HC Wainwright reissued their neutral rating on shares of Revance Therapeutics (NASDAQ:RVNC - Free Report) in a report published on Friday,Benzinga reports. They currently have a $6.60 price objective on the biopharmaceutical company's stock.

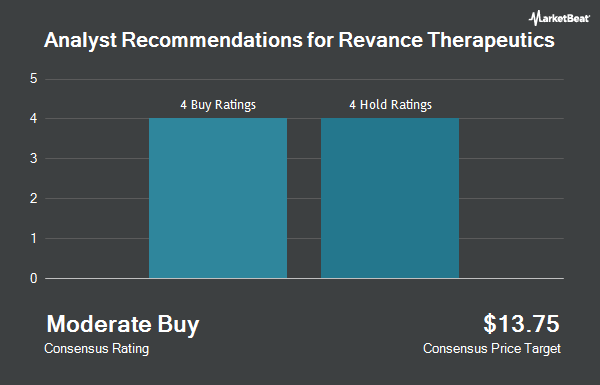

A number of other brokerages have also recently issued reports on RVNC. Needham & Company LLC restated a "hold" rating on shares of Revance Therapeutics in a report on Monday, October 28th. Barclays reaffirmed an "equal weight" rating and issued a $7.00 price objective (down from $10.00) on shares of Revance Therapeutics in a research note on Friday, September 13th. William Blair restated a "market perform" rating on shares of Revance Therapeutics in a report on Monday, August 12th. StockNews.com assumed coverage on shares of Revance Therapeutics in a research note on Saturday, November 2nd. They issued a "hold" rating for the company. Finally, Stifel Nicolaus cut their target price on shares of Revance Therapeutics from $24.00 to $20.00 and set a "buy" rating on the stock in a research note on Friday, August 9th. Nine analysts have rated the stock with a hold rating and one has assigned a buy rating to the company's stock. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average price target of $9.66.

Check Out Our Latest Analysis on RVNC

Revance Therapeutics Stock Performance

Shares of NASDAQ:RVNC traded down $2.08 on Friday, hitting $3.70. 13,129,610 shares of the company were exchanged, compared to its average volume of 2,753,991. The firm has a market capitalization of $387.83 million, a price-to-earnings ratio of -1.16 and a beta of 0.95. Revance Therapeutics has a one year low of $2.30 and a one year high of $9.74. The company's 50 day moving average price is $5.66 and its two-hundred day moving average price is $4.42.

Revance Therapeutics (NASDAQ:RVNC - Get Free Report) last released its earnings results on Thursday, August 8th. The biopharmaceutical company reported ($0.36) earnings per share for the quarter, beating the consensus estimate of ($0.48) by $0.12. The company had revenue of $65.39 million during the quarter, compared to analyst estimates of $66.30 million. The company's quarterly revenue was up 20.2% compared to the same quarter last year. During the same period in the previous year, the company posted ($0.80) EPS. Research analysts predict that Revance Therapeutics will post -1.53 earnings per share for the current year.

Institutional Inflows and Outflows

Large investors have recently added to or reduced their stakes in the stock. Capital World Investors grew its stake in Revance Therapeutics by 16.8% in the 1st quarter. Capital World Investors now owns 13,945,535 shares of the biopharmaceutical company's stock worth $68,612,000 after buying an additional 2,006,459 shares in the last quarter. Vanguard Group Inc. increased its position in shares of Revance Therapeutics by 6.5% during the 1st quarter. Vanguard Group Inc. now owns 5,398,406 shares of the biopharmaceutical company's stock valued at $26,560,000 after purchasing an additional 328,781 shares during the last quarter. Alpine Associates Management Inc. purchased a new position in shares of Revance Therapeutics during the 3rd quarter valued at about $21,605,000. Stonepine Capital Management LLC lifted its position in Revance Therapeutics by 41.7% in the 2nd quarter. Stonepine Capital Management LLC now owns 2,800,000 shares of the biopharmaceutical company's stock worth $7,196,000 after buying an additional 823,658 shares during the last quarter. Finally, LMR Partners LLP purchased a new stake in Revance Therapeutics in the third quarter worth approximately $11,648,000. Institutional investors own 97.70% of the company's stock.

Revance Therapeutics Company Profile

(

Get Free Report)

Revance Therapeutics, Inc, a biotechnology company, engages in the development, manufacture, and commercialization of neuromodulators for various aesthetic and therapeutic indications in the United States and internationally. The company's lead drug candidate is DAXXIFY (DaxibotulinumtoxinA-lanm) for injection for the treatment of glabellar lines and cervical dystonia; has completed phase II clinical trials to treat upper facial lines, moderate or severe dynamic forehead lines, and moderate or severe lateral canthal lines; and has completed Phase II clinical trials for the treatment of adult upper limb spasticity and plantar fasciitis.

Read More

Before you consider Revance Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Revance Therapeutics wasn't on the list.

While Revance Therapeutics currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.