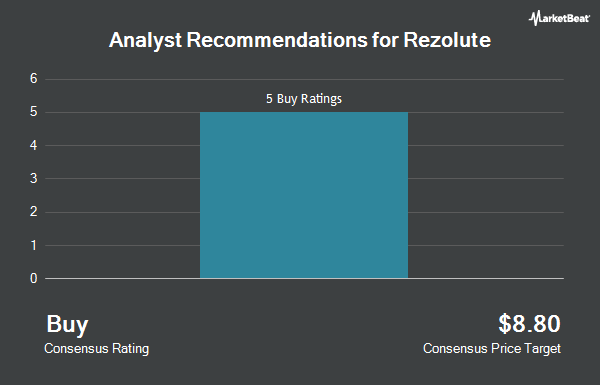

Rezolute, Inc. (NASDAQ:RZLT - Get Free Report) has earned an average recommendation of "Buy" from the eight brokerages that are presently covering the stock, Marketbeat.com reports. Eight investment analysts have rated the stock with a buy rating. The average 1-year target price among brokers that have issued a report on the stock in the last year is $24.13.

RZLT has been the topic of several analyst reports. HC Wainwright restated a "buy" rating and set a $14.00 price objective on shares of Rezolute in a report on Friday, November 8th. Wedbush restated an "outperform" rating and issued a $112.00 price target on shares of Rezolute in a research note on Monday, November 4th. Guggenheim initiated coverage on shares of Rezolute in a research note on Tuesday, August 27th. They set a "buy" rating and a $11.00 price objective on the stock. JMP Securities reissued a "market outperform" rating and issued a $7.00 target price on shares of Rezolute in a research report on Friday, September 20th. Finally, BTIG Research increased their price target on shares of Rezolute from $13.00 to $15.00 and gave the stock a "buy" rating in a research report on Tuesday, September 10th.

View Our Latest Stock Report on RZLT

Rezolute Stock Up 3.8 %

Shares of NASDAQ RZLT traded up $0.16 during trading on Friday, reaching $4.39. 357,180 shares of the stock were exchanged, compared to its average volume of 426,258. The company has a market capitalization of $254.37 million, a price-to-earnings ratio of -3.46 and a beta of 1.01. The business's 50-day moving average price is $5.12 and its 200 day moving average price is $4.78. Rezolute has a twelve month low of $0.86 and a twelve month high of $6.19.

Rezolute (NASDAQ:RZLT - Get Free Report) last posted its quarterly earnings data on Thursday, September 19th. The company reported ($0.44) earnings per share for the quarter, missing analysts' consensus estimates of ($0.30) by ($0.14). As a group, sell-side analysts expect that Rezolute will post -0.99 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, CFO Daron Evans bought 10,000 shares of the business's stock in a transaction on Wednesday, December 18th. The shares were bought at an average cost of $4.29 per share, for a total transaction of $42,900.00. Following the completion of the purchase, the chief financial officer now owns 150,900 shares of the company's stock, valued at $647,361. This represents a 7.10 % increase in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders have acquired a total of 23,259 shares of company stock worth $104,317 over the last quarter. 18.39% of the stock is owned by company insiders.

Hedge Funds Weigh In On Rezolute

Several institutional investors have recently modified their holdings of RZLT. Jeppson Wealth Management LLC bought a new position in Rezolute in the 2nd quarter worth about $45,000. Acadian Asset Management LLC boosted its position in shares of Rezolute by 104.2% during the second quarter. Acadian Asset Management LLC now owns 184,502 shares of the company's stock worth $792,000 after buying an additional 94,156 shares during the period. Federated Hermes Inc. grew its holdings in Rezolute by 11.1% in the 2nd quarter. Federated Hermes Inc. now owns 11,279,327 shares of the company's stock worth $48,501,000 after buying an additional 1,125,000 shares in the last quarter. Dimensional Fund Advisors LP acquired a new stake in Rezolute in the 2nd quarter valued at approximately $255,000. Finally, XTX Topco Ltd increased its position in Rezolute by 205.8% in the 2nd quarter. XTX Topco Ltd now owns 33,671 shares of the company's stock valued at $145,000 after acquiring an additional 22,660 shares during the period. Institutional investors own 82.97% of the company's stock.

Rezolute Company Profile

(

Get Free ReportRezolute, Inc, a clinical stage biopharmaceutical company, develops therapies for metabolic diseases associated with chronic glucose imbalance in the United States. The company's lead product candidate is RZ358, a human monoclonal antibody that is in Phase 2b clinical trial for the treatment of congenital hyperinsulinism, an ultra-rare pediatric genetic disorder.

Recommended Stories

Before you consider Rezolute, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rezolute wasn't on the list.

While Rezolute currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.