching $3.99. The company's stock had a trading volume of 1,374,437 shares, compared to its average volume of 2,765,130. The company has a 50 day moving average of $5.41 and a two-hundred day moving average of $4.45. The firm has a market cap of $418.56 million, a price-to-earnings ratio of -2.16 and a beta of 0.95. Revance Therapeutics has a 1-year low of $2.30 and a 1-year high of $9.74.

Revance Therapeutics (NASDAQ:RVNC - Get Free Report) last announced its quarterly earnings results on Thursday, November 7th. The biopharmaceutical company reported ($0.37) earnings per share for the quarter, missing analysts' consensus estimates of ($0.35) by ($0.02). The business had revenue of $59.88 million during the quarter, compared to the consensus estimate of $67.73 million. As a group, analysts forecast that Revance Therapeutics will post -1.54 EPS for the current fiscal year.

Institutional Trading of Revance Therapeutics

Several institutional investors and hedge funds have recently made changes to their positions in the business. Certuity LLC acquired a new stake in shares of Revance Therapeutics during the second quarter worth $26,000. Vanguard Personalized Indexing Management LLC acquired a new position in shares of Revance Therapeutics during the 2nd quarter worth about $33,000. Hsbc Holdings PLC bought a new stake in shares of Revance Therapeutics in the 2nd quarter valued at about $38,000. Nisa Investment Advisors LLC raised its position in shares of Revance Therapeutics by 2,167.5% in the 2nd quarter. Nisa Investment Advisors LLC now owns 18,911 shares of the biopharmaceutical company's stock valued at $49,000 after acquiring an additional 18,077 shares during the period. Finally, FORA Capital LLC bought a new position in Revance Therapeutics during the 3rd quarter worth approximately $54,000. Institutional investors own 97.70% of the company's stock.

Revance Therapeutics Company Profile

(

Get Free Report)

Revance Therapeutics, Inc, a biotechnology company, engages in the development, manufacture, and commercialization of neuromodulators for various aesthetic and therapeutic indications in the United States and internationally. The company's lead drug candidate is DAXXIFY (DaxibotulinumtoxinA-lanm) for injection for the treatment of glabellar lines and cervical dystonia; has completed phase II clinical trials to treat upper facial lines, moderate or severe dynamic forehead lines, and moderate or severe lateral canthal lines; and has completed Phase II clinical trials for the treatment of adult upper limb spasticity and plantar fasciitis.

Featured Articles

Before you consider Revance Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Revance Therapeutics wasn't on the list.

While Revance Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.