RH (NYSE:RH - Free Report) had its price target upped by Guggenheim from $425.00 to $550.00 in a research report sent to investors on Friday,Benzinga reports. They currently have a buy rating on the stock.

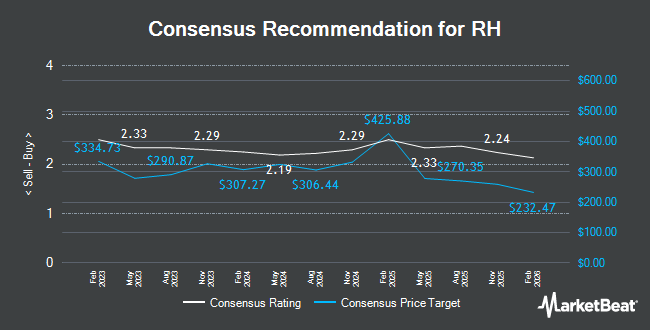

Several other research firms also recently weighed in on RH. Barclays cut their price target on RH from $340.00 to $320.00 and set an "equal weight" rating on the stock in a research note on Monday, September 16th. Stifel Nicolaus reissued a "buy" rating and issued a $420.00 target price (up from $375.00) on shares of RH in a research note on Monday, December 9th. Telsey Advisory Group lifted their price target on RH from $290.00 to $330.00 and gave the stock a "market perform" rating in a research report on Monday, December 9th. Wells Fargo & Company increased their price objective on shares of RH from $325.00 to $350.00 and gave the company an "overweight" rating in a research report on Friday, September 13th. Finally, BNP Paribas restated an "underperform" rating and set a $253.00 price objective on shares of RH in a research note on Wednesday, November 13th. Two research analysts have rated the stock with a sell rating, seven have issued a hold rating and eight have issued a buy rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Hold" and an average price target of $377.07.

Read Our Latest Analysis on RH

RH Stock Performance

Shares of NYSE RH traded up $64.66 during mid-day trading on Friday, hitting $446.04. The stock had a trading volume of 3,056,518 shares, compared to its average volume of 723,773. The business has a 50 day moving average price of $347.81 and a two-hundred day moving average price of $297.56. RH has a 1 year low of $212.43 and a 1 year high of $457.26. The firm has a market cap of $8.23 billion, a P/E ratio of 262.38, a price-to-earnings-growth ratio of 2.44 and a beta of 2.44.

RH (NYSE:RH - Get Free Report) last announced its quarterly earnings results on Thursday, December 12th. The company reported $2.48 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $2.67 by ($0.19). The firm had revenue of $811.73 million during the quarter, compared to the consensus estimate of $812.19 million. RH had a negative return on equity of 11.29% and a net margin of 1.13%. RH's revenue was up 8.1% on a year-over-year basis. During the same period last year, the business earned ($0.42) EPS. Equities research analysts predict that RH will post 5.63 EPS for the current fiscal year.

Insider Activity at RH

In other news, insider Stefan Duban sold 4,285 shares of the business's stock in a transaction on Thursday, September 19th. The shares were sold at an average price of $346.37, for a total transaction of $1,484,195.45. Following the completion of the sale, the insider now owns 78 shares of the company's stock, valued at $27,016.86. The trade was a 98.21 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is available at this link. Also, insider Edward T. Lee sold 2,000 shares of RH stock in a transaction on Friday, October 18th. The shares were sold at an average price of $353.57, for a total value of $707,140.00. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 8,285 shares of company stock worth $2,871,935. 28.10% of the stock is owned by insiders.

Institutional Inflows and Outflows

Several hedge funds have recently bought and sold shares of the company. Anomaly Capital Management LP grew its holdings in RH by 503.6% during the 2nd quarter. Anomaly Capital Management LP now owns 349,227 shares of the company's stock valued at $85,365,000 after buying an additional 291,368 shares in the last quarter. Dimensional Fund Advisors LP boosted its position in shares of RH by 18.0% during the second quarter. Dimensional Fund Advisors LP now owns 270,993 shares of the company's stock worth $66,239,000 after acquiring an additional 41,242 shares during the last quarter. Allspring Global Investments Holdings LLC grew its stake in RH by 8.2% during the third quarter. Allspring Global Investments Holdings LLC now owns 245,810 shares of the company's stock valued at $82,206,000 after acquiring an additional 18,563 shares in the last quarter. Charles Schwab Investment Management Inc. increased its holdings in RH by 26.4% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 184,834 shares of the company's stock valued at $61,814,000 after acquiring an additional 38,572 shares during the last quarter. Finally, Marshall Wace LLP lifted its stake in RH by 58.6% in the 2nd quarter. Marshall Wace LLP now owns 174,324 shares of the company's stock worth $42,612,000 after purchasing an additional 64,423 shares in the last quarter. Institutional investors own 90.17% of the company's stock.

RH Company Profile

(

Get Free Report)

RH, together with its subsidiaries, operates as a retailer in the home furnishings market. The company offers products in various categories, including furniture, lighting, textiles, bathware, décor, outdoor and garden, baby, child, and teen furnishings. It provides its products through rh.com, rhbabyandchild.com, rhteen.com, rhmodern.com, and waterworks.com online channels, as well as operates RH Galleries, RH outlet stores, RH Guesthouse, and Waterworks showrooms in the United States, Canada, the United Kingdom, and Germany.

Featured Articles

Before you consider RH, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and RH wasn't on the list.

While RH currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.