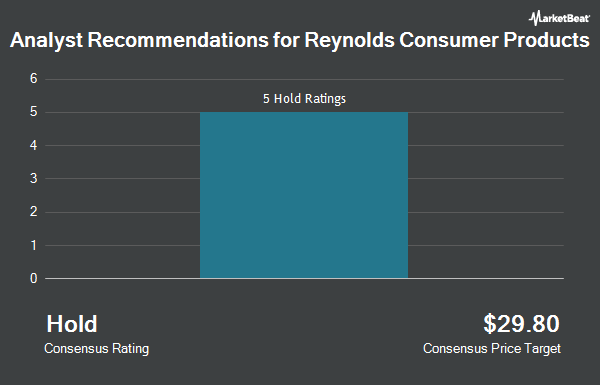

Shares of Reynolds Consumer Products Inc. (NASDAQ:REYN - Get Free Report) have received a consensus recommendation of "Hold" from the six analysts that are currently covering the firm, Marketbeat.com reports. Five investment analysts have rated the stock with a hold rating and one has given a buy rating to the company. The average 1 year target price among brokerages that have issued a report on the stock in the last year is $32.17.

A number of research analysts have recently issued reports on REYN shares. Jefferies Financial Group began coverage on shares of Reynolds Consumer Products in a research report on Thursday, August 29th. They issued a "buy" rating and a $38.00 price objective on the stock. Barclays cut their price target on shares of Reynolds Consumer Products from $29.00 to $28.00 and set an "equal weight" rating on the stock in a report on Thursday, October 31st.

Get Our Latest Stock Analysis on Reynolds Consumer Products

Insider Activity at Reynolds Consumer Products

In other Reynolds Consumer Products news, Director Rolf Stangl bought 7,207 shares of the firm's stock in a transaction that occurred on Friday, November 1st. The stock was bought at an average cost of $27.25 per share, for a total transaction of $196,390.75. Following the completion of the transaction, the director now directly owns 7,207 shares of the company's stock, valued at approximately $196,390.75. This trade represents a ∞ increase in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, Director Helen Golding purchased 1,190 shares of the business's stock in a transaction on Thursday, November 14th. The shares were bought at an average cost of $27.58 per share, for a total transaction of $32,820.20. Following the completion of the transaction, the director now directly owns 1,190 shares in the company, valued at $32,820.20. This trade represents a ∞ increase in their position. The disclosure for this purchase can be found here. 0.20% of the stock is owned by insiders.

Institutional Trading of Reynolds Consumer Products

Several hedge funds and other institutional investors have recently bought and sold shares of REYN. Pacer Advisors Inc. boosted its position in Reynolds Consumer Products by 48.6% in the 2nd quarter. Pacer Advisors Inc. now owns 3,890,109 shares of the company's stock worth $108,845,000 after purchasing an additional 1,272,353 shares in the last quarter. AQR Capital Management LLC increased its holdings in Reynolds Consumer Products by 122.7% in the second quarter. AQR Capital Management LLC now owns 1,557,835 shares of the company's stock valued at $43,588,000 after buying an additional 858,419 shares in the last quarter. Verition Fund Management LLC acquired a new position in shares of Reynolds Consumer Products in the third quarter worth about $12,844,000. Dimensional Fund Advisors LP boosted its stake in shares of Reynolds Consumer Products by 17.2% during the 2nd quarter. Dimensional Fund Advisors LP now owns 1,781,815 shares of the company's stock worth $49,859,000 after acquiring an additional 261,513 shares in the last quarter. Finally, Beacon Harbor Wealth Advisors Inc. acquired a new stake in shares of Reynolds Consumer Products during the 3rd quarter valued at about $5,731,000. 26.81% of the stock is owned by institutional investors and hedge funds.

Reynolds Consumer Products Stock Up 1.9 %

NASDAQ:REYN traded up $0.53 during trading hours on Tuesday, reaching $28.31. The company's stock had a trading volume of 572,443 shares, compared to its average volume of 572,736. The stock has a 50 day moving average price of $28.58 and a two-hundred day moving average price of $29.00. The company has a debt-to-equity ratio of 0.84, a quick ratio of 0.89 and a current ratio of 2.04. The company has a market capitalization of $5.95 billion, a P/E ratio of 15.94 and a beta of 0.50. Reynolds Consumer Products has a 12 month low of $26.16 and a 12 month high of $32.65.

Reynolds Consumer Products (NASDAQ:REYN - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The company reported $0.41 EPS for the quarter, missing the consensus estimate of $0.42 by ($0.01). Reynolds Consumer Products had a return on equity of 18.27% and a net margin of 10.03%. The company had revenue of $910.00 million during the quarter, compared to the consensus estimate of $902.88 million. During the same period in the previous year, the firm posted $0.37 earnings per share. The company's revenue was down 2.7% on a year-over-year basis. Equities analysts predict that Reynolds Consumer Products will post 1.69 EPS for the current fiscal year.

Reynolds Consumer Products Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Friday, November 29th. Stockholders of record on Friday, November 15th were paid a dividend of $0.23 per share. The ex-dividend date of this dividend was Friday, November 15th. This represents a $0.92 annualized dividend and a dividend yield of 3.25%. Reynolds Consumer Products's payout ratio is currently 52.57%.

Reynolds Consumer Products Company Profile

(

Get Free ReportReynolds Consumer Products Inc produces and sells products in cooking, waste and storage, and tableware product categories in the United States and internationally. It operates through four segments: Reynolds Cooking & Baking, Hefty Waste & Storage, Hefty Tableware, and Presto Products. The Reynolds Cooking & Baking segment produces aluminum foil, disposable aluminum pans, parchment paper, freezer paper, wax paper, butcher paper, plastic wrap, baking cups, oven bags, and slow cooker liners under the Reynolds Wrap, Reynolds KITCHENS, and EZ Foil brands in the United States, as well as under the ALCAN brand in Canada and under the Diamond brand internationally.

Read More

Before you consider Reynolds Consumer Products, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Reynolds Consumer Products wasn't on the list.

While Reynolds Consumer Products currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.