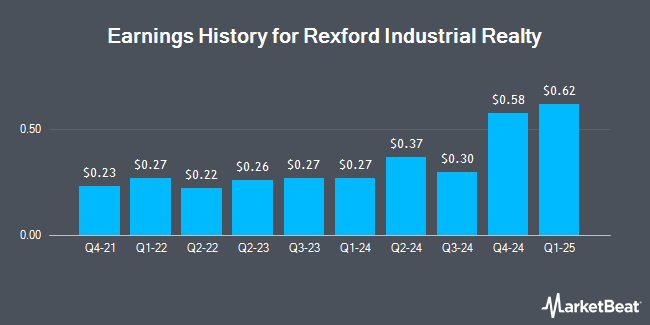

Rexford Industrial Realty (NYSE:REXR - Get Free Report) is projected to post its quarterly earnings results after the market closes on Wednesday, April 16th. Analysts expect Rexford Industrial Realty to post earnings of $0.58 per share and revenue of $246.74 million for the quarter. Rexford Industrial Realty has set its FY 2025 guidance at 2.370-2.410 EPS.Persons that are interested in participating in the company's earnings conference call can do so using this link.

Rexford Industrial Realty (NYSE:REXR - Get Free Report) last issued its quarterly earnings results on Wednesday, February 5th. The real estate investment trust reported $0.58 EPS for the quarter, topping analysts' consensus estimates of $0.27 by $0.31. Rexford Industrial Realty had a net margin of 29.10% and a return on equity of 3.26%. On average, analysts expect Rexford Industrial Realty to post $2 EPS for the current fiscal year and $3 EPS for the next fiscal year.

Rexford Industrial Realty Price Performance

NYSE:REXR traded up $0.50 during midday trading on Friday, hitting $32.44. The company had a trading volume of 3,730,293 shares, compared to its average volume of 1,920,938. The company has a market capitalization of $7.40 billion, a PE ratio of 26.81, a P/E/G ratio of 2.62 and a beta of 0.99. The company has a quick ratio of 1.30, a current ratio of 1.30 and a debt-to-equity ratio of 0.39. Rexford Industrial Realty has a 52-week low of $29.68 and a 52-week high of $52.61. The stock's fifty day moving average price is $38.98 and its 200-day moving average price is $41.05.

Rexford Industrial Realty Increases Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Tuesday, April 15th. Stockholders of record on Monday, March 31st will be given a dividend of $0.43 per share. The ex-dividend date is Monday, March 31st. This is a positive change from Rexford Industrial Realty's previous quarterly dividend of $0.42. This represents a $1.72 annualized dividend and a dividend yield of 5.30%. Rexford Industrial Realty's dividend payout ratio is 142.15%.

Wall Street Analysts Forecast Growth

A number of research analysts have commented on REXR shares. Industrial Alliance Securities set a $38.00 price target on shares of Rexford Industrial Realty in a research report on Tuesday, March 25th. Barclays decreased their price objective on Rexford Industrial Realty from $41.00 to $38.00 and set an "underweight" rating on the stock in a report on Tuesday, March 25th. JPMorgan Chase & Co. reduced their price target on Rexford Industrial Realty from $45.00 to $44.00 and set a "neutral" rating on the stock in a research report on Thursday, February 13th. Robert W. Baird cut their target price on shares of Rexford Industrial Realty from $48.00 to $47.00 and set a "neutral" rating on the stock in a report on Tuesday, March 4th. Finally, Scotiabank dropped their price target on shares of Rexford Industrial Realty from $47.00 to $39.00 and set a "sector perform" rating for the company in a research report on Monday, April 7th. Two equities research analysts have rated the stock with a sell rating, seven have issued a hold rating and three have given a buy rating to the stock. According to MarketBeat.com, the stock presently has an average rating of "Hold" and an average price target of $46.17.

Get Our Latest Stock Report on REXR

Rexford Industrial Realty Company Profile

(

Get Free Report)

Rexford Industrial Realty, Inc is a self-administered and self-managed real estate investment trust, which engages in owning and operating industrial properties in infill markets. The company was founded by Richard S. Ziman on January 18, 2013 and is headquartered in Los Angeles, CA.

Read More

Before you consider Rexford Industrial Realty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rexford Industrial Realty wasn't on the list.

While Rexford Industrial Realty currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.